Talking Points:

- US Dollar in Consolidation Mode Below Four-Month High

- S&P 500 Finds Interim Support Above the 1900.00 Figure

- Crude Oil Snaps 7-Day Loss Streak, Gold May Turn Higher

US DOLLAR TECHNICAL ANALYSIS – Prices are digesting gains having hit a four-month high after rising as expected following the formation of a Bullish Engulfing candle pattern. Near-term resistance is at 10560, the 50% Fibonacci retracement, with a daily close above that exposing the 61.8% level at 10606. Alternatively, a reversal below resistance-turned-support in the 10513-27 area marked by the May 28 high and 38.2% Fib opens the door for a test of a horizontal pivot in play since late April at 10481.

S&P 500 TECHNICAL ANALYSIS – Prices turned lower as expected after putting in a bearish Evening Star candlestick pattern bolstered by negative RSI divergence. Sellers are testing the 38.2% Fibonacci retracement at 1921.80, with a break below that on a daily closing basis exposing the 50% level at 1900.30. Alternatively, a reversal above the 23.6% Fib at 1948.40 clears the way for a challenge of the 14.6% retracement at 1964.80.

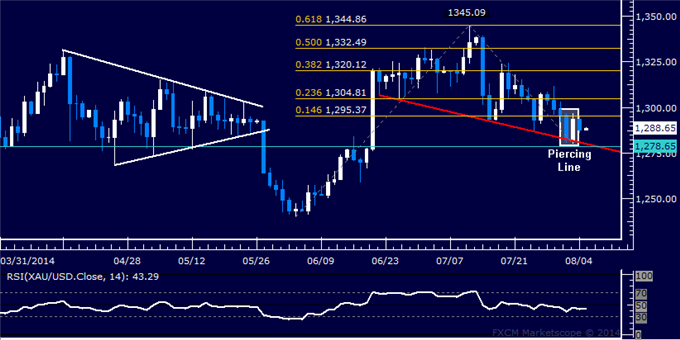

GOLD TECHNICAL ANALYSIS – Prices put in a bullish Piercing Line candlestick pattern, hinting a move higher may be ahead. Initial resistance is at 1295.37, the 14.6% Fibonacci expansion. A break above that on a daily closing basis exposes the 23.6% level at 1304.81. Near-term support is at 1278.65, marked by the intersection of a horizontal pivot in play since early April and a falling trend line connecting major lows from late June.

Daily Chart - Created Using FXCM Marketscope 2.0

CRUDE OIL TECHNICAL ANALYSIS – Prices dropped to challenge support in the 97.30-34 area, marked by the March 17 low and the 76.4% Fibonacci expansion. A break below that on a daily closing basis exposes a rising trend line set from June 2012, now at 96.34. Alternatively, a reversal above the 61.8% level at 98.56 aims for the 99.00 figure, followed by the 50% Fib at 99.58.