For sterling all eyes this coming week, well certainly as far as the UK is concerned, will be on the outcome of the vote on Scottish independence, as the debate continues to rage with a string of opinion polls reflecting the constantly changing ebb and flow in sentiment and forecast outcome. The gap down for Cable at the start of trading last week on the daily futures chart, was triggered by one such poll, forecasting a shock yes vote, contrary to the expectation at the time, which has largely been expecting a ‘no’. This shocked the market with the ramifications of a ‘euro equivalent’ scenario on the horizon.

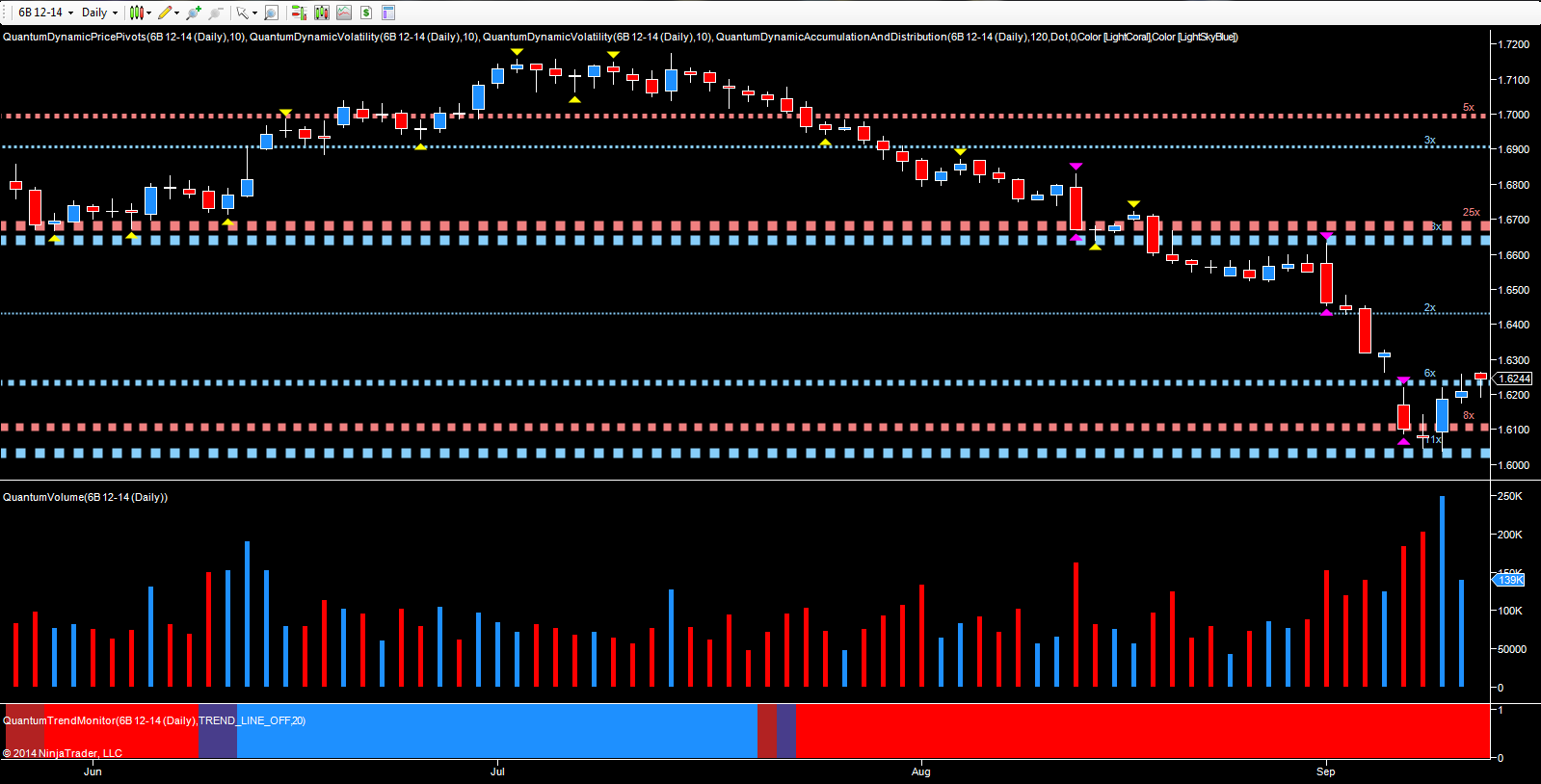

As we all know however, gaps get filled and with the market calming as further polls were released, the pair recovered some composure to close marginally above the shock open of the past week. The volume perspective this week is particularly interesting, as indeed is the price action, and if we start with this, the volatile swings on Monday, duly triggered the volatility indicator on the daily chart, with the subsequent price action of the remainder of the week, failing to confirm this signal.

Typically what happens is the market jumps on a news release or rumour, as indeed was the case here. Traders then jump in expecting some easy quick profits, with the market then reversing to trade back inside the range of the bar or candle. This is a classic trap, and one beloved of the market makers, with the poll of Sunday night a real gem and too good an opportunity to miss! Tuesday’s price action simply confirmed this analysis, with a very narrow spread candle, associated with high volume at just below 200k on the day, suggesting a pause point and possible reversal. Wednesday’s wide spread up candle duly delivered with very strong volumes driving the pair higher, as the big operators moved in to trap the bears in a short squeeze, and with Friday’s price action, now looking increasingly like a test of supply, coupled with a move above the resistance in the 1.6230 region, the stage is now set. All the components are in place, for the gap to be filled, on the expectation of a no vote on Thursday.

The weekly CFTC commitment of traders report has confirmed an interesting position, with a sharp reversal, with the net longs moving from 9,948 as of Tuesday 2nd Sept to 26,727 as of the 9th of September, which is what we are seeing reflected in the futures chart here. As always, remember that the COT data is slightly lagged, but the volumes on Tuesday will be interesting in next week’s COT report. What is perhaps even more interesting in the report over the last few weeks, is that the pair never achieved a net short position, despite the short term change in sentiment. The last time this occurred was back in 2013. Should be an interesting week ahead!