Gold didn’t shine in January. The struggle could continue, although the more distant future looks more optimistic for the yellow metal.

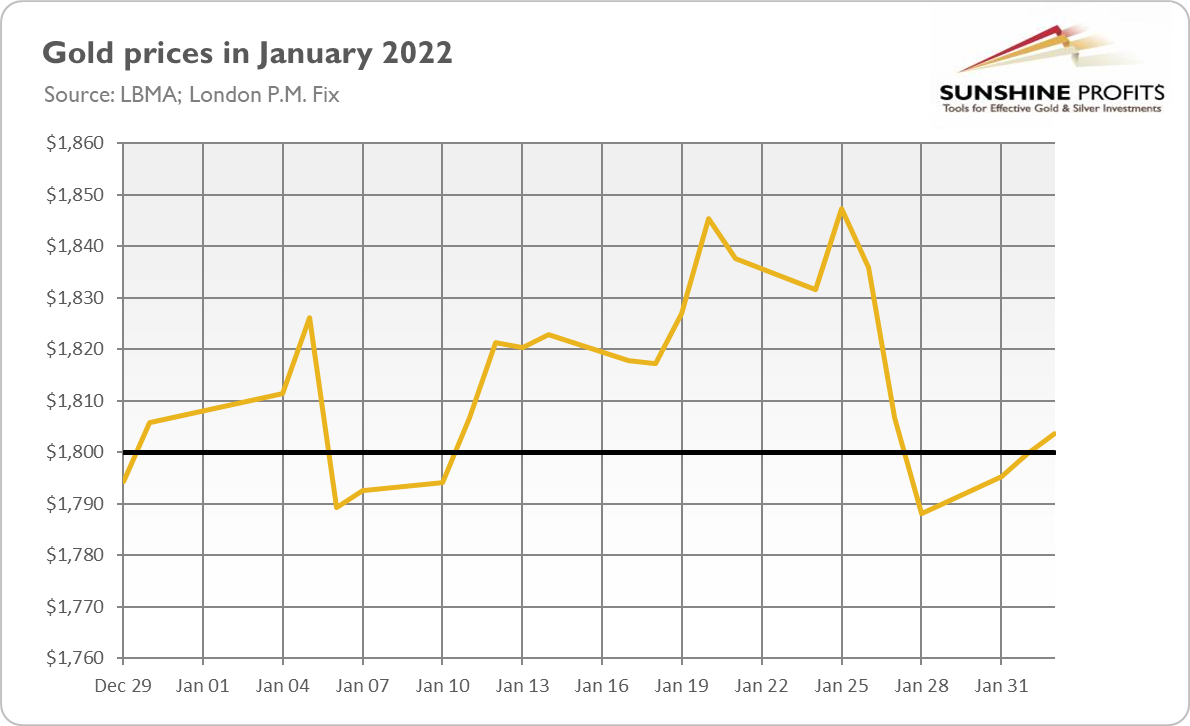

That was quick! January has already ended. Welcome to February! I hope that this year has started well for you. For gold, the first month of 2022 wasn’t particularly good. As the chart below shows, the yellow metal lost about $11 of its value, or less than 1%, during January.

This is the bad side of the story. The ugly side is that gold wasn’t able to maintain its position above $1,800, even though geopolitical risks intensified, while inflation soared to the highest level in 40 years. The yellow metal surpassed the key level in early January and stayed above this level for most of the time, even rallying above $1,840 in the second half of the month. But gold couldn’t hold out and plunged at the end of January, triggered by a hawkish FOMC meeting.

However, there is also a good side. Gold is still hovering around $1,800 despite the upcoming Fed’s tightening cycle and all the hawkish expectations about the U.S. monetary policy in 2022. The Fed signalled the end of tapering of quantitative easing by March, the first hike in the federal funds rate in the same month, and the start of quantitative tightening later this year. Meanwhile, in the last few weeks, the markets went from predicting two interest rate hikes to five.

