Major U.S. indexes ground modestly higher last week to reach new multi-year highs but remain in technical “red zones” and facing significant fundamental challenges. This confluence of events leaves global financial markets at a major crossroads.

On My Wall Street Radar

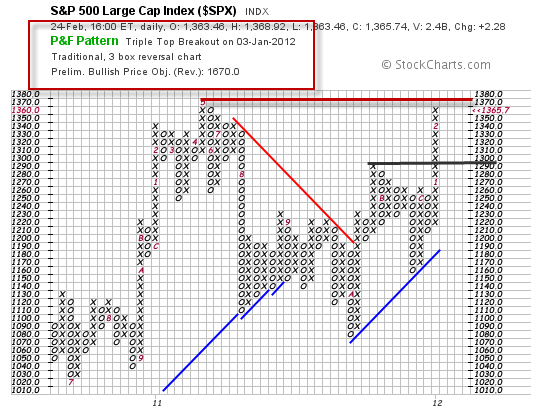

A quick glance at the chart of the S@P 500 (NYSEARCA:SPY) shows us that the index is in a bullish configuration with a price objective of 1670. However, it is also bouncing along below major resistance levels at 1365-1370 which it has failed to surmount and is represented by the red line in the chart above. Major support rests at 1290, as represented by the black line, and a glance at the long column of Xs shows how overextended the index is relative to the start of this move.

Conventional indicators like RSI are also at very overbought levels with a reading of 70.15 which is considered the “red zone” and levels from which corrections often take place. Other major U.S. stock indexes like the Russell 2000 (NYSEARCA:IWM) and the Dow Jones Industrial Average (NYSEARCA:DIA) find themselves in similar positions with high RSI readings and channeling sideways at significant resistance levels.

On Friday, VIX, the CBOE “fear gauge,” rose along with stock prices which usually doesn’t happen as the two are typically uncorrelated, and this kind of action indicates growing fear in the market in spite of rising prices. Finally, VIX below 20 oftentimes precedes major sell offs, as does RSI above 70. Confirming negative sentiment going forward, the Dow Jones Transportation Average has not participated in recent gains with the index rolling over and declining by some 4% over the last 14 trading days.

On the upside, bulls can say, correctly, that a break above 1370 would likely bring more buyers off the sidelines as the fear of being left behind replaces the fear of loss that usually drives markets lower.

However, the best overall probability from a technical standpoint says that we’re in a bull market, severely overbought and subject to a measurable correction at any time.

The Economic View From 35,000 Feet

Last week’s economic news was mostly positive as the Greek bailout moved ahead and bond prices generally rose in Europe. However, the G20 continues wrangling this weekend over increasing the “firepower” of its rescue mechanism and everyone wants Europe, and particularly Germany, to step up with more money before countries outside the Euro Zone pony up more cash to save Europe. European stock markets were mixed with The Vanguard MSCI European ETF (NYSEARCA:VGK) showing small gains as the Greek Tragedy continues and seemingly never can get to the final curtain.

At home, economic news was largely positive with unemployment claims continuing to fall, consumer confidence rising to yearly highs and new home sales improving.

On the negative side of the ledger, Europe appears now certainly to be entering recession with its PMI dropping below 50 and Germany showing contraction in its economy for the 4th Quarter of 0.2%. The European Commission expects the entire Euro Zone to contract 0.3% this year with Italy and Spain registering declines of more than 1%, all of which will make it more challenging for the zone to bolster its weaker members that are forecast to slide into deeper recessions.

Of course, the biggest potential negative for today is the parabolic move higher in oil prices with West Texas Intermediate Crude (NYSEARCA:USO) at $109.45 and Brent Crude at $125.47, a more than 10% gain since the start of February. With gasoline prices topping $3.65 nationally and over $4.00 in California and Hawaii, one can only wonder how long it will take for these levels to add more headwinds to the economic picture in the United States.

This week will see important economic reports in the areas of home sales, Federal Reserve Manufacturing Reports, Durable Goods, Home Prices, Consumer Confidence and jobs. Particularly newsworthy reports come on Wednesday with a 4th Quarter GDP estimate, February PMI and Fed Beige Book which are followed on Thursday by the widely watched February ISM Report from the Institute of Supply Manufacturing.

Bottom Line for ETF Investors

Global markets stand at a crossroads and now face significant technical and fundamental challenges as February draws to a close.

Disclaimer: Wall Street Sector Selector actively trades a wide range of exchange traded funds (ETFs) and positions can change at any time.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Global Stocks, ETFs at Crossroads

Published 02/27/2012, 12:14 AM

Updated 05/14/2017, 06:45 AM

Global Stocks, ETFs at Crossroads

After reaching new highs not seen since June, 2008, major U.S. stock market indexes stand at a major crossroads.

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.