EUR/USD showed little movement earlier but that changed after German CPI was softer than expected. The euro gained 0.40% in the aftermath of the inflation report but has given back about half of those gains. In the North American session, EUR/USD is trading at 1.0857, up 0.11%.

German CPI Falls to 2.9%

Germany’s inflation rate dropped to 2.9% y/y in January, down sharply from 3.7% in December and just below the market estimate of 3.0%. The reading, a preliminary estimate, was the lowest rate since June 2021. The drop was driven by a slowdown in goods inflation, with energy and food prices both decelerating. Services prices, however, rose slightly. Monthly, inflation ticked higher to 0.2%, compared to 0.1% in December and matching the market estimate of 0.2%.

Inflation continues to fall in the eurozone’s largest economy, as the ECB’s steep hike in interest rates has dampened inflationary pressures. High-interest rates have also cooled the German economy, as GDP declined by 0.2% q/q. This follows the Q3 reading of -0.3%, which means that the economy is technically in a recession with two straight quarters of negative growth.

The eurozone managed to avoid a technical recession, but just barely. The economy posted zero growth in Q4 after third-quarter growth of -0.1%. The eurozone releases preliminary CPI on Thursday, with CPI expected to drop from 3.4% y/y to 3.2%.

The Federal Reserve meets later today and a pause is a virtual certainty. This would mark the fourth straight time that the Fed has held rates at the target range of 5.25%-5.50%. Traders will be looking for clues about the Fed’s rate path from the rate statement and Fed Chair Powell’s press conference. If the statement or the press conference signals that the Fed is moving away from its “higher for longer” stance and is looking at rate cuts, the US dollar could react with volatility.

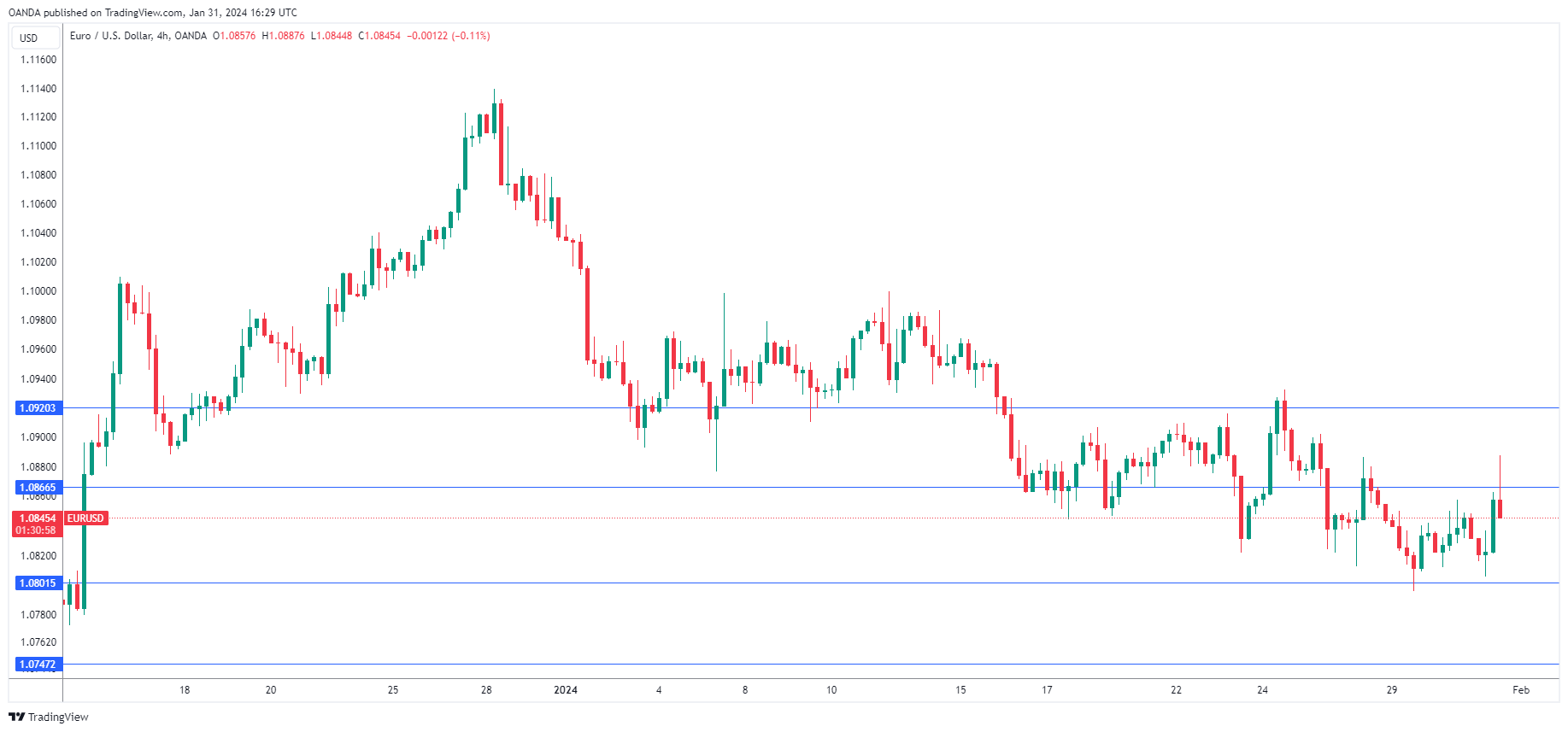

EUR/USD Technical

- EUR/USD tested resistance at 1.0866 earlier. Above, there is resistance at 1.0920

- There is support at 1.0801 and 1.0747