My wife forwarded this to me last week. It has gone viral after all (which is the only reason a finance-o-phobe like my wife - and like most normal people outside of geeks like you and me - would have seen it). It comes courtesy of Business Insider, which saw fit to pump the bear case at the exact moment that fear could not get any more palpable in US and global stocks markets.

Now Zero Hedge is apparently still hung up on it. I generally like ZH and marvel at the shear volume of information that these guys churn out; but come on guys, enough already. Raoul Paul (a hedge fund manager no less; oooohhhhh) thinks the system is going to end and a new one will rise from its ashes. Wow, ya think?

Here is what I think; I think the American Association of Individual Investors puked in May and remains resistant to a rally right up to this minute. I had been looking for potential on the S&P 500 down to 1200 or so, but news items like the now viral End Game report, sentiment data and some technicals shaping up across many markets make me wonder if the top of the 1260 to 1200 target was all we will get.

Regardless, I am expecting generally bullish themes for much of the balance of 2012. If I am wrong, then I am wrong. The system is after all, going to end sometime because it has been choked with unsustainable inputs from meddling and egomaniacal monetary autocrats most intensely since the age of Inflation onDemand took hold in 2001 when a brand new bouncing baby credit bubble began to take shape.

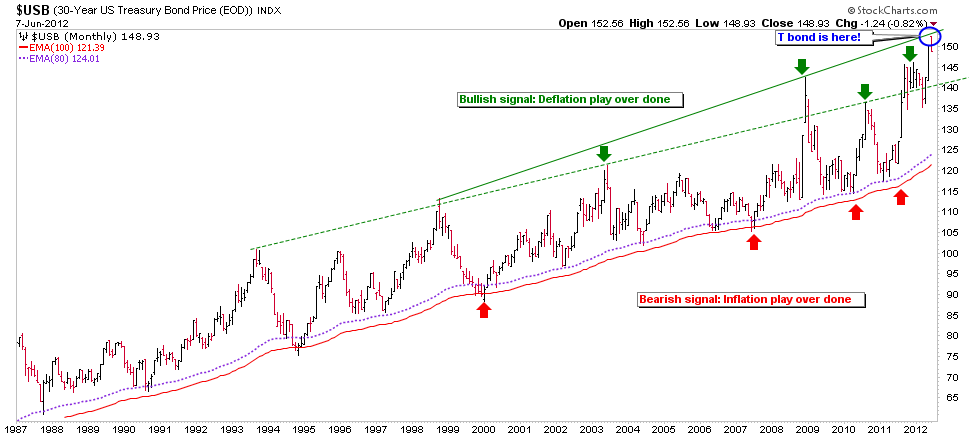

The credit bubble was the funding mechanism of the mortgage and housing bubbles and Wall Street's 'leveraged products' bubble. These of course already wrecked the system. But now the bubble has morphed and embedded itself into US Treasury bonds. And what a bubble this is!

With seemingly limitless power to fund itself, the US can now leverage a critically over bought T bond and relatively strong US dollar to fund operations for a limited time period, like say into the election? It is the age of Inflation onDemand and the T bond says there is demand for inflation; whether this demand was cooked up by official Treasury yield 'operations' or not.

The bear phase in the markets has done its job. Business Insider has done its job. Zero Hedge is making sure that the last doomsday survivor is tucked away safe and sound in his bunker and all is aligned for some unexpected outcomes over the intermediate term.

Long term? Yeh, the system is going to end.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Generally Bullish Themes On Tap For Balance Of 2012

Published 06/10/2012, 01:21 AM

Updated 07/09/2023, 06:31 AM

Generally Bullish Themes On Tap For Balance Of 2012

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.