The CAD strengthened to its highest in nearly three weeks against the USD, before paring most of its gains ahead of further talks to revamp the NAFTA trade pact. Canadian Foreign Minister Chrystia Freeland is due to hold fresh talks on the North American Free Trade Agreement with U.S. Trade Representative Robert Lighthizer in Washington as a U.S.-imposed deadline of October 1 looms.

We opened USD/CAD short at 1.3065, in line with our trading strategy, and set the target at 1.2795.

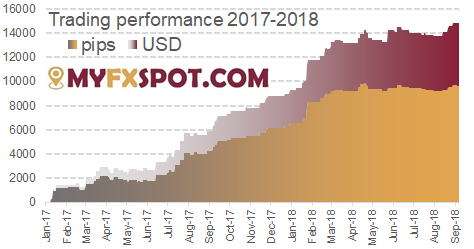

This is how MyFXspot.com trades now:

EUR/USD

Trading strategy: Long

Open: 1.1550

Target: 1.1750

Stop-loss: 1.1605 (raised from 1.1450)

Recommended size: 2.00 mini lots per $10,000 in your account

Short analysis: EUR/USD bulls are in control, this is likely to remain the case while the 10-day moving average remains intact. The overall scope is for an eventual break above the 1.1734 August high, which in turn will unmask the 1.1780 key Fibonacci level, a 38.2% retrace of 1.2556 to 1.1301 fall.

GBP/USD

Trading strategy: Buy

Open: 1.3080

Target: -

Stop-loss: 1.2975

Recommended size: 1.43 mini lots per $10,000 in your account

Short analysis: The GBP/USD was supported by higher-than-expected UK inflation data, but the pair failed to hold above 30-day moving average (1.3217) and we see doji candle today. This may suggest counter-trend run back to the daily cloud top, 1.3067. We have raised our bid to 1.3080

USD/JPY

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: Stop-loss hit at 112.30, lost: 100 pips, $150 per $10,000 in your account. USD/JPY registered its third largest one-day rise of September on Tuesday to marginally break the key 112.38 Fibo, a 76.4% retrace of the 113.18 to 109.78 fall. This move reinforces bullish momentum on this pair. That being said, we think that more USD./JPY strength above past peaks of around 113.17 may prove challenging for now, given lingering sources of risk aversion worldwide. We stand aside.

USD/CAD

Trading strategy: Short

Open: 1.3065

Target: 1.2795

Stop-loss: 1.3200

Recommended size: 1.44 mini lots per $10,000 in your account

Short analysis: We opened our short at 1.3065. The USD/CAD broke below 100-day moving average and psychological level of 1.3000. The pair is now also below the 76.4% Fibo of 1.2887-1.3225 rise, which suggest stronger bearish momentum. We set USD/CAD short target at 1.2795.

AUD/USD

Trading strategy: Buy

Open: 0.7235

Target: -

Stop-loss: 0.7135

Recommended size: 1.50 mini lots per $10,000 in your account

Short analysis: Yesterday’s slide towards 0.7135/45 support failed. AUD/USD rally sees pair above 10-day moving average and RSIs rise. A bull hammer forms on the monthly candle. Bull sentiment is increasing. In our opinion there are convincing signals to open a long position now. We have placed a bid at 0.7235.

EUR/GBP

Trading strategy: Await signal

Open: -

Target: -

Stop-loss: -

Recommended size: -

Short analysis: Choppy price action spoiled the early Wednesday potential for a sub-cloud continuation of the bear trend. We see a rebound back inside the cloud. Stand aside for now while signals are mixed.  Trading ideas by MyFXspot.com

Trading ideas by MyFXspot.com