The euro has posted small losses in the Tuesday session. Currently, EUR/USD is trading at 1.1854, down 0.09% on the day. On the release front, German Final Services PMI edged lower to 54.3, short of the forecast of 54.9 points. Eurozone Final Services improved to 56.2, matching the forecast.

The good news is that the Brexit talks have gained some momentum, but a breakthrough on the non-trade issues has not been reached. There were hopes that a breakthrough would be announced on Monday, following talks between Prime Minister May and European Commission President Jean-Claude Juckner, but the gaps on two issues remain, for now. One thorny issue is that of northern Ireland and its border. The UK will clearly not remain in a customs union with the EU, but Ireland is insistent that there not be a hard border with the North, while the DUP, which is propping up the May government, is strongly against any border between the UK mainland and Northern Ireland. The second issue is whether the European Court of Justice will have a role protecting European citizens in the UK. The EU is in favor of a role for the court, while many British lawmakers feel that such a move would impinge on British sovereignty. The EU holds a meeting on December 12, and May is anxious to wrap up the non-trade sticking points and move on to trade talks by that date.

The US Senate passed a tax reform bill on the weekend, but the vote was a squeaker, 51-49, as the vote went along party lines, with one Republican voting against the bill. Now that that the House and the Senate have passed tax bills, a conference committee will try and hammer out a uniform bill which can be sent to President Trump and signed into law. There are some differences in the two bills, notably individual tax rates, the alternative minimum tax, mortgage interest deductions and the estate tax. The Senate and House will have to work out their differences quickly, as the new “merged” bill will have to pass through in both houses. If the bill does become law, it will mark the first major tax reform in the US in 30 years, and could boost the US dollar against the euro and other major currencies.

EUR/USD Fundamentals

Tuesday (December 5)

- 3:15 Spanish Services PMI. Estimate 55.2. Actual 54.4

- 3:45 Italian Services PMI. Estimate 53.4. Actual 54.7

- 3:50 French Final Services PMI. Estimate 60.2. Actual 60.4

- 3:55 German Final Services. Estimate 54.9. Actual 54.3

- 4:00 Eurozone Final Services PMI. Estimate 56.2. Actual 56.2

- 5:00 Eurozone Retail Sales. Estimate -0.6%

- 5:00 Eurozone Revised GDP. Estimate 0.6%

- All Day – ECOFIN Meetings

- 8:30 US Trade Balance. Estimate -46.2B

- 9:45 US Final Services PMI. Estimate 55.4

- 10:00 US ISM Non-Manufacturing PMI. Estimate 59.2

- 10:00 US IBD/TIPP Economic Optimism. Estimate 54.6

Wednesday (December 6)

- 2:00 German Factory Orders. Estimate -0.1%

- 4:10 Eurozone Retail PMI

- 8:15 US ADP Nonfarm Employment Change. Estimate 191K

*All release times are GMT

*Key events are in bold

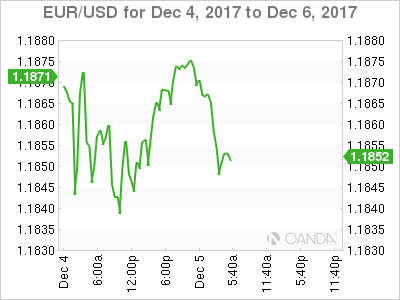

EUR/USD for Tuesday, December 5, 2017

EUR/USD for December 5 at 4:20 EDT

Open: 1.1865 High: 1.1877 Low: 1.1845 Close: 1.1854

EUR/USD Technical

| S1 | S2 | S1 | R1 | R2 | R3 |

| 1.1574 | 1.1657 | 1.1777 | 1.1876 | 1.1961 | 1.2092 |

EUR/USD ticked higher in the Asian session but has reversed directions and is moving lower in European trade

- 1.1777 is providing support

- 1.1876 was tested earlier in resistance

Further levels in both directions:

- Below: 1.1777, 1.1657 and 1.1574

- Above: 1.1876, 1.1961, 1.2092 and 1.2193

- Current range: 1.1777 to 1.1876

OANDA’s Open Positions Ratio

EUR/USD is unchanged in the Tuesday session. Currently, short positions have a majority (60%), indicative of EUR/USD continuing to head downwards.