On analysis of the moves by the gold futures during the last three weeks, I find that the bulls look not confident enough to hold the heights tested last Friday.

Undoubtedly, the gold futures found strong buying support during the second week of February after hitting a low at $1987, as the bulls continued to hold command during the second half of Feb. 2024, amid diminishing hopes of rate cuts soon.

In the daily chart, gold futures could define a lot about the next directional move in today’s session as the gap-down weekly opening looks evident enough for a steep slide soon if the gold futures find a breakdown below the immediate support at $2083 in today’s trading session.

On Tuesday, gold futures could witness indecisive moves on the announcement of the ISM Non-Manufacturing PMI (Feb) and some more data on Wednesday and Thursday.

Gold futures witnessed some gain after the announcement of some soft U.S. economic data spurring bets that the Fed will cut interest rates by June. But anticipation of more cues from the central bank saw traders once again step back from big bets on the yellow metal.

Finally, I conclude that the gold bears will continue to focus on a two-day testimony by the Fed Chair Jerome Powell this week, for any more cues on the path of interest rates.

Undoubtedly, the gold bears are showing their strength on Monday as the gold futures, finding it difficult to hold the current levels which ensures a steep slide by the gold futures could wash all gains made by the bulls during the last two trading sessions of the previous week.

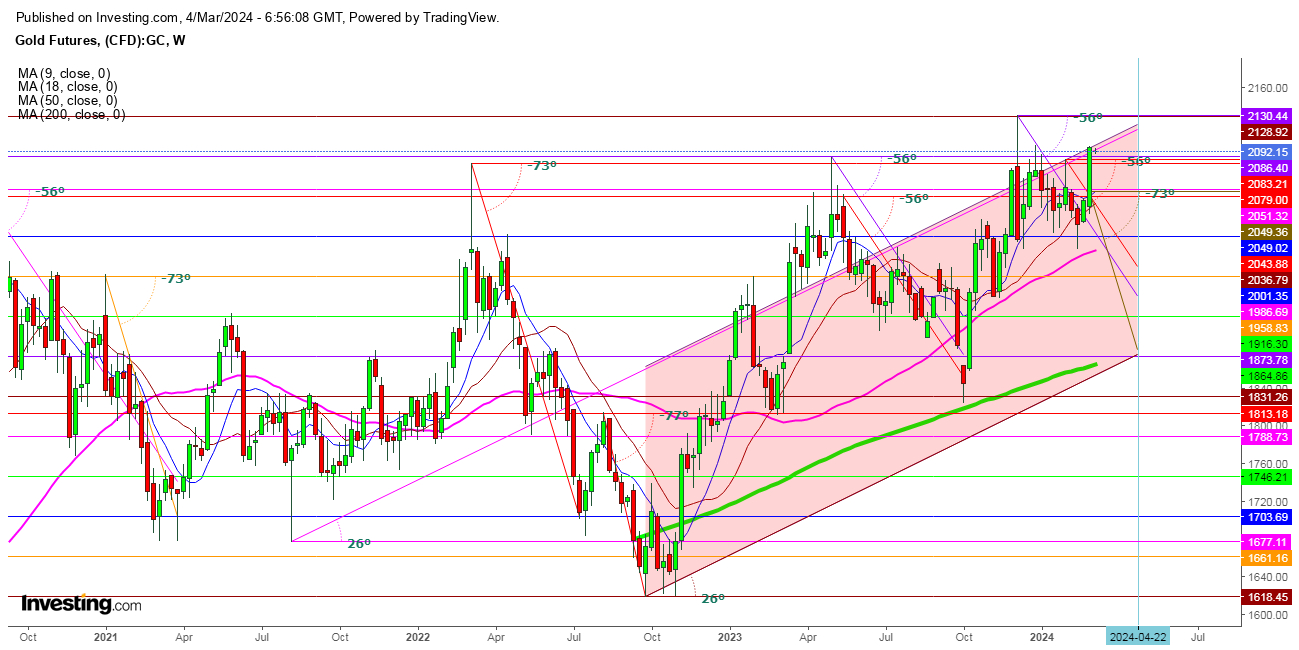

In the weekly chart, gold futures could not go above the limits, set by me for the bulls, despite a bumpy move on last Friday.

Undoubtedly the appearance of a ‘Bearish Dozy’ this week could grow large if the gold futures find a breakdown below the immediate support at $2083 on Monday.

On the reverse side, if this bearish dozy tries to hold above the weekly opening, immediate resistance for gold futures will be at $2098.

Despite holding two-month high levels, gold futures could find a sudden slide as seen during the last week of Dec. 2023. In such a scenario, gold futures could retest the first support at $2048 and the second support at $2036 this week before finding some reactionary reversal after hitting 50 DMA, which is at $1986 in the weekly chart.

Disclaimer: The author of this analysis may or may not have any position in the Gold futures. All the Readers are requested to take any long or short trading position at their own risk.