- Markets expect Fed to raise interest rates by 75 bps today

- ECB calls emergency meeting today too - time to close spreads?

- Yen and sterling retreat ahead of their own central bank meetings

Fed playbook

The next couple of days are loaded with central bank meetings, kicking off with the Fed decision today. A rate increase is almost certain as the Fed attempts to dismantle inflationary forces - the question is exactly how big this move will be and where the Committee envisions the terminal rate in the updated ‘dot plot’.

Markets have almost fully priced in a rate increase of 75 basis points after the latest inflation print came in hot and a couple of media articles floated the idea of a shock-and-awe move, which many investors saw as ‘off the record’ guidance by Fed officials during their blackout period.

This has turned into a messy affair, with some traders arguing an even bigger 100bps hike is needed to get inflation under control while others insist anything bigger than 50bps would shatter the Fed’s credibility and diminish the power of forward guidance. Positioning ahead of this event has been a prime driver of market volatility lately.

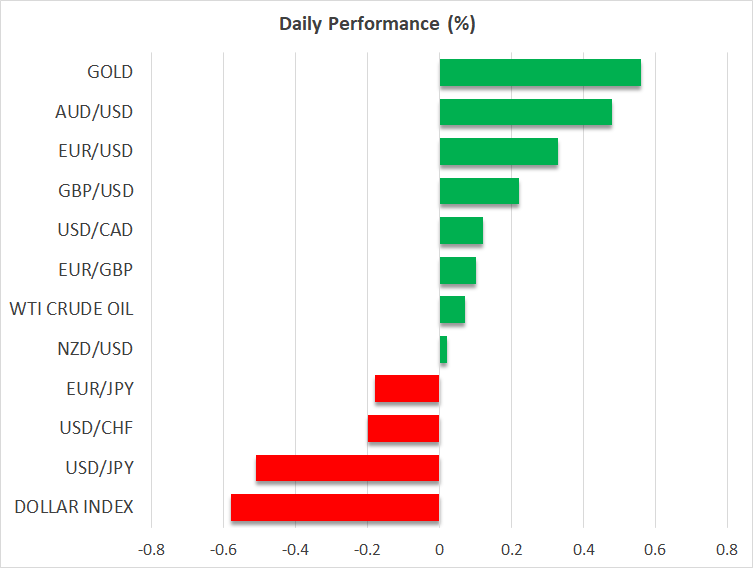

Assuming the Fed simply delivers the expected 75bps hike, the market reaction will be governed mostly by the new interest rate projections and Chairman Powell’s commentary. Overall, it’s difficult to call for any trend reversal in the mighty US dollar while every other major currency grapples with its own demons - euro with energy, yen with yields, sterling with stocks - and the Fed is beating other central banks to the punch.

ECB emergency meeting

The European Central Bank has finally hit the panic button, announcing an extraordinary meeting today to ‘discuss market conditions’ just six days after its latest decision. There are some whispers of an emergency rate increase but that is probably off the table, as things haven’t changed enough in one week to warrant such drastic measures.

Instead, this is most likely a meeting to address fragmentation risks. The ECB has been heavily criticized for having no solid plan to prevent a blow-out in spreads between European yields. This ultimately means Italian yields should not be allowed to rise much more than German ones since that would risk another debt crisis.

The ECB is trying to eliminate this concern, so it has to design a program that essentially closes spreads, most likely by reinvesting all the bonds it has accumulated in a strategic manner. Establishing such a framework would spell good news for the euro, although any relief rally is unlikely to get very far until energy prices calm down.

Yen, sterling, and equities

The relentless rally in global yields and the energy price shock have torpedoed the Japanese yen, which sank to new two-decade lows against the dollar yesterday. There is tremendous pressure on Tokyo to intervene in the FX market, but the BoJ scrapping yield curve control would be a far simpler and cheaper option to stop the bleeding. That’s not on the menu this week.

Sterling has also been ransacked. Cable hit its lowest levels since the depths of the pandemic lately as the stronger US dollar joined forces with fragile risk sentiment and some disappointing economic data. Market pricing for the BoE to raise rates by another 190bps this year seems unrealistic given the weakening data pulse, which suggests the pound’s troubles may not be over yet.

Stock markets closed another session in the red, caught in a vice between Treasury yields ripping higher ahead of the Fed decision and escalating concerns around a sharp economic slowdown. Futures point to a minor recovery when Wall Street opens today, although that is subject to change depending on the outcome of the meeting.

The latest edition of US retail sales will be released ahead of the Fed decision. On Thursday, the spotlight will turn to the Swiss National Bank and the Bank of England, ahead of the Bank of Japan meeting early on Friday.