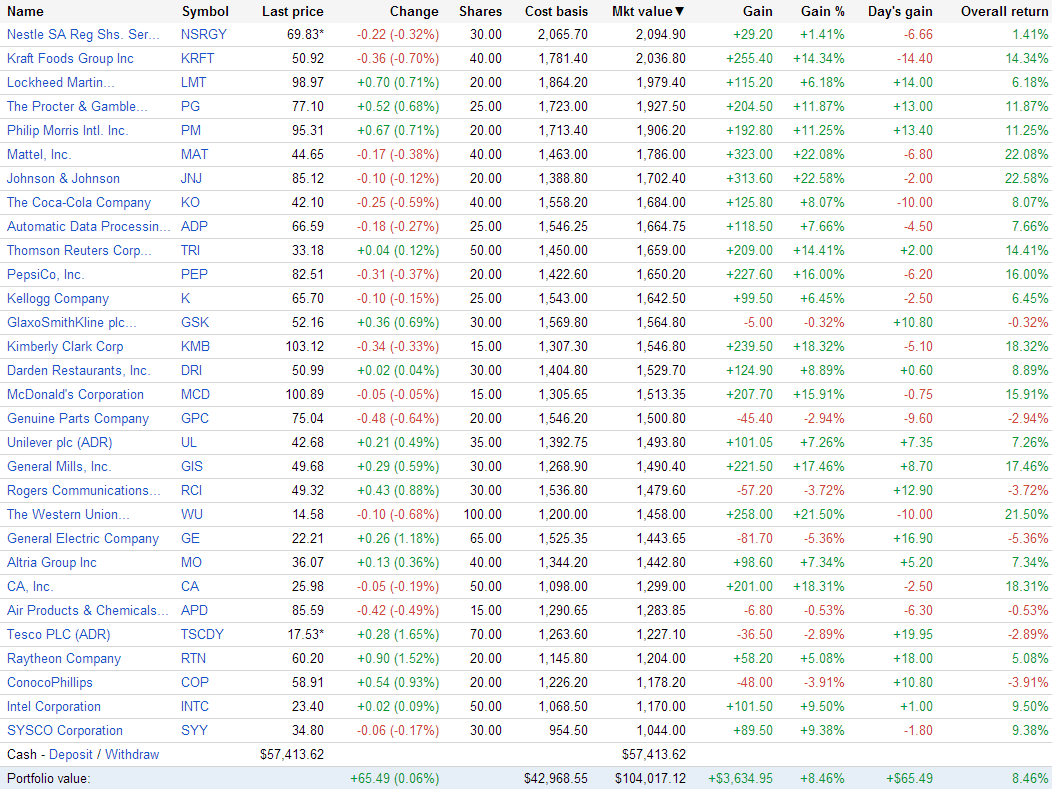

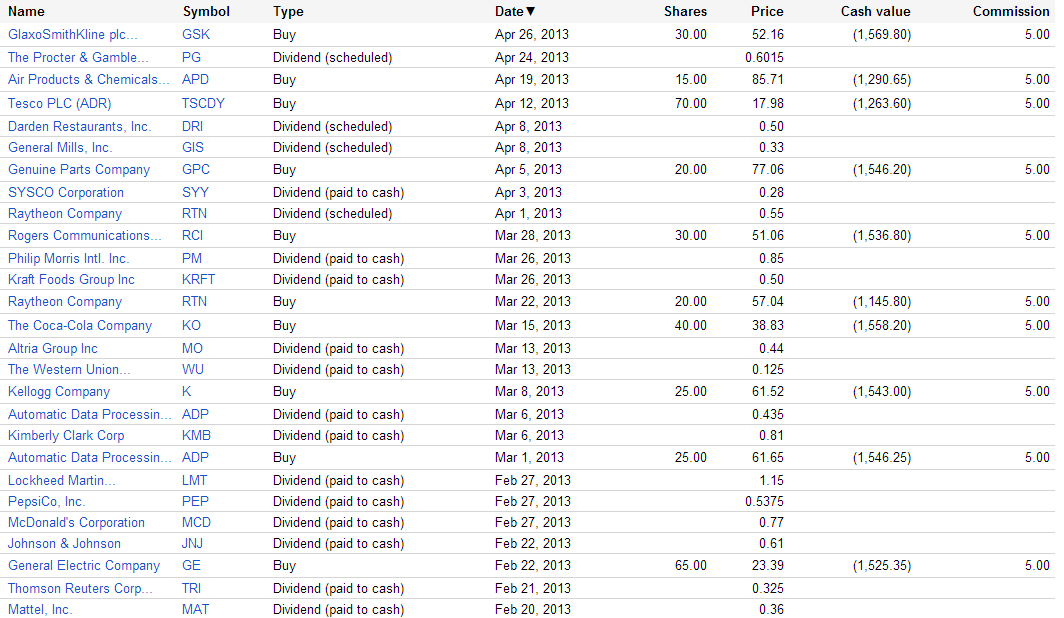

The British drug manufacturer GlaxoSmithKline is the next stock purchase for my Dividend Yield Passive Income Portfolio (DYPI). I bought 30 shares at $52.16, the ADR version of the British stock.