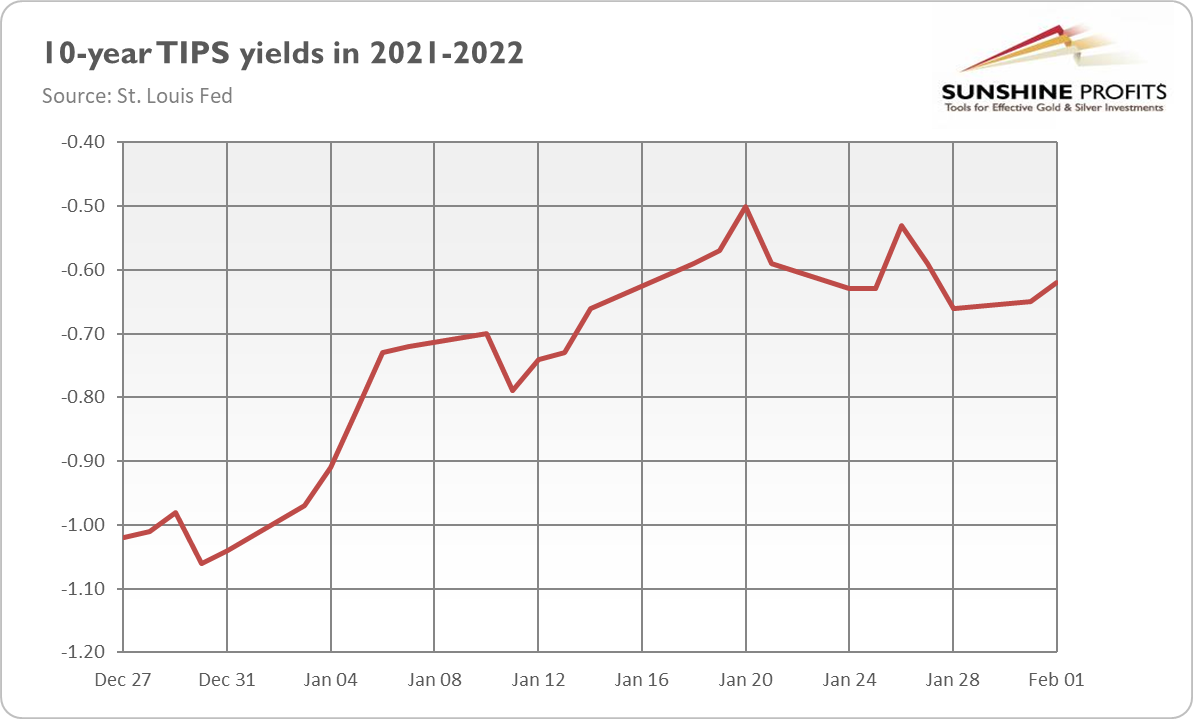

Even more intriguing, and perhaps encouraging as well, is that the real interest rates have increased last month, rising from -1% to -0.6%. Gold is usually negatively correlated with the TIPS yields, but this time it stayed afloat amid rising rates.

Implications For Gold

What does gold’s behavior in January imply for its 2022 outlook?

Well, I must admit that I expected gold’s performance to be worse. Last month showed that gold simply don’t want to either go down (or up), but it still prefers to go sideways, glued to the $1,800 level. The fact that strengthening expectations of the Fed’s tightening cycle and rising real interest rates didn’t plunge gold prices makes me somewhat more optimistic about gold’s future.

However, I still see some important threats to gold. First of all, some investors are still underpricing how hawkish the Fed could become to combat inflation. Hence, the day of reckoning could still be ahead of us. You see, just today, the Bank of England hiked its policy rate by 25 basis points, although almost half of the policy-makers wanted to raise interest rates by half a percentage point. Second, the market seems to be biased downward, with lower and lower peaks since August 2020.

Having said that, investors should remember that what the Fed says it will do and what it ends up doing are often very different. When the Fed says it will be dovish, it will be dovish. But when the Fed says it will be hawkish, it says so. This is because a monetary tightening could be painful for asset valuations and all the debtors, including Uncle Sam. The U.S. stock market already saw significant losses in January. As the chart below shows, the S&P 500 Index lost a few hundred points last month, marking the worst decline since the beginning of the pandemic.

Thus, the Fed won’t risk recession in its fight with inflation, especially if it peaks this year, and would try to engineer a soft-landing. Hence, the Fed could reverse its stance relatively soon, especially that it’s terribly late with its tightening. However, as long as the focus is on monetary policy tightening, gold is likely to struggle within its tight range.

Some policy-makers and economists have argued that the emergence from the COVID-19 pandemic is more like a postwar demobilization and conversion to a civilian industry than a normal business cycle.

White House economists have compared the current picture to the rapid increases in 1947, caused by the end of price controls in conjunction with supply chain problems and pent-up demand after the war (“Historical Parallels to Today’s Inflationary Episode”, Council of Economic Advisers, July 6, 2021).

The problem with this analogy is that it is only one instance from more than 70 years ago. More recent and more frequent inflation episodes have generally been ended by a recession or a mid-cycle slowdown.

Price pressures have an internal momentum of their own and tend to intensify rather than lessen as the business cycle becomes more mature and the margin of spare capacity shrinks in all markets.