Signet Jewelers Limited (NYSE:SIG) , a retailer of diamond jewelry, watches and other products, is slated to report third-quarter fiscal 2018 results on Nov 21. Last quarter, the company’s earnings surpassed the Zacks Consensus Estimate by a margin of 20.9%. Notably, the company’s earnings beat estimates in three of the trailing four quarters by an average of 10.4%.

What to Expect?

The question that now lingers in investors’ minds is whether Signet Jewelers will be able to deliver a positive earnings surprise in the quarter to be reported. The Zacks Consensus Estimate is pegged at 18 cents, down nearly 30% year over year. We note that the consensus mark has been stable over the past 30 days. Analysts polled by Zacks expect revenues of $1,170 million, down over 1% from the year-ago quarter.

Factors at Play

Signet Jewelers’ focus on effective cost management, digital marketing, higher e-commerce sales and outsourcing of credit portfolio bode well. Total e-commerce sales increased 18.1% year over year in second-quarter fiscal 2018. Further, in an effort to drive growth in the long run, the company has been implementing certain strategies including expansion in mid-market and the best in bridal segment.

Additionally, the company is focusing on diversifying store base and opening more stores at off-mall locations. Hence in fiscal 2018, the company plans to close down 165-170 stores mostly in mall-based regions and unveil 90-115 fresh stores, mostly Kay off-mall.

However, margins which have been declining since the past few quarters will remain under pressure in the second half of the year due to rise in investment and promotional expenses. The company will invest $260-$275 million toward new store launches, store remodeling, information and technology advancement as well as improving distribution facilities. Further, the industry has been grappling with waning store traffic, stiff competition from online retailers as well as an unwillingness of consumers to spend exorbitantly on discretionary items.

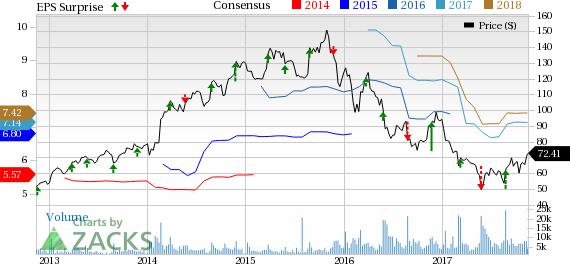

Signet Jewelers Limited Price, Consensus and EPS Surprise

What the Zacks Model Unveils

Our proven model shows that Signet Jewelers is likely to beat estimates this quarter as the stock has the right combination of two key ingredients — a positive Earnings ESP and a favorable Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — for this to happen.

The company has an Earnings ESP of +27.52%, indicating a likely earnings surprise. Further combined with the company’s Zacks Rank #3, which increases the predictive power of ESP, the chance of an earnings beat is pegged higher. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Other Stocks Poised to Beat Earnings Estimates

Here are some other companies you may want to consider as these too have the right combination of elements to beat on earnings this quarter:

American Eagle Outfitters, Inc. (NYSE:AEO) has an Earnings ESP of +1.90% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Burlington Stores, Inc. (NYSE:BURL) has an Earnings ESP of +1.27% and a Zacks Rank of 3.

Wal-Mart Stores, Inc. (NYSE:WMT) has an Earnings ESP of +0.96% and the company is Zacks #3 Ranked.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

American Eagle Outfitters, Inc. (AEO): Free Stock Analysis Report

Wal-Mart Stores, Inc. (WMT): Free Stock Analysis Report

Burlington Stores, Inc. (BURL): Free Stock Analysis Report

Signet Jewelers Limited (SIG): Free Stock Analysis Report

Original post

Zacks Investment Research