To finish out last week the GBP/USD did well to surge higher and move back through the 1.52 before easing off slightly. In doing so, it moved through 1.5150 which it had previously experienced some difficulty with over the last week or so. Over the last couple of weeks it has also received solid support from 1.50 which has given it the opportunity to rally higher and move back above 1.52 again. During last week however, it did move to a lower level and therefore reached a new two month low close to 1.50 before the strong surge higher. For a few days a couple of weeks ago it found some support around 1.5160 however this level was clearly broken as it fell down towards 1.50. Then throughout last week the area around the 1.5160 level was providing some resistance as the pound continued to try and rally higher.

Despite its recent rally to back above 1.52, the pound has now experienced a strong fall over the last month which has seen it fall from above 1.56 down to the two month low near 1.50. Prior to the last month, the pound enjoyed a strong couple of weeks and move to new highs above 1.56. It experienced all sorts of bother at 1.56 as it made several pushes to this significant level however it was turned away with excessive supply. For about a week it ran into a wall of resistance right around the 1.56 level. The pound had enjoyed a very solid couple of weeks moving from the support level at 1.52 to reach new highs at 1.56, a new ten week high. Back around mid April the pound experienced solid support at 1.52 for about a week which greatly assisted the recent surge higher, and recently this level was called upon again to offer some support and a soft landing, however the pound fell strongly through it on its way down to near 1.50. A couple of weeks ago, we saw some evidence that the decline had been slowed down as it traded around 1.52 for about a week whilst receiving solid support from around 1.5160.

The last month has seen the pound fall strongly and return almost all of its gains from the few weeks before that. About a month ago the 1.54 level provided a little piece of resistance and this level has since been broken as it offered limited support. In early March the pound moved to new lows around 1.4830 from a starting point near 1.64 at the beginning of the year. With the surge higher over the last couple of months, the GBP/USD had completely turned around its fortunes from earlier in the year, however it is starting to ease off and return most of the good work.

The U.K. could post better-than-expected growth numbers over the next three years, with a strong service sector propelling household consumption and business investment, according to business lobby group, the British Chambers of Commerce (BCC). In its second quarter economic outlook, the BCC upped its gross domestic product (GDP) growth forecast for 2013, 2014 and 2015, and said the service sector was likely to outperform other sectors. “We have constantly said that earlier fears of a triple-dip recession were misguided and risked damaging confidence unnecessarily,” said John Longworth, the BCC’s director general, on Friday.

GBP/USD June 3 at 01:45 GMT 1.5207 H: 1.5209 L: 1.5192 GBP/USD Technical" title="GBP/USD Technical" width="595" height="81">

GBP/USD Technical" title="GBP/USD Technical" width="595" height="81">

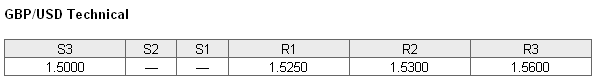

During the early hours of the Asian trading session on Monday, the GBP/USD is continuing to rally a little higher and move back above the 1.52 level. Throughout the first part of this year, the pound fell very strongly from the key resistance level at 1.63 level down to levels not seen in two and a half years and has done well the last month to rally well and move back up above 1.56. Current range: Just above 1.5200 around 1.5210.

Further levels in both directions:

• Below: 1.5000.

• Above: 1.5250, 1.5300 and 1.5600.

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has remained above 50% after the GBP/USD has surged higher through the 1.52 level. Trader sentiment remains in favour of long positions.

Economic Releases

- 01:30 AU Inventories (Q1)

- 01:30 AU Retail trade (Apr)

- 05:00 JP Vehicle Sales (May)

- 07:00 UK Halifax House Price Index (3rd-7th) (May)

- 07:58 EU Manufacturing PMI (May)

- 08:28 UK CIPS/Markit Manufacturing PMI (May)

- 12:58 US Manufacturing PMI (May)

- 14:00 US Construction Spending (Apr)

- 14:00 US ISM Manufacturing (May)

- 21:00 US Vehicle Sales (May)