Comments from ECB President Draghi yesterday, in which he stated that euro-zone economic growth may slow down, resulted in the euro tumbling against most of its main currency rivals. Draghi's comments also had a negative impact on gold prices, which fell more than $14 an ounce during afternoon trading. Today, the main piece of economic news is likely to be the US Trade Balance figure, set to be released at 13:30 GMT. A worse than expected figure could result in dollar losses before markets close for the week.

Economic News

USD - Risk Aversion Boosts Safe-Haven Dollar

The US dollar advanced against several of its higher-yielding currency rivals during afternoon trading yesterday, following comments from the ECB President which caused investors to shift their funds to safe-haven currencies. The USD/CHF gained close to 60 pips following the ECB press conference, eventually reaching as high as 0.9143. Against the Canadian dollar, the greenback some 26 pips to trade as high as 0.9967.

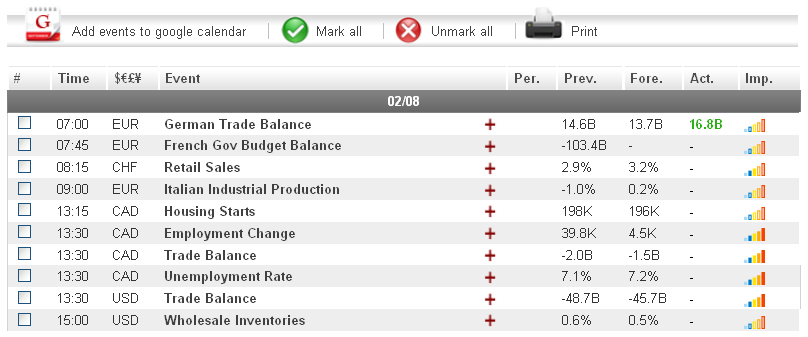

Turning to today, dollar traders will want to pay close attention to the US Trade Balance figure, set to be released at 13:30 GMT. Analysts expect the indicator to come in at -45.8B, slightly better than last month's -48.7B. If today's news comes in above the forecasted level, the greenback could extend yesterday's bullish trend before markets close for the weekend.

EUR - Draghi Comments Cause Euro to Turn Bearish

The euro took significant losses against virtually all of its main currency rivals during afternoon trading yesterday, following comments from ECB President Draghi, in which he said that euro-zone economic growth may slow down. The EUR/USD fell more than 140 pips following Draghi's comments, eventually reaching as low as 1.3428 before bouncing back to the 1.3450 level. Against the British pound, the common-currency lost more than 100 pips during European trading, eventually reaching as low as 0.8554.

Today, traders will want to pay attention to any announcements related to euro-zone growth prospects coming out of the EU Economic Summit, scheduled to take place throughout the day. A positive announcement from EU officials may help the euro bounce back before markets close for the week. Meanwhile, if the US Trade Balance figure comes in below expectations, the euro could recover some of yesterday's losses against the US dollar.

Gold - Gold Prices Tumble after ECB Press Conference

The price of gold dropped by more than $14 an ounce during afternoon trading yesterday, following comments from ECB President Draghi, which caused investors to shift their funds back to the safe-haven US dollar. After reaching as low as $1662.84, the precious metal was able to bounce back ot the $1665 level by the end of European trading.

Today, gold traders will want to pay attention to the US Trade Balance figure. If the figure comes in below the expected level, the dollar could reverse some of its gains from yesterday, which would boost gold prices before markets close for the weekend.

Crude Oil - Crude Oil Prices Remain Stable despite Risk Aversion

The price of crude oil remained relatively stable throughout European trading yesterday, despite risk aversion in the marketplace due to comments from the ECB President related to the euro-zone economic recovery. The commodity spent most of the day fluctuation between $96.49 and $96.91 a barrel.

As markets get ready to close for the weekend, crude oil traders will want to pay attention to the US Trade Balance figure, set to be released at 13:30 GMT. A better than expected figure may be taken as evidence that demand for oil in the US has increased, which could boost prices during afternoon trading.

Technical News

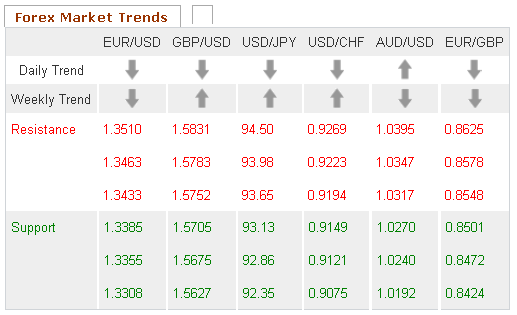

EUR/USD

The weekly chart's Slow Stochastic is close to forming a bearish cross, indicating that a downward correction could occur in the near future. Additionally, the same chart's Relative Strength Index has crossed into overbought territory. Opening long positions may be the smart choice for this pair.

GBP/USD

The Williams Percent Range on the weekly chart has fallen into oversold territory, indicating that an upward correction could occur in the near future. Furthermore, the MACD/OsMA on the daily chart appears close to forming a bullish cross. Traders may want to open long positions.

USD/JPY

The Relative Strength Index on the weekly chart has cross into overbought territory, indicating that a downward correction could occur in the coming days. This theory is supported by the Slow Stochastic on the same chart, which has formed a bearish cross. Opening short positions may be the smart choice for this pair.

USD/CHF

While the weekly chart's Williams Percent Range has crossed over into oversold territory, most other long-term technical indicators place this pair in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

The Wild Card

AUD/CHF

A bullish cross on the daily chart's Slow Stochastic is signaling that this pair could see upward movement in the near future. Additionally, the Williams Percent Range on the same chart has fallen into oversold territory. Opening long positions may be the smart choice for forex traders today.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Tumbles Following Draghi Comments

Published 02/08/2013, 06:34 AM

Updated 02/20/2017, 07:55 AM

Euro Tumbles Following Draghi Comments

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.