What do 72 countries – including developed nations such as Canada, Australia, Japan and Sweden; emerging giants such as Argentina, Brazil, Mexico, Nigeria, India, Iran and Russia; and small countries such as Burundi, Haiti, Myanmar, Syria and Tonga – all have in common?

Not much, you might say; they differ vastly in such metrics as population, GDP per capita, inflation rate, income inequality and political stability. Yet these 72 nations do share one surprising feature: The price of gold is at an all-time high in the currencies of all these countries. Furthermore, the price is not far from its historical zenith in terms of the British pound, the Chinese yuan, the Swiss franc, the euro and even the US dollar.

This phenomenon was pointed out to us by Ross Norman, CEO of Sharps Pixley, a London bullion broker, who wrote an article titled “Gold hits an all-time high in 72 currencies” (Jan. 15, 2019).

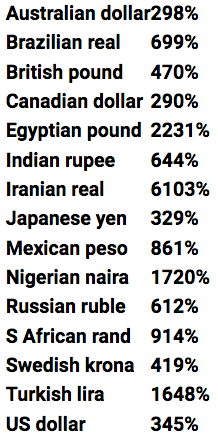

So what’s going on here? We can certainly point to the drastic appreciation of gold over the last 20 years. Since 1999, gold has risen by the following percentages relative to these nations’ currencies (some figures are approximate):

Data source: goldprice.org/gold-price-history.html

In the span of these two decades we have seen the dot-com bubble and crash (followed by recession), the US housing crash and Great Financial Crisis (and recession), and then the longest bull market in US history. Gold has tended to tread water in most major currencies in the latter period, from March 2009 to present, but it’s clear that a post-millennial flight from risk and into gold has been a powerful and globally consistent pattern. There has simply been more financial, economic, and geopolitical turbulence over the last two decades than there was in the period 1945–2000.

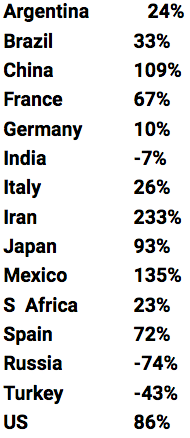

Sovereign debt must be a factor in gold’s ascendance, too. Around the world, nations have responded to the challenges of our era by taking on ever greater debt. From 2000 to 2017, these nations experienced the following percentage growth in debt to GDP:

Source for US and other data: tradingeconomics.com/united-states/government-debt-to-gdp

Interestingly, the biggest increases in central bank gold holdings from 2000 to 2018 are found among both nations with the greatest debt growth and those with the least.

Source: gold.org/goldhub/data/monthly-central-bank-statistics

Apparently, gold purchases are driven more by central bank policy than by economic factors per se. Gold can, however, be a geopolitical force. Bloomberg reported on Jan. 25, 2019, that the Bank of England – at the urging of US officials – had blocked an effort by the embattled Maduro regime in Venezuela to repatriate $1.2 billion in gold.

In conclusion we can certainly say that gold has retained its global significance as a store of value, and indeed there has been a widespread, strong, and sustained “flight to gold” in this century.

Cumberland’s US ETF managed accounts hold a position in GDX, a gold miner ETF.