I would like to provide an update on what my expectations are with respect to gold and PMs for the remainder of 2017.

First off, I now no longer feel that early May hosted the ICL for gold and PMs but I do expect an ICL to unfold in gold over the next week or so (see my last chart of this post). This update will focus mostly on Cycles analysis but will also bring in some elements of Elliot Wave (EW) Theory that will give you some insight of what I am looking for at the next Intermediate Cycle Low (ICL) in gold. While I am not an EW expert or practitioner, I do understand its concepts and basic rules enough to use it in conjunction with my Cycle work. Both methodologies try to use Major Lows to determine the direction of the longer Cycles or Waves.

First, here are some basic EW rules followed by a generic EW chart.

A correct Elliott wave count must observe three rules:

- Wave 2 never retraces more than 100% of wave 1.

- Wave 3 cannot be the shortest of the three impulse waves, namely waves 1, 3 and 5.

- Wave 4 does not overlap with the price territory of wave 1, except in the rare case of a diagonal triangle formation.

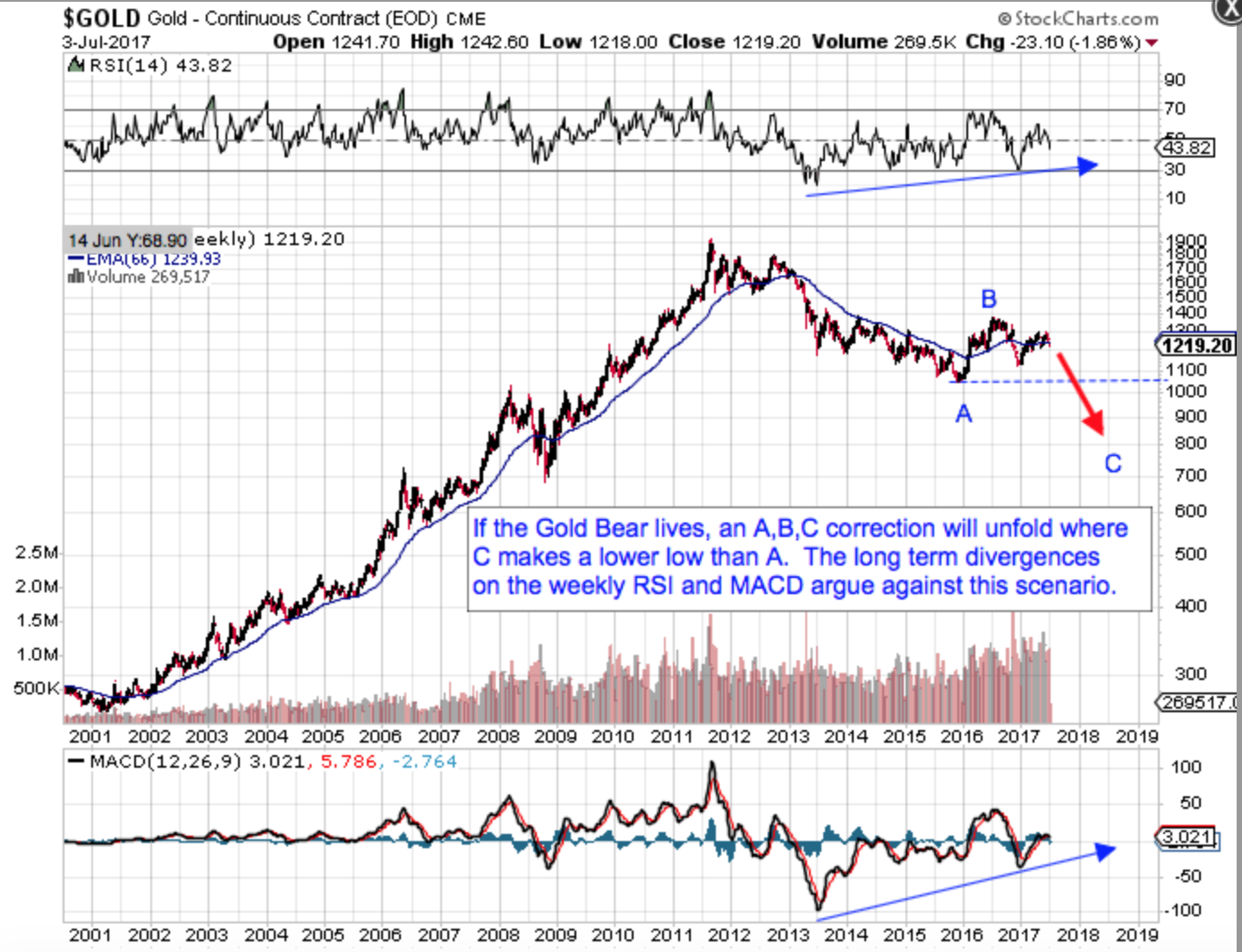

Based on my longer term Cycle Analysis of both gold and the USD, I do believe that gold has found a major Bear Market low in late 2015 but this still needs to be proven out as it may be possible that we are also in the mist of an A,B,C correction as depicted on the above chart (not my primary scenario from a Cycle standpoint). As I mentioned, Bresserts Cycle work and EW do have some common elements regarding how major lows are analyzed to determine the longer term price trends.

Based on Bressert, we do not want to see either the Dec 2015 or Dec 2016 YCLs/ICLs broken from here as this would break key EW and Cycle rules leading to the C move lower. My expectation is that the next ICL will be a higher low than Dec 2016 based on the Price and Time action I am seeing. At the start of Wave III, I want to see higher ICLs starting with the next one that is currently developing. See my next two charts for the two possible scenarios from here. Again, I apologize if my EW numbering convention is not correct, but it should be sufficient to illustrate what I am looking for.

My last two charts are the same weekly chart. The first provides a close up of the potential bullish EW structure I am looking for after the next ICL. My second weekly shows my Intermediate Cycle counts out of what I feel is the Bear Market Low in Dec 2015. Based on my longer term Cycle analysis on both the USD and gold, these are still my expectations.