The total purchase amount was $1,569.80 and represents roughly 1.5 percent of the full portfolio value.

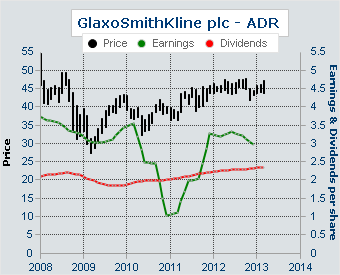

GlaxoSmithKline discovers, develops, manufactures, and markets pharmaceutical products, over-the-counter medicines, and health-related consumer products worldwide. It offers pharmaceutical products in various therapeutic areas comprising respiratory, anti-virals, central nervous system, cardiovascular and urogenital, metabolic, antibacterials, oncology and emesis, dermatology, rare diseases, immuno-inflammation, vaccines, and HIV. The company provides prescription medicines to treat a range of conditions, including infections, depression, skin conditions, asthma, heart and circulatory disease, and cancer.

GSK is one of the world’s leading drug manufactures with a solid non pharmaceutical division. It sells also oral care products and is the second biggest global player behind Colgate. The current dividend yield is above the 5 percent mark at 5.29 percent and the price to earnings ratio amounts to 18.90. The stock started to gain more momentum which resulted in a year to date gain of 21.81 percent.

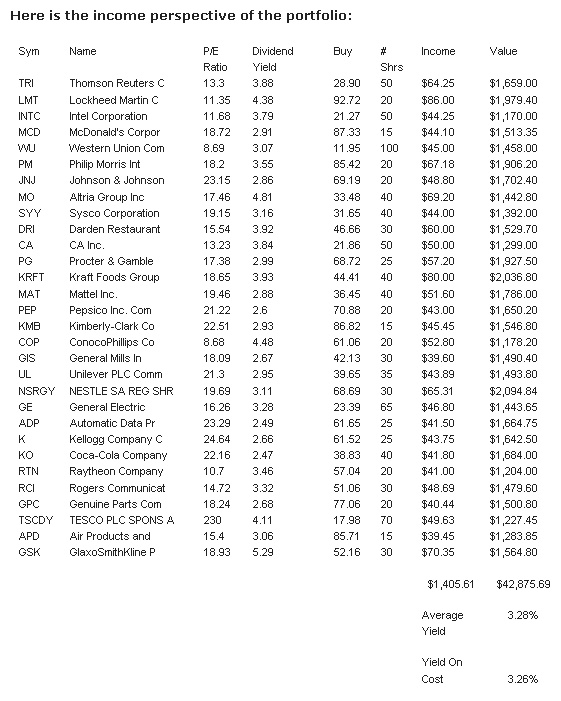

The new GSK stake gives me $70.35 dividend income. The full portfolio dividend income is now estimated at $1,405.61. I plan to increase the total number of stocks by the end of the year to 50-70. As a result, the dividend income should grew to $3,000 to 4,000.

All I need to do is to hunt further for stocks with a yield over 3 percent. As of now, the acquisition process was successful done with a yield on cost of 3.26%.

The DYPI-Portfolio was funded virtual on October 04, 2012 with 100k. Each week, I try to put one stock into the portfolio with a solid dividend growth history as well as an attractive yield. It’s a slow buying process but in line with my strategy to show you how long-term dividend investing works.

Not all stocks will deliver a great performance over the time but I believe that the huge amount of stockholdings should result in an adequate annual return of at least 8 percent of which 3 percent are dividends.

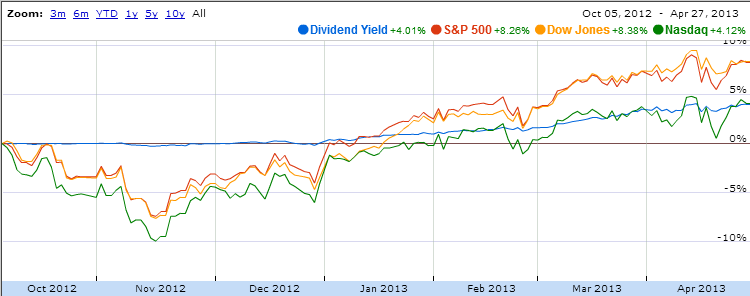

Because of the slow purchase process and the high cash amount, the full portfolio performance is up 4 percent since the date of funding. A deeper look at the stockholdings shows that the core performance is at 8.46 percent, a value better than the Dow Jones, Nasdaq and S&P 500.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

GlaxoSmithKline For The Dividend Yield Passive Income Portfolio

Published 04/29/2013, 02:23 AM

Updated 07/09/2023, 06:31 AM

GlaxoSmithKline For The Dividend Yield Passive Income Portfolio

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.