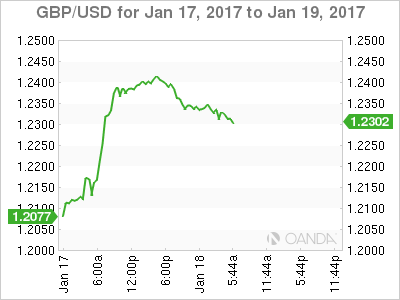

The pound has dipped on Wednesday, after posting spectacular gains in the Tuesday session. Currently, GBP/USD is trading just above the 1.23 level. On the release front, British employment numbers were strong, as wage growth and unemployment claims were better than expected. In the US, we’ll get a look at CPI, with the estimate standing at 0.3%.

All eyes were on Prime Minister Theresa May on Tuesday, as she delivered a landmark speech on Brexit. Much of the speech had been leaked to the British press ahead of time, but the pound had a historic day nonetheless, surging 2.9%, its largest 1-day gain since 2008. In her remarks, May confirmed that Britain would no longer enjoy access to Europe’s common market, but would assume full control over its borders and immigration policy.

She said that Britain was not looking for a “half-in, half out” relationship with the EU, and Britain would seek free-trade deals with Europe and countries around the world. May intends to begin Brexit negotiations with Europe in March and has set a two-year time frame for an agreement to be reached. Many European leaders were decidedly cool towards the speech, but Germany’s foreign minister acknowledged that May had finally clarified Britain’s stance on Brexit. The pound soared after the speech, mainly on May’s reassurance that any agreement would have to be ratified by both houses of parliament.

The pound was also buoyed by strong UK inflation data. CPI, the primary gauge of consumer inflation, climbed 1.6%, its highest level since July 2014. On Monday, BoE Governor Mark Carney said that higher inflation the country is experiencing will take a toll on wages and consumer spending.

Carney didn’t shed any light on future monetary policy, saying that interest rates could move in either direction in the months ahead. Still, the BoE will want to keep a lid on inflation and could raise rates in order to do so. The bank has projected an inflation rate of 2.7% in 2017, but some experts are forecasting inflation levels closer to 4 percent.

The US dollar was broadly lower on Tuesday, courtesy of president-elect Donald Trump. In an interview with the Wall Street Journal on Monday, Trump complained that the currency was “too strong”. These sentiments were echoed on Tuesday by Trump advisor Anthony Scaramucci. Speaking at the World Economic Forum in Davos that “we must be careful of a rising dollar.” Trump broke with the unwritten rule that US presidents refraining from commenting on the US dollar, and his comments could be a taste of more to come, as Trump is unlikely to veer from his habit of making controversial comments.

Trump Deflates USD Ahead of Inflation Data

Sterling Remains in Focus This Morning

GBP/USD Fundamentals

Wednesday (January 17)

- 9:30 British Average Earnings Index. Estimate 2.6%. Average 2.8%

- 9:30 British Claimant Count Change. Estimate +4.6K. Average -10.1K

- 9:30 British Unemployment Rate. Estimate 4.8. Average 4.8%

- 13:30 US CPI. Estimate 0.3%

- 13:30 US Core CPI. Estimate 0.2%

- 14:15 US Capacity Utilization Rate. Estimate 75.6%

- 14:15 US Industrial Production. Estimate 0.8%

- 15:00 US NAHB Housing Market Index. Estimate 69 points

- 16:00 US FOMC Member Neel Kashkari Speech

- 19:00 US Beige Book

- 20:00 US Federal Chair Yellen Speech

- 21:00 US TIC Long-Term Purchases. Estimate 21.3B

Upcoming Key Events

Thursday (January 18)

- 13:30 US Building Permits. Estimate 1.22M

- 13:30 US Philly Fed Manufacturing Index. Estimate 16.3

- 13:30 US Unemployment Rate. Estimate 252K

*All release times are EST

* Key events are in bold

GBP/USD for Wednesday, January 18, 2017

GBP/USD January 18 at 5:15 EST

Open: 1.2386 High: 1.2402 Low: 1.2299 Close: 1.2311

GBP/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1943 | 1.2111 | 1.2272 | 1.2351 | 1.2471 | 1.2579 |

- GBP/USD has posted losses in the Asian and European sessions

- 1.2272 is providing support

- 1.2351 has switched to a resistance role following losses by GBP/USD in the Wednesday session

Further levels in both directions:

- Below: 1.2272, 1.2111, 1.1943 and 1.1844

- Above: 1.2351, 1.2471 and 1.2579

- Current range: 1.2272 to 1.2351

OANDA’s Open Positions Ratio

GBP/USD ratio continues to show gains in short positions in the Wednesday session. Currently, long positions have a majority (57%), indicative of trader bias towards GBP/USD reversing directions and moving upwards.