Gold loses momentum after reaching a two-week high

Short-term risk remains skewed to the upside above 2,325

The week began with gold losing ground and giving up the gains it made on Friday when it reached a two-week high of 2,378.

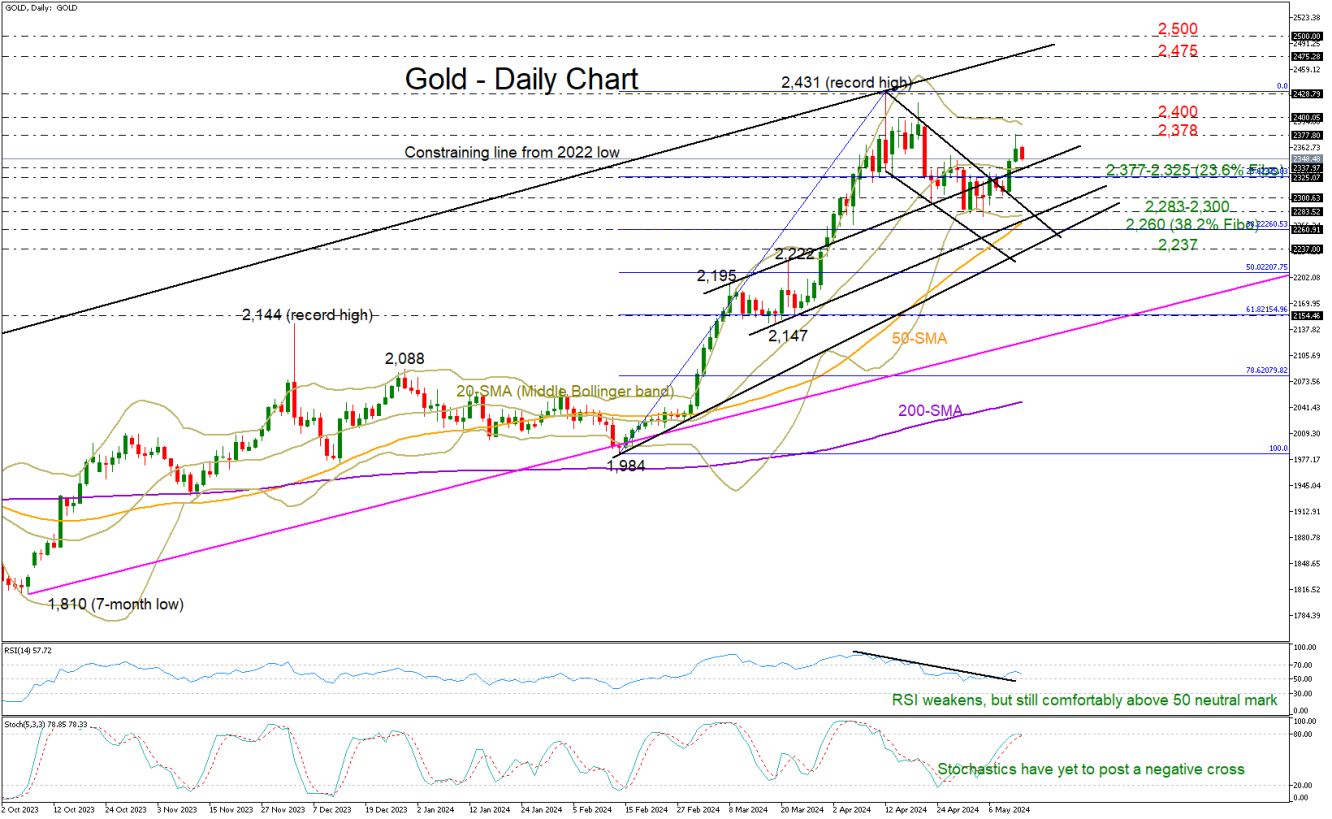

Technically, the bounce back above the resistance line from March and the 20-day simple moving average (EMA) feeds optimism that the latest upturn could resume as the RSI keeps fluctuating clearly above its 50 neutral mark and the price has yet to reach the upper Bollinger band.

Still, if the current bearish pressures strengthen below the 2,325-2,337 area, reducing the odds for a bullish continuation, the focus might shift to the 2,283-2,300 trendline territory where the 50-day SMA is converging. Should the bears breach the 38.2% Fibonacci retracement of the February-April uptrend at 2,260 too, the decline could then stretch towards the support trendline from February seen at 2,237.

Should the opposite scenario occur, the bulls might aim to breach the range of 2,378 to 2,400, with the possibility of retesting the all-time high of 2,431 or creating a new higher high between the ascending line from the 2022 low at 2,475 and the psychological level of 2,500.

All in all, the latest rebound in the market might remain attractive in the short term if the price manages to hold above 2,337-2,325. Otherwise, the yellow metal might revisit May’s lows.