GBP/USD for Wednesday, December 4, 2013

After starting the week strongly getting within reach of 1.6450, the GBP/USD retreated sharply yesterday moving back down towards 1.6350 before finding some support at that level. In the middle of last week it did well to break through the long term resistance level at 1.6250 which had established itself as a level of significance over the last few months. Over the last few weeks or so the pound has bounced strongly off the support level at 1.59 to return back to its present levels. Towards the end of October the GBP/USD slowly drifted lower from the strong resistance level at 1.6250 and down to a three week low just around 1.5900 which was recently passed as the pound moved down towards 1.5850 only a week ago. For the week or so before that the pound moved well from the key level at 1.60 back up to the significant level at 1.6250, only again for this level to stand tall and fend off buyers for several days. Throughout September the pound rallied well and surged higher to move back up strongly through numerous levels which was punctuated by a push through to its highest level for the year just above 1.6250 several weeks ago. In the first week of October the pound was easing back towards 1.60 and 1.59 where it established a narrow trading range between before surging back to 1.6250 again.

Back in the middle of August the pound surged higher to through the resistance level at 1.56 to a then two month high around 1.5650, before spending the next few days consolidating and trading within a narrow range around 1.5650, receiving support from the key 1.56 level. A couple of months ago the resistance level at 1.54 was proving to be quite solid, and once it broke through the pound surged higher to a new seven week high near 1.56 in a solid 48 hour period run. In the week leading up to this the pound had recovered strongly and returned to the previous resistance level at 1.54 after the week earlier undoing some of its good work and falling away sharply from the resistance level at 1.54 back down to around 1.5150 and a two week low. A few weeks ago the 1.54 resistance level stood firm and the pound fell away heavily, however the 1.51 support level proved decisive and helped the pound rally strongly.

Earlier in July after having done very little for about a week, the GBP/USD started to move and surge higher and move through the 1.52 and 1.53 levels to the one month high above 1.54. Prior to the move higher, it moved very little as it found solid support at 1.51 and traded within a narrow range above this level. It established a trading range in between 1.51 and 1.52 after it took a breather from its excitement just prior when it experienced a strong surge higher moving back to within reach of the 1.52 level from below 1.49, all in 24 hours. About a month ago it did well to climb off the canvas and move back above 1.49 and towards 1.50 again before seeing the pound reverse and head back down below 1.49 to reach a new multi-year low near 1.48. It experienced sharp falls moving from 1.53 down to the key long term level of 1.50 and then through 1.49. That movement saw it resume its already well established medium term down trend from the second half of June and move it to a four month low.

The Bank of England is continuing to closely monitor the affordability of mortgages and the lending policies of banks after taking steps last week to cool the housing market. The record of the November meeting of the financial policy committee, set up inside Threadneedle Street to spot bubbles in the financial system, shows that concerns about the housing market had risen since their last meeting in June. "Committee members had become more concerned about the potential risks to financial stability that might arise from developments in the UK housing market," the record said. After the meeting the Bank announced last week that the flagship Funding for Lending Scheme (FLS), which supplies cheaper money to banks and building societies, would end a year early for mortgages to focus on small businesses. The record of the meeting shows that Bank of England governor Mark Carney informed the committee – made of Bank of officials and external members – that he and the Treasury had agreed to amend the FLS to focus on business lending. GBP/USD Daily Chart" title="GBP/USD Daily Chart" height="228" width="550">

GBP/USD Daily Chart" title="GBP/USD Daily Chart" height="228" width="550"> GBP/USD 4 Hourly Chart" title="GBP/USD 4 Hourly Chart" height="228" width="550">

GBP/USD 4 Hourly Chart" title="GBP/USD 4 Hourly Chart" height="228" width="550">

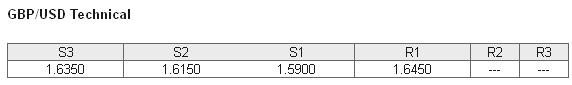

GBP/USD December 4 at 03:55 GMT 1.6389 H: 1.6437 L: 1.6362 GBP/USD Technical" title="GBP/USD Technical" height="123" width="500">

GBP/USD Technical" title="GBP/USD Technical" height="123" width="500">

During the early hours of the Asian trading session on Wednesday, the GBP/USD is trying to climb back towards 1.64 after dropping down below in the last 12 hours or so. To start this year the pound fell very strongly from near 1.64 down to below 1.50 however the second half of the year has seen it recover strongly and move beyond 1.64 to new highs. Current range: Right below 1.64 around 1.6395.

Further levels in both directions:

• Below: 1.6350, 1.6150 and 1.5900.

• Above: 1.6450. GBP/USD Open Position Ratios" title="GBP/USD Open Position Ratios" height="132" width="450">

GBP/USD Open Position Ratios" title="GBP/USD Open Position Ratios" height="132" width="450">

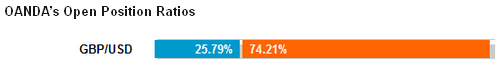

(Shows the ratio of long vs. short positions held for the GBP/USD among all OANDA clients. The left percentage (blue) shows long positions; the right percentage (orange) shows short positions.)

The GBP/USD long positions ratio has moved back well below 30% as the GBP/USD continues to push higher strongly. Trader sentiment remains heavily in favour of short positions.

Economic Releases

- 00:30 AU GDP (Q3)

- 08:58 EU Composite PMI (Nov)

- 08:58 EU Services PMI (Nov)

- 09:28 UK CIPS/Markit Services PMI (Nov)

- 10:00 EU GDP (2nd Est.) (Q3)

- 10:00 EU Retail Trade (Oct)

- 13:15 US ADP Employment Survey (Nov)

- 13:30 CA Merchandise Trade (Oct)

- 13:30 US Trade Balance (Oct)

- 15:00 CA BoC - Overnight Rate (Dec)

- 15:00 US ISM Non-Manufacturing (Nov)

- 15:00 US New Home Sales (Oct & Sep)

- 19:00 US US Federal Reserve releases Beige Book