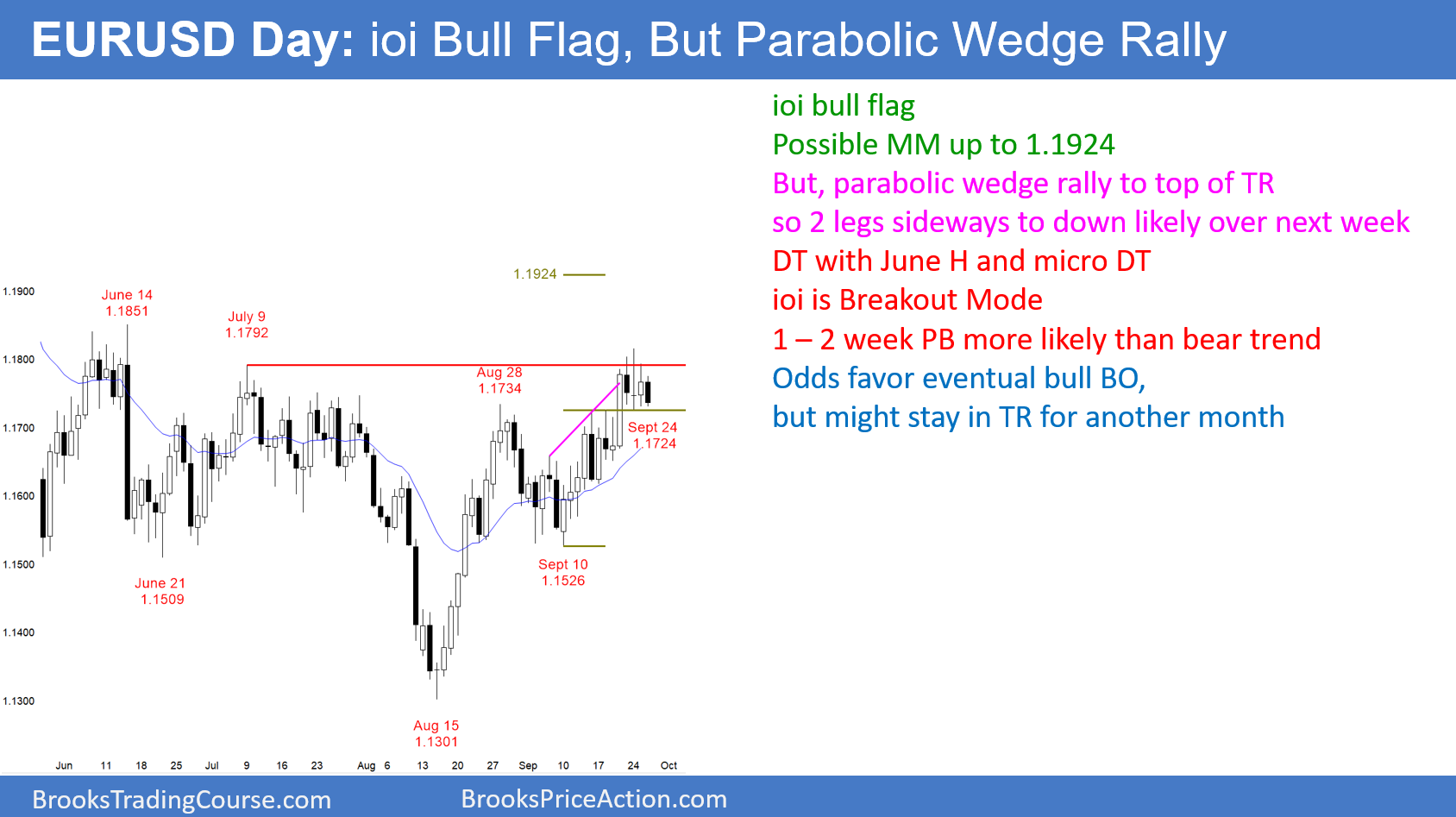

The EUR/USD daily has a bear body today ahead of today’s FOMC report. yesterday’s bull inside bar created a 3 day ioi breakout mode pattern. The 4-week rally is a parabolic wedge at the top of the 5-month trading range.

The EUR/USD daily chart had a strong bull trend reversal in August and it is now at the top of its 5-month range. The rally is forming a double top with the July high. In addition, there is a micro double top over the past 4 days. The odds favor lower prices for a week or two. Also, trading ranges resist breaking out. Therefore, the bulls might have to wait more than a month before they see their breakout.

An ioi is a Breakout Mode pattern. The bulls want a breakout above the June high. But, the parabolic wedge makes a 200-pip pullback more likely over the next week.

While the bears want a break below the August 15 low, the reversal up was strong enough to make a bull trend more likely. Consequently, the bulls will buy a 200 – 300 pip selloff, knowing that a higher low is more likely than a bear trend.

The odds favor a 1 – 2 week selloff down to below 1.16.

Overnight EUR/USD Trading

The EUR/USD 5-minute chart sold off 45 pips in a tight bear channel over the past 3 hours. It is testing yesterday’s low. While the ioi on the daily chart is a breakout mode pattern, yesterday was a bull day. That is a weak sell signal bar for today. Therefore, there are probably buyers not far below yesterday’s low. Consequently, the overnight selloff will probably stall there. This is especially true because financial markets tend to enter trading ranges on the mornings of FOMC reports.

Will there is a big trend after the 11 a.m. PST report today? There sometimes is, even though the Forex markets usually enter tight ranges by 11 a.m. Day traders will probably scalp until then and exit positions about an hour before the report. Since there is usually a fast reversal in the 1st 10 minutes after the report, they should wait until at least 11:10 a.m. PST before resuming trading.