Open 1.6022

High 1.6088

Low 1.5996

Close 1.6033

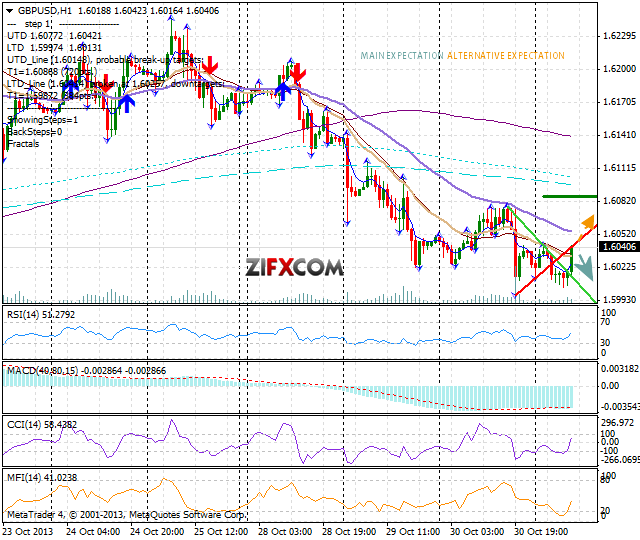

On Wednesday GBP/USD decreased with 90 pips. The Cable depreciated from 1.6088 to 1.5996 yesterday, in line with the negative money flow sentiment at below -23%, closing the day at 1.6033. Today the British pound is trading hesitantly, but moving within yesterday's range for the time being.

On the 1 hour chart range trading has formed, while on the 3 hour the the upward channel is on hold. First resistance is yesterday's peak at 1.6088. Break above it should extend the bullish movement further towards 1.6210. The nearest support level is yesterday's bottom at 1.5996. Going below it should extend British pound's reduction further down towards next downward objective 1.5874.

Today are UK Gfk consumer confidence and Nationwide house price index, at 0:05 and 7 GMT respectively.

Quotes are moving just above the 20 and below 50 the EMA on the 1 hour chart, indicating short term slim bullish and medium term bearish pressure. The value of the RSI indicator is neutral and inclining upwards, the MACD is negative and tranquil, while the CCI is has thinly up the 100 line on the 1 hour chart, giving over all neutral signals.

Technical resistance levels: 1.6088 1.6210 1.6342

Technical support levels: 1.5996 1.5874 1.5740

Already made +13 pips profit/loss on GBP/USD today from the following sent to clients only signal:

5:15 GMT Sell GBP/USD at 1.6020 SL 1.6046 TP 1.5960, exit sent at 5:33 GMT.

Today so far +60, yesterday +108. GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="640" height="540">

GBP/USD Hour Chart" title="GBP/USD Hour Chart" width="640" height="540">