Gold has gained 0.3% since the start of the day on Friday, marking only its third session of gains since the beginning of August. Despite signs of local oversold conditions suggesting a bounce, the ultimate downside target looks to be the $1800 area.

Gold's sharp decline began a month ago when the bears once again prevented the metal from consolidating above $1980, a critical resistance level since May.

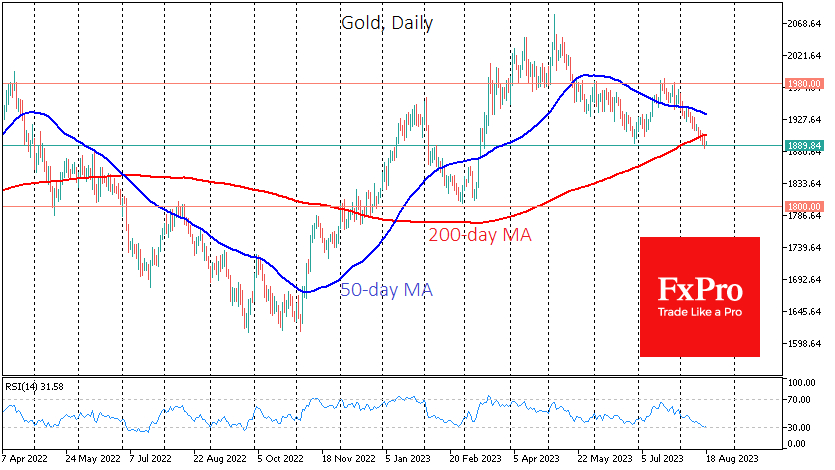

On the way down in August, gold first broke below the 50-day moving average, and two days ago, it sank below the 200-day MA. Both curves act as medium and long-term trend indicators. Gold failed to rally higher after a drop below the 50-day MA, but the failure only intensified the sell-off.

Tuesday and Wednesday saw a battle for the 200-day, which the Bears also won. Since the beginning of 2021, at least a month of sustained pressure on prices has followed such a signal.

This week, gold also broke below previous local lows - another signal of a downtrend formation in addition to lower local highs: $1985 in July vs. $2080 in May.

A crucial fundamental factor putting pressure on gold is the rise in government bond yields in developed countries with falling inflation. It is becoming increasingly difficult for gold to compete on yield.

We also expect China's attempts to protect its currency from depreciation to lead to US government bonds and gold sales.

And we must consider the possibility that other major emerging market reserve holders will do the same as they face diminishing returns from the economic slowdown.

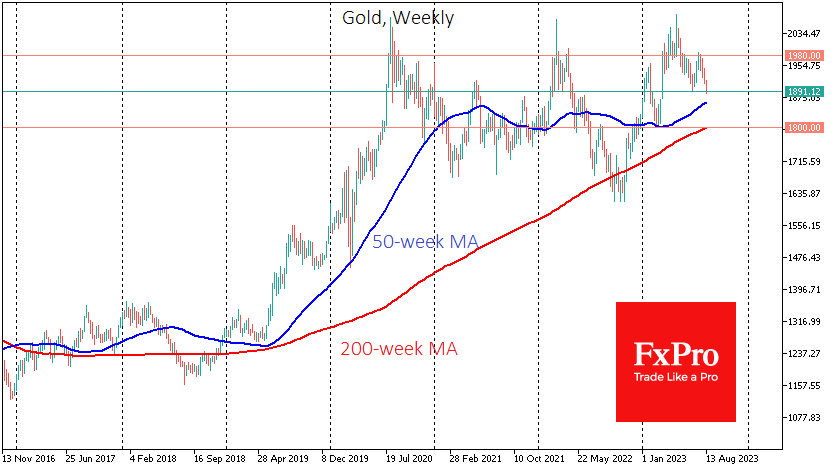

If there is no strong rally above $1905 today or Monday, confidence will grow that gold's downtrend is already established. The $1800-1810 area is a potential technical target. This is where gold has been supported or surrendered many times over the past three years.

The 200-week moving average, which has attracted buyers for the past six years, passes through these levels, and we expect the battle to be much more intense at these levels.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Heading Towards $1800

Published 08/18/2023, 09:16 AM

Updated 03/21/2024, 07:45 AM

Gold Heading Towards $1800

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Great

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.