- UK unemployment rises to 4% in the three months to May, up from 3.8%

- Average earnings hit 7.3% (excluding bonus) and 6.9% (including bonus)

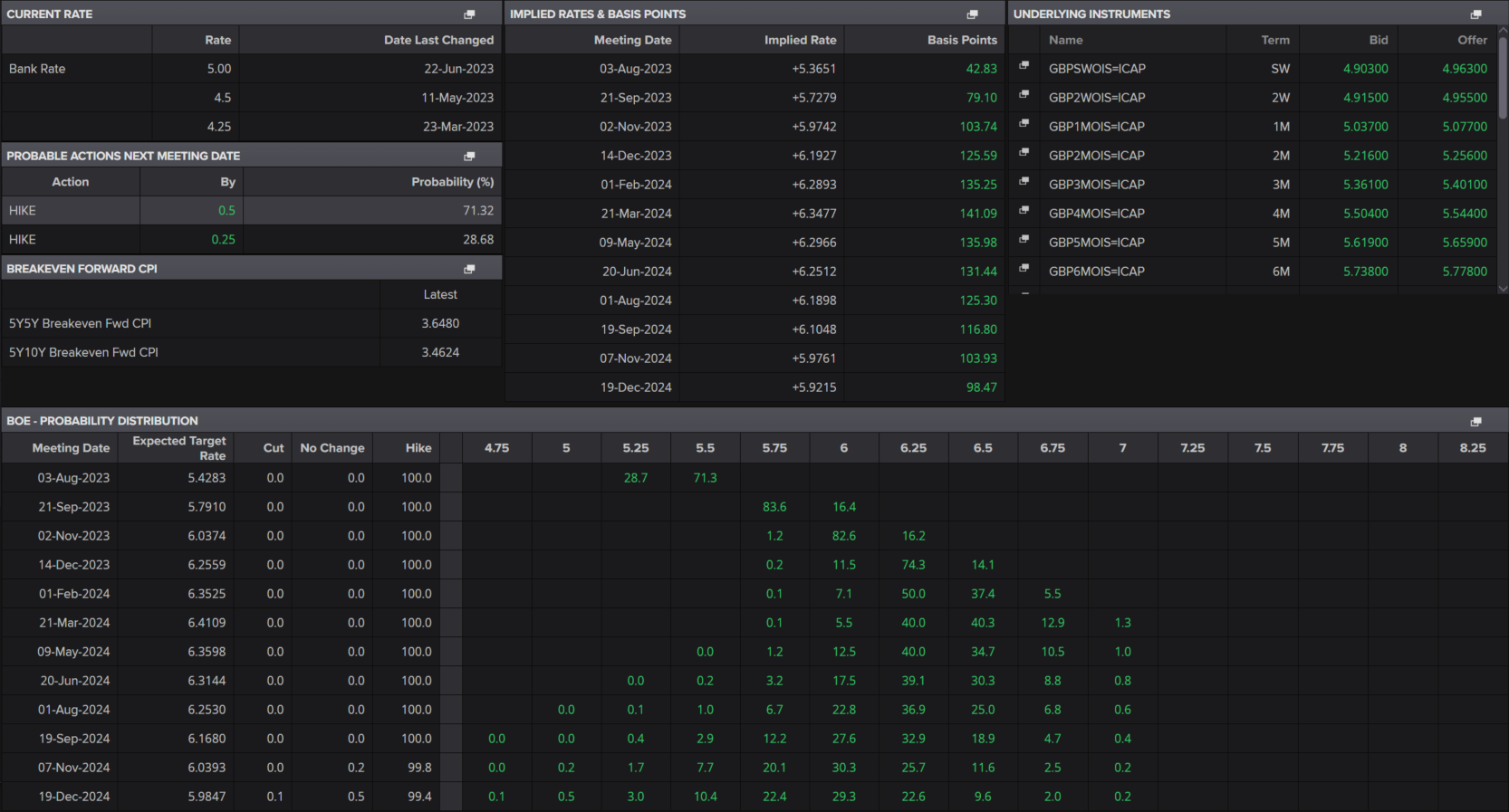

- Markets expect BoE to raise rates another 1.25%

UK jobs data this morning was a mixed bag on the face of it but a deeper dive into the numbers may give the Bank of England more cause for optimism than pessimism.

The earnings component of the report, while continuing to partly shield households from soaring inflation, is the part the MPC will be most concerned about. Getting inflation back to 2% on a sustainable basis simply won’t happen unless that wage growth falls dramatically and instead, it’s still rising, reaching 6.9% including bonuses and 7.3% without. The revisions to the April figures will not be welcome by the BoE either.

That said, there is plenty within this report to suggest the trend in wages will soon reverse which will give the MPC cause for optimism. Unemployment in the three months to May jumped to 4%, up 0.5% from its low nine months ago and steadily rising. There are other signs too that labour market tightness is easing, like falling vacancies to unemployment and lower inactivity as people are drawn back into the labour force due to high inflation.

While this isn’t hampering wage growth yet, it almost certainly will as bargaining power shifts and inflation falls. Lower energy and food prices, alone, should drive inflation down considerably over the coming months and that will filter into wage numbers over time which will give the BoE some confidence that pressures will ease.

Sterling makes small gains after initial volatility

The pound has been quite volatile in the aftermath of the data which probably reflects the mixed nature of it. It is trading a little higher on the day still, even as yields are marginally lower.

Source – OANDA on Trading View

It’s interesting to see momentum starting to slip as the pair gets closer to 1.30 which has previously been a very notable area of support and resistance, being a major psychological level. There appears to be a divergence forming between price, which has made new higher highs, and the stochastic and MACD, both of which thus far have not. That may change but if it doesn’t, it could be a potential red flag on approach to that notable level.

Markets still expect the BoE to hike rates by another 1.25% over the next few quarters, including a significant chance of another 50 basis point move next month. Of course, those expectations could be pared back if we do finally start to see progress on the inflation front.

BoE Interest Rate Probability

Source – Refinitiv Eikon