- Fed pivot may hang on tomorrow’s CPI data

- Markets pricing in five rate cuts from ECB next year ahead of meeting

- EUR/USD hangs around key support level

A lackluster start to the week but there’s so much to come over the next few days which could determine how markets end the year and start 2024.

The US will be front and center this week even as events also unfold elsewhere. The Fed decision on Wednesday is unlikely to be controversial but the forecasts, dot plot and press conference that accompany it may well be.

Markets are very bullish in pricing in four interest rate cuts next year, the first likely coming in May, something the FOMC is unlikely to line up behind. The question is how much of a change we’ll see from the September projections and to what extent the committee will push back against the markets.

That may well depend on what the CPI report tells us tomorrow. The November inflation reading is expected to fall to 3.1% at the headline level but remains at 4% on a core basis. A setback here following the stronger jobs report on Friday could encourage the FOMC to dig their heels in a little, warning of upside risks and even the door still being open to further hikes. That would be a very late and sharp pivot or markets being too optimistic with the first cut.

And it’s not just the Fed meeting this week. The ECB and BoE will both announce their final interest rate decisions of the year on Thursday, with the former also releasing new forecasts and holding a press conference.

Markets are currently pricing in a March rate cut for the ECB, one of five next year, so again we’re looking at very bullish expectations and the question is whether the central bank will be more accommodating given the progress on inflation and the fact that the economy may already be in recession.

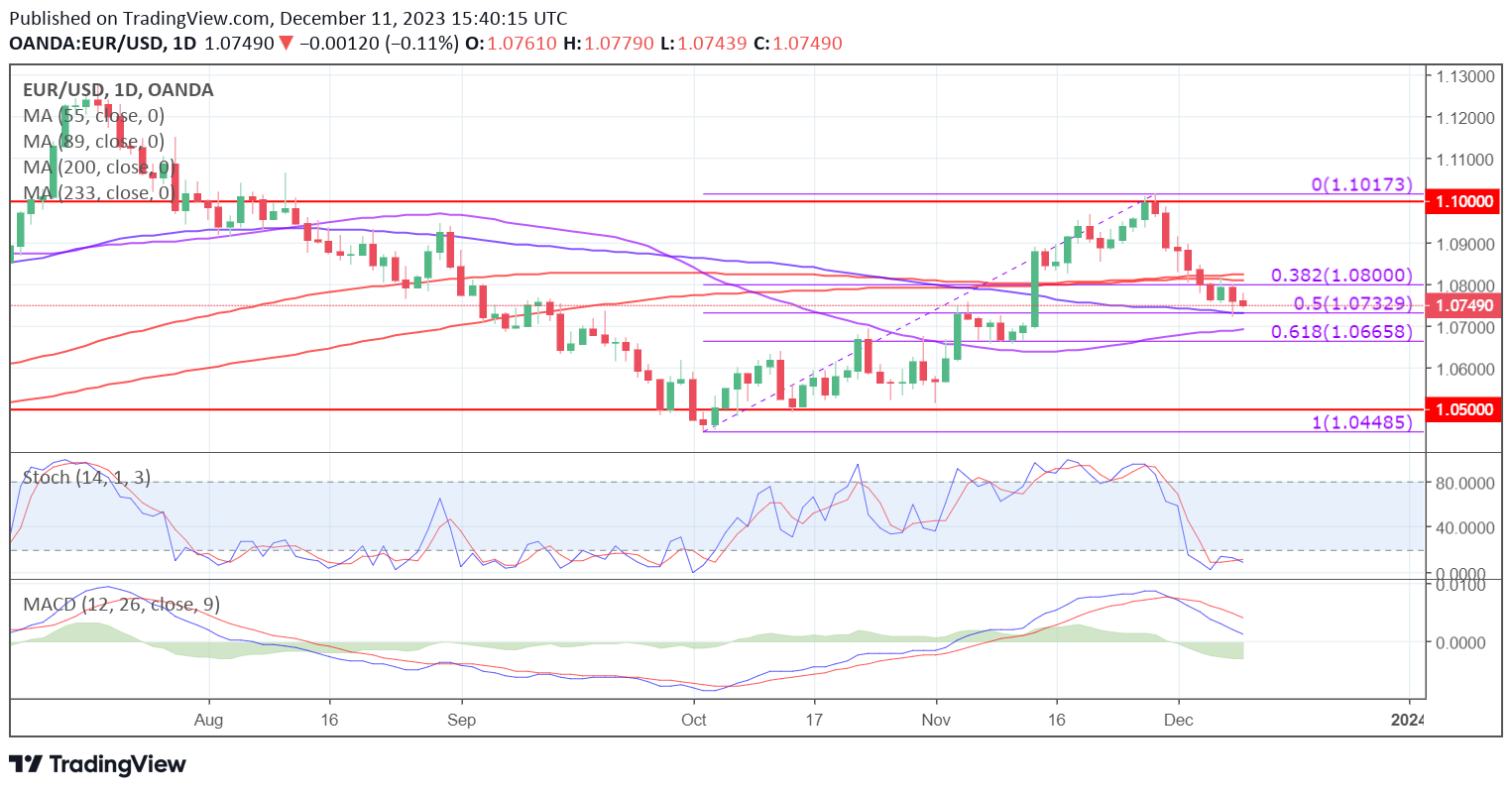

A Big Test of Support

We’ve seen a pullback in EUR/USD over the last couple of weeks but it’s steadying around a very interesting area of support, with the 50% Fibonacci retracement level and 55-day simple moving average combining.

Source – OANDA