- Fed Chair Powell reiterates disinflation remarks

- Dollar slides as investors revise their implied rate path slightly lower

- Eurozone inflation expectations edge up

Dollar retreats as Powell fails to appear more hawkish

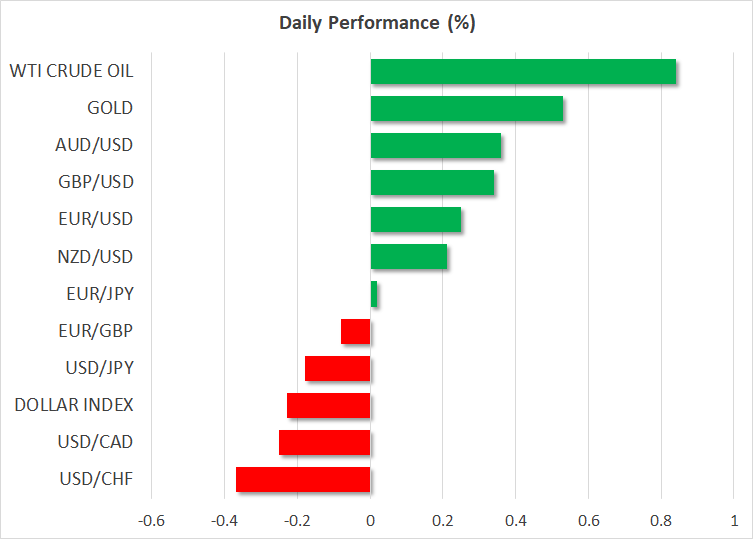

The US dollar traded lower against most of its major counterparts on Tuesday, giving back a small portion of the gains it recorded in the aftermath of Friday’s astounding employment report. The greenback remains on the back foot today as well.

The person responsible for the dollar’s retreat was once again Fed Chair Jerome Powell, who at a speech before the Economic Club of Washington, reiterated the view that interest rates might need to move higher and that no cuts are on the Fed’s agenda for this year. However, he also repeated that disinflation is now underway, and that inflation is likely to decline significantly this year.

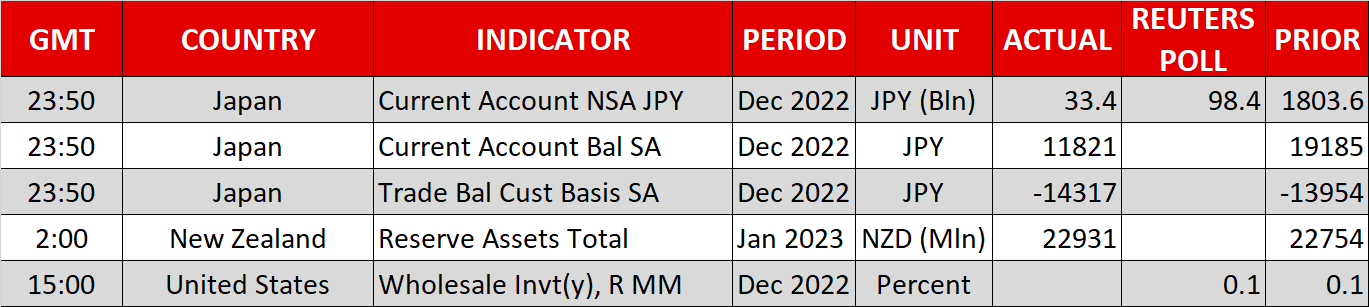

After the unexpected surge in Friday’s nonfarm payrolls, investors revised higher their implied rate path, matching the Fed’s projection with regards to where interest rates should peak, and priced out around 25bps worth of rate cuts by the end of the year. In other words, they saw interest rates rising to slightly above 5% and anticipated only one quarter-point cut later this year instead of nearly two.

That said, although they maintained bets of a nearly 5.15% terminal rate, following Powell’s remarks, they added some extra basis points to their cut estimates. They now see interest rates ending the year 35 basis points below the estimated terminal rate.

Following comments by Atlanta Fed President Raphael Bostic and Minneapolis Fed President Neel Kashkari, who stressed the need for higher interest rates, investors were likely expecting that, with the employment numbers now in hand, Powell could sound more hawkish than he did at the press conference of the latest FOMC gathering. The fact that he didn’t came as a disappointment and allowed for some dollar selling.

More Fed speakers are stepping onto the rostrum today, among which are New York President John Williams and Fed Board Governor Christopher Waller. Bostic and Kashkari will also speak, but they are unlikely to deviate from what they said on Monday and Tuesday. Should more members support the case for higher interest rates, the dollar may resume its latest recovery. However, with the CPIs on next week’s agenda, talking about a long-lasting recovery is very premature as another negative surprise could trigger the resumption of the dollar’s downtrend.

Eurozone inflation expectations keep the ECB on track for more hikes

In the Eurozone, consumer expectations for inflation edged up again in December according to an ECB survey released yesterday, adding credence to the narrative that the ECB may need to continue raising interest rates aggressively to bring inflation to heel. Yes, headline inflation in the euro area seems to have peaked, but underlying price pressures remain in accelerating mode, which leaves ECB policymakers with no other choice than to keep delivering double hikes. According to money markets, the ECB is expected to raise interest rates by another 100 basis points before it presses the stop button.

This enhances the view that it is too early to talk about a potential bullish reversal in the US dollar. Euro/dollar is the largest component of the dollar index, with a 57.6% weigh, and thus a stronger euro may consequently limit any further strength in the dollar. Combined with a potential slowdown in next week’s US CPI data, this may result in a rebound in euro/dollar and perhaps allow traders to put back the 1.1175 zone on their radars.

Wall Street cheers Powell’s remarks

All three of Wall Street’s main indices rallied on Powell’s disinflation remarks, with the more-rate-sensitive Nasdaq gaining almost 2%. The fact that the selling following the robust jobs data was not as strong as the dollar buying suggests that equity investors are not willing to significantly reduce their risk exposure yet.

Perhaps the fact that the strong employment report was followed by the rebound of the ISM non-manufacturing PMI back above the boom-or-bust zone of 50 increased their hopes of a potential soft landing, while Powell’s remarks may have helped valuations as expectations of lower interest rates later this year are adding to firms' present values.