Throughout the last few weeks the GBP/USD has slowly but surely drifted lower away from the resistance level 1.57 and back down below 1.55, however in the last week or so it has rallied well and moved back up strongly through 1.56 and through 1.57. The 1.57 level was likely to provide some resistance and whilst it has moved through there, it is presently consolidating just below. A couple of weeks ago it fell down to a two week low near 1.54 before rallying back towards 1.5550. The week before it did well to maintain its level above the key 1.56 level and in the process moving to a new two month high above 1.57 which has now been surpassed by the recent high. It immediately retreated strongly but continued to receive solid support from the 1.56 level before closing below at the end of that week. Several weeks ago it surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level.

A couple of months ago the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

Earlier in July after having done very little for about a week, the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. Prior to the move higher, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It established a trading range in between 1.51 and 1.52 after it took a breather from its excitement just prior when it experienced a strong surge higher moving back to within reach of the 1.52 level from below 1.49, all in 24 hours. About a month ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. It experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. That movement saw it resume its already well established medium term down trend from the second half of June and move it to a four month low.

The pound has started off September with a bang, gaining over two cents against the US dollar. British PMIs in the manufacturing, construction and services sectors were all very sharp last week, and the pound took full advantage as it pushed to higher levels. This week’s key release is Claimant Count Change, the most important UK employment indicator. A strong release could fuel the pound’s impressive rally.

GBP/USD September 10 at 00:50 GMT 1.5695 H: 1.5732 L: 1.5639

During the early hours of the Asian trading session on Tuesday, the GBP/USD is consolidating right underneath the key 1.57 level after having recently surged higher to 1.5730. Since the middle of June the pound has fallen very strongly from the resistance level at 1.57 back down towards the long term key level at 1.50 and is now enjoying a solid recovery over the last month or so moving back to 1.57. Current range: Right around 1.5700.

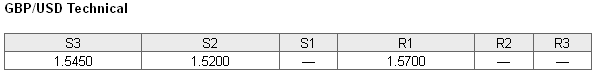

Further levels in both directions:

• Below: 1.5450 and 1.5200.

• Above: 1.5700.

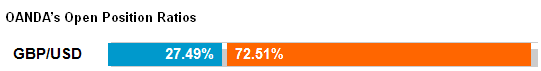

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has eased back under 30% as the GBP/USD has moved to the 1.57 level. Trader sentiment remains heavily in favour of short positions.

Economic Releases

- 01:30 AU NAB Business Conditions & Confidence (Aug)

- 12:15 CA Housing starts (Aug)