Federal Open Market Committee Meeting Minutes were released on Wednesday. Most Fed officials agreed to continue with gradual rate hikes. They highlighted the expected increase in the pace of inflation as one of the reasons to shorten the time between hikes. However, they also highlighted the failure of inflation to increase above 2% as a reason to widen the time period between hikes. The consensus was for inflation to reach 2% and for labour inflation to gradually lift inflation. The medium-term inflation outlook appears little changed and the flatness of the yield curve is not unusual. Several officials were concerned by low inflation. EUR/USD sold off to session lows close to 1.20000, while USD/JPY rallied from 112.292 to 112.604 after the minutes were released.

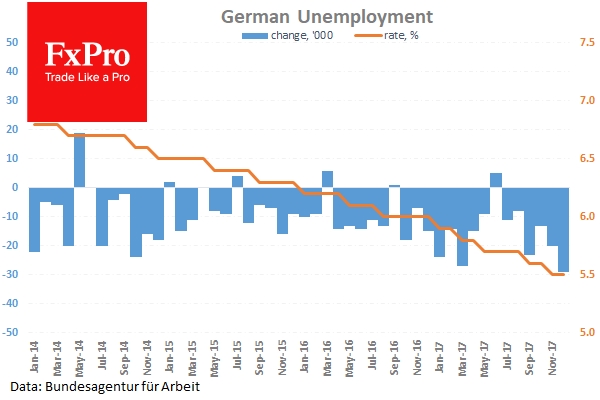

German Unemployment Rate s.a.(Dec) data came in unchanged at 5.5% v an expected 5.6%. Unemployment Change (Dec) was out at the same time and came in at -29K v an expected -12K, from a prior of -20K. EUR/USD was at 1.20420 when the data was released but sold off to 1.20110.

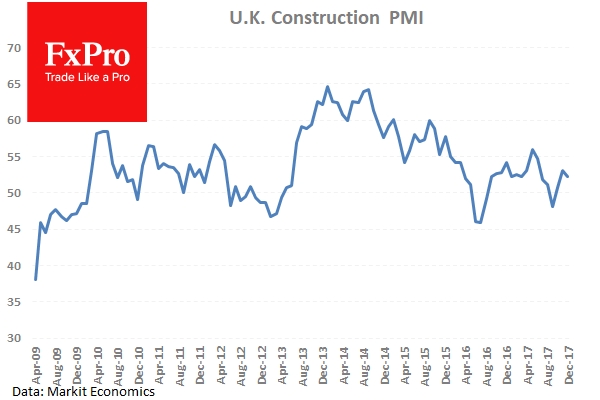

UK Construction PMI (Dec) was out at 52.2 v an expected 52.5, from a prior number of 53.1. While still expanding, this data point is much lower compared to the recent highs around 64.0 in 2014. GBP/USD was trading around 1.35925 but slowly sold off to 1.35000 following the release.

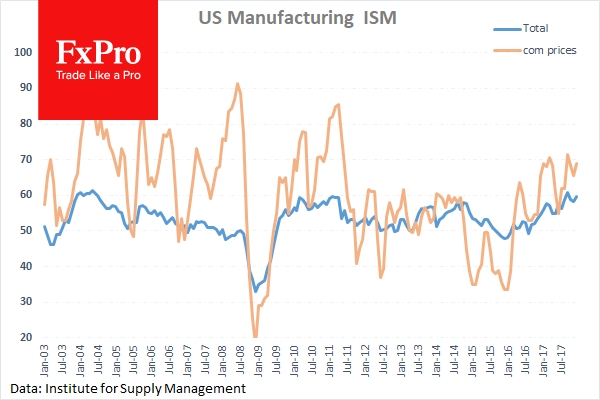

US ISM Prices Paid (Dec) came in at 69.0 v a consensus of 65.0. The previous reading was 65.5. ISM Manufacturing PMI (Dec) was also out at this time and came in at 59.7 v 58.2 expected, from 58.2 prior. And finally, Construction Spending (MoM) (Nov) was 0.8% v 0.6% expected, from the previous reading of 1.4%, which was revised to 0.9%. USDJPY was at 112.223 before the release but moved higher to 112.495 before pulling back.

EUR/USD is up 0.14% overnight, trading at around 1.20308.

USD/JPY is largely unchanged in the early session trading at around 112.539.

GBP/USD is up 0.10% to trade around 1.35244.

Gold is down -0.21% in early morning trading at around $1,310.14.

Crude is up 0.29%, trading at around $62.06.

Major data releases for today:

At 09.00 GMT, Eurozone Markit Services PMI (Dec) data is expected to be unchanged from the previous reading of 56.5. Markit PMI Composite (Dec) is also due out at this time and is expected to be unchanged at 58. EUR pairs could see price movement if the data released varies from the consensus.

At 09.30 GMT, UK Markit Services PMI (Dec) is out and expected to be unchanged from the previous value of 53.8. Also at this time, Net Lending to Individuals (MoM) (Dec) is expected at £4.9B v a previous reading of £4.8B. Mortgage Approvals (Nov) is expected at 64.000K v a prior 64.575K. Consumer Credit (Nov) is expected to be £1.500B v £1.451B previously. GBP crosses may experience volatility if the number differs from the expected reading.

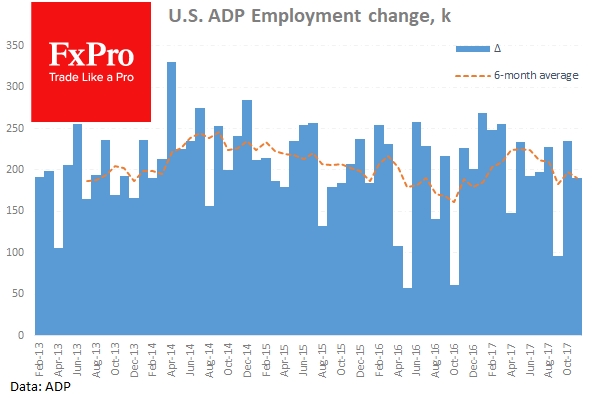

At 13:15 GMT, US ADP Non-Farm Employment Change is expected to come in unchanged at 190K. USD crosses could be impacted by the volume of data releases at this time and may result in turbulent price action.

At 13:30 GMT, US Continuing Jobless Claims (Dec 22) is expected at 1.947M from a prior of 1.943M. Initial Jobless Claims (Dec 29) is expected to be 240K with a previous reading of 245K.

At 14:45 GMT, US Markit PMI Composite (Dec) is expected at 53.7 from a prior of 53.0. Markit Services PMI (Dec) is expected to come in unchanged from the previous reading at 52.4. This data could move Stocks, Bonds and USD pairs upon its release.

At 16.00 GMT, EIA Crude Oil Stocks change (Dec 29) is released, with a headline number of -5.260M from a previous -4.609M. This data release was delayed due to New Year’s festivities. WTI Oil may see volatility around this data release.