Micron shares surge amid sharply higher revenue forecasts on AI-led memory demand

In poker terms, central bankers have given the bulls an open-ended straight draw. They have “outs” to a win at both the high and low end of the straight:

High end: Increasingly bad news / economic deterioration increases the odds of stimulus, which propels risk assets higher.

Low end: In a “muddle through” scenario, equities are still supported by near-zero interest rates and the “nowhere else to go” argument, with blue chip dividend payers, for example, giving superior yields to Treasuries etc.

In addition to the above, the United States – both equities and Treasuries – has a “best house in a bad neighborhood” profile, with capital leaving Europe and elsewhere having nowhere else to go.

Chase-happy poker players tend to love their draws, and will expend a lot of chips chasing them. And it would appear the bulls have a very good thing going here. The problem for the bulls is that a straight can still lose to a full house or flush – and in either instance, the draw can “hit” and still lose badly. In these terms, the flush and full house (for bears) are:

- Return of macro crisis

- Corporate earnings deterioration

- Post-stimulus letdown

NEWS FLOW

StanChart analysts write that “The ground has finally cracked under the weight of China’s copper inventories,” and they mean it LITERALLY. They are stockpiling so much base metal that the concrete is getting stress fractures and pooling water beneath!

China permabulls continue to amaze me. No rapidly growing nation in all of economic history has successfully avoided the test of financial crisis. And the notion that a command-and-control economy, let alone one racked by severe corruption, can thrive without serious waste and internal contradiction is laughable on its face. I can only conclude those refusing to be realistic on China’s prospect for a hard landing simply do not exist in a land of reality. Their wishes and hopes have transported them to a place of make believe.

- Euro Zone Economy Declines, Putting Pressure on Leaders

- German Small Businesses Reflect Country’s Strength

- How Bad Is Greece? Worse Than You Think, Ross Says

For bulls, Europe remains a potential hand grenade because any weekend now, markets could wake up to some insane announcement: Greece is leaving, Germany is doing X, and so on and so forth. It’s the gift that keeps on giving.

Retail sales put in a bullish showing on Tuesday and markets declined. In the screwed up world of stimulus expectations, good news is actually bad news. If America has the wherewithal to slowly heal on its own, it increases the odds central banks can hold fire or implement weaker versions of stimulus than the market would like.

Here is another serious problem for the bullish case:

- A genuine recovery will require a rise in wages and employment

- Rise in wages / employment will cut into corporate profits

- (The above because much of profits were cost-cutting oriented)

- This same recovery will eventually put the Fed on “hold”

Manipulated markets are NOT A SUSTAINABLE REASON TO BE OPTIMISTIC. Whoever doesn’t get this deserves a frying pan to the face, economically speaking, and is likely to get one if they stay complacent.

- Analysis: Oil price inflates as speculators bet on stimulus

- Central Banks Have Conditioned Equity Investors

In the aftermath of the financial crisis, corporate profits expanded with the help of stimulus in large part because of an aggressive program of retooling, retrenching and cost-cutting, with revenues sustained by the top 30% (upper middle to upper class) continuing to spend.

But those gains were always going to be of limited duration in nature, and without REAL recovery, further stimulus efforts will lead to stagflation, depression, inflation or some combination of all three.

This seems blindingly obvious. It isn’t, of course, to those who either pay no attention to macro logic or have little patience / incentive to heed logic in the first place…

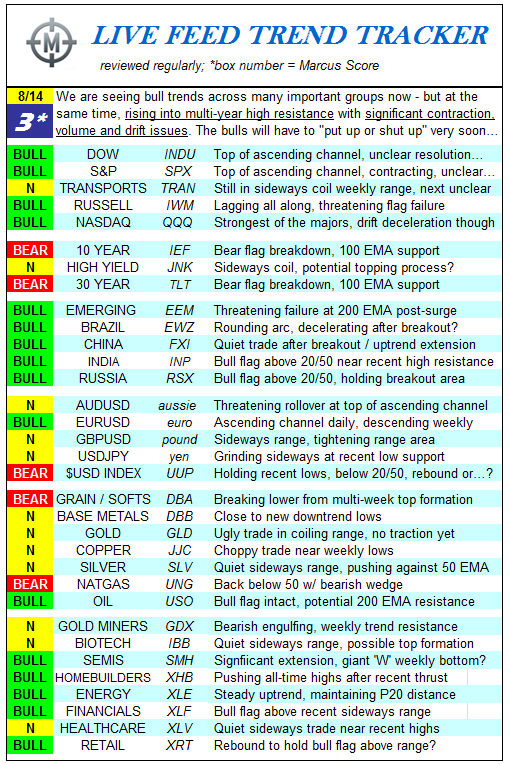

TECHNICALS

There is an argument that the major indices are working out their overbought state through time rather than price.

The longer we stay in this “do-nothing” range without a meaningful breakdown, the greater the odds it resolves into some kind of flag or grind-up higher.

And yet, nonetheless:

- So many vehicles tagged ‘bullish’ look overextended here

- Contraction and low volume extension all over the place

- The ‘stimulus’ argument has been BEATEN TO DEATH

- Key bellwethers like copper looking more bearish than bullish

We favor the bearish side philosophically at this juncture too – NOT because we are permabears, but because, seriously, who can really enjoy these rickety-ass hope-and-hype rallies that are based more on stupidity and greater fool theory than anything else? Buy the false trend and ride the daylights out of it, yes, but do so in the solid and sustainable part, not at 1:45 a.m. when only the hardcore drunks are left and the lights are about to switch on announcing closing time…

Disclosure: This content is general info only, not to be taken as investment advice. Click here for disclaimer