Gold and Gold Stocks have hit bottom. The correction in terms of price is likely over.

Time will tell if they push to new highs or chop around well into 2021. Regardless of that outcome, the downside potential in price is minimal.

Let me start with the stocks.

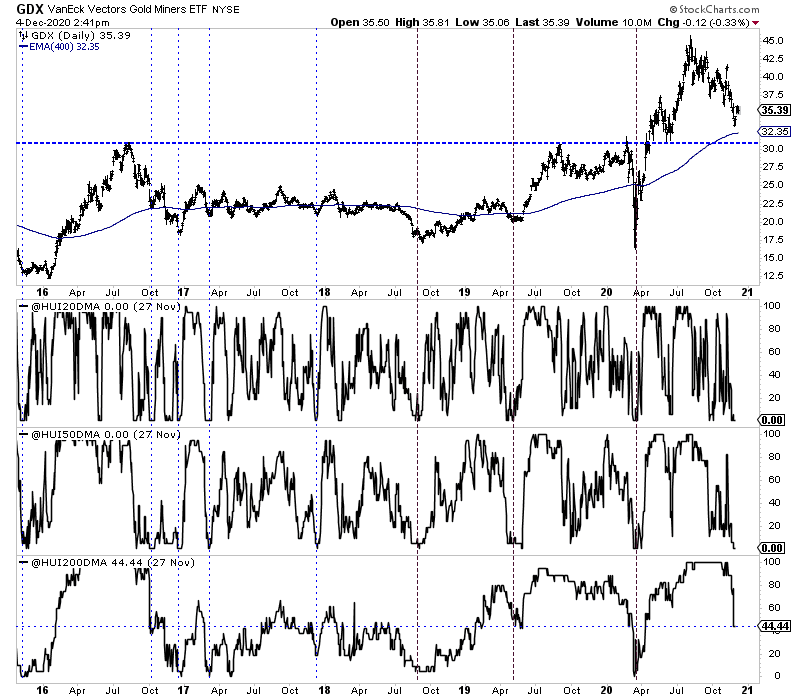

Last week VanEck Vectors Gold Miners ETF (NYSE:GDX) nearly tested its 400-day exponential moving average, which has often marked correction lows within bull markets. It looks like GDX bottomed right at the 38% retracement from the 2016 low.

Also, consider the extreme oversold readings in breadth indicators. At the low, the percentage of HUI stocks that closed above the 20-day and 50-day moving averages was 0%, and only 44% closed above the 200-day moving average.

The vertical lines mark similar breadth readings. Since 2018, these kinds of oversold readings marked important lows.

GDX Daily Bars w/ Breadth Indicators

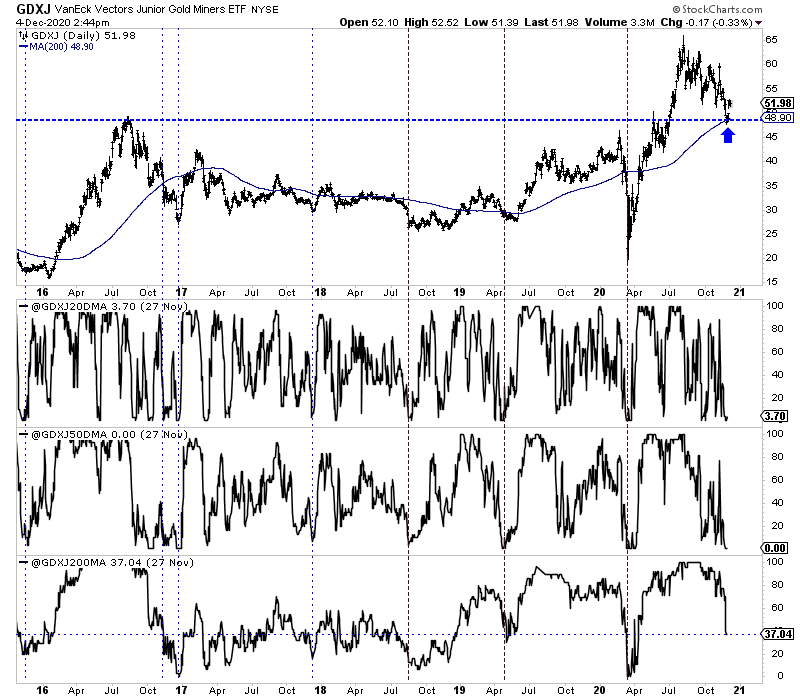

VanEck Vectors Junior Gold Miners ETF (NYSE:GDXJ) bottomed just below $48, a level at which there is a significant confluence of support. It includes the previous 7-year resistance, the 200-day moving average, and it marked the 38% retracement from the COVID low.

Moreover, breadth readings at that point were also extremely oversold and argued for a rebound.

GDXJ Daily Bars w/ Breadth Indicators

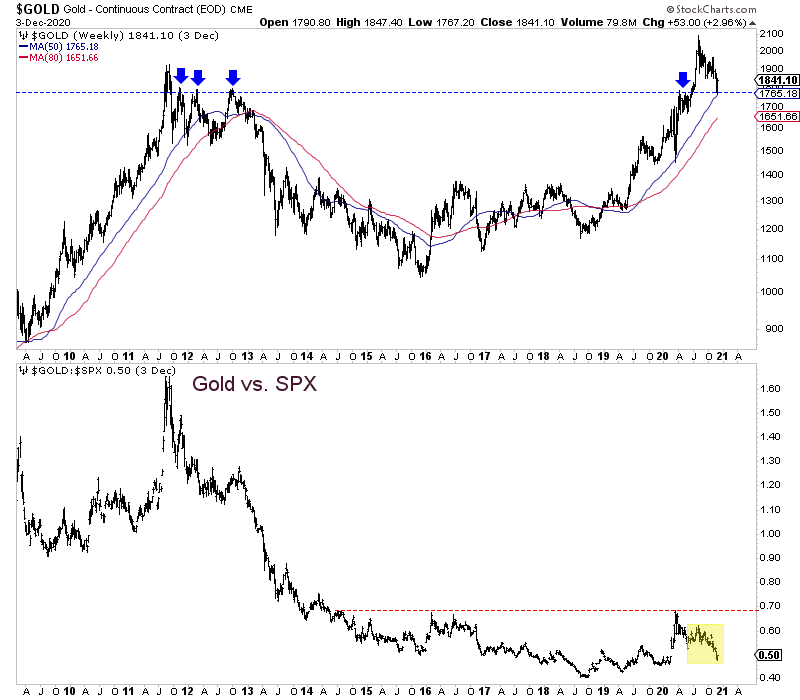

Gold, much like GDX and GDXJ, also bottomed around a strong confluence of support.

There is strong monthly support around $1770, which also marks the 50% retracement from the COVID low in March 2020.

Furthermore, Gold corrected in price exactly as much as it did as comparable points in history (2004 and twice in 2009).

Gold Weekly and Gold/S&P 500 Ratio

The sector has bottomed or is bottoming, but the current negative is precious metals have underperformed in real terms as the market has been focused on the potential for recovery more so than inflation. That is positive for stocks and commodities but less so for precious metals.

The macro fundamentals for precious metals will remain bullish as the Fed stays at 0, the yield curve continues to steepen, and real rates decline. These fundamentals will support Gold and gold stocks, but they must regain relative strength.

Gold will not make a new high and run towards $3000 unless the Gold to S&P 500 ratio breaks above 0.70.

In short, precious metals are trading at a low, and this is a buying opportunity, but don’t assume they are going to rocket to new highs as they did in the summer.