- EURUSD in the red again today after making a new 5-month high

- The key resistance area at 1.1032 is playing a key role in this move

- Momentum indicators signal that the current bullish move has probably ended

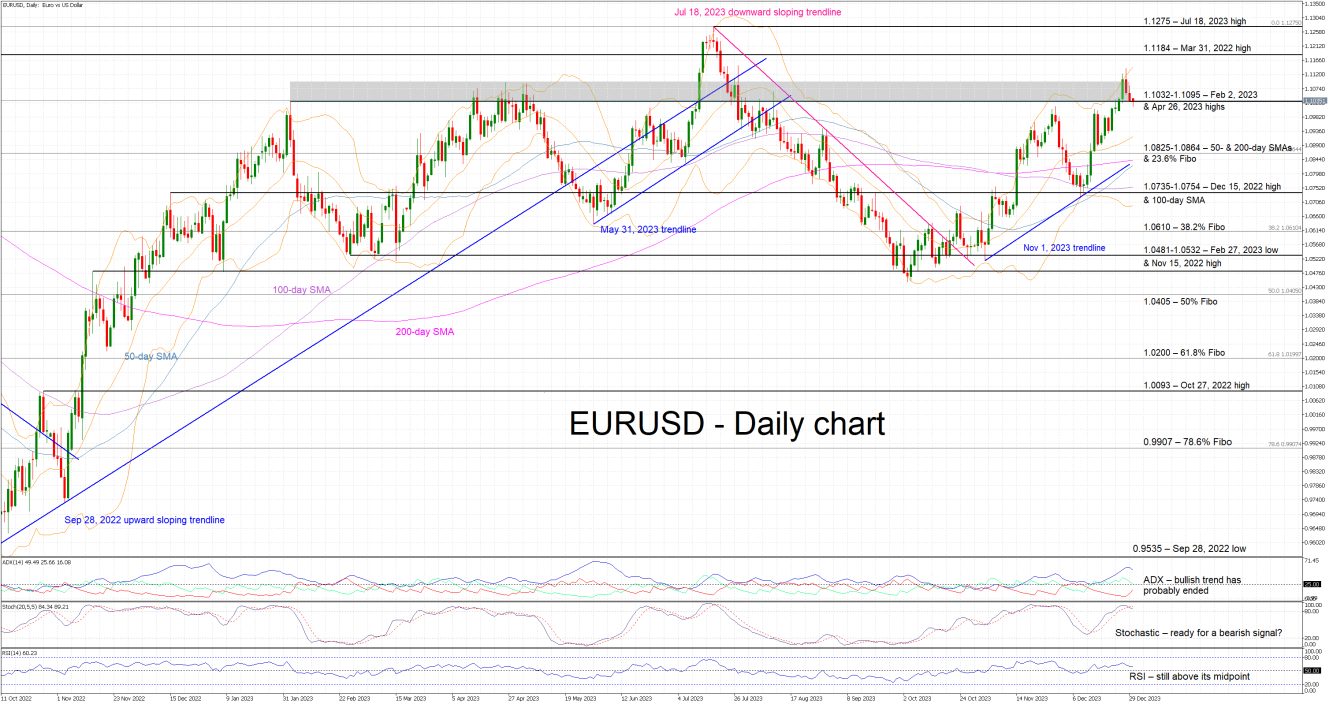

EURUSD is registering its third straight red candle, after reaching a new 5-month high at 1.1139. However, the busy 1.1032-1.1095 area, which has been making the bulls’ lives difficult since February 2023 with several failed breakout attempts recorded, appears to have played a key part again. EURUSD is edging lower with the momentum indicators ready to send strong bearish signals.

The RSI is heading towards its 50-threshold and the Average Directional Movement Index (ADX) has peaked and is now edging lower, possibly confirming the completion of the current bullish trend in EURUSD. More crucially, the stochastic oscillator has crossed below its moving average and it appears ready to break below its overbought territory. Should this take place, it would be seen as a strong bearish signal.

If the bulls remain hungry, they could try again to overcome the busy 1.1032-1.1095 area, which is populated by the February 2, 2023 and April 26, 2023 highs. If they are successful, they could then have a go at pushing EURUSD towards the March 31, 2022 and the July 18, 2023 highs at 1.1184 and 1.1275 respectively.

On the flip side, the bears are keen to push EURUSD decisively below the 1.1032-1.1095 range. They could then stage a move towards the 1.0825-1.0864 area, which is defined by the 50- & 200-day simple moving averages (SMAs) and the 23.6% Fibonacci retracement of the September 28, 2022 – July 18, 2023 uptrend. Even lower, the 1.0735-1.0754 region set by the December 15, 2022 high and the 100-day SMA could prove stronger to break than currently foreseen.

To sum up, EURUSD bulls appear to have failed again at overcoming the busy 1.1032-1.1095 area and thus opening the door for a more protracted correction, especially if the stochastic oscillator sends a strong bearish signal.