For the 24 hours to 23:00 GMT, the EUR rose 0.13% against the USD and closed at 1.3151, following report about a possible cease-fire agreement between Russia and Ukraine. The service sector in Germany, Euro-zone’s biggest economy further worsened in August falling to 54.9 in August, against market expectations for a reading of 56.4 and compared to previous month’s similar reading.

Elsewhere, the services PMI in the Euro-zone dropped to 53.1 in August, down from a reading of 53.5 in July. Moreover, the retail sales in the Euro-region dropped 0.4% on monthly basis in July, compared to revised advance of 0.3% in the prior month. Markets were expecting retail sales to fall 0.3%. Meanwhile, the services PMI of France & Italy recorded a drop in August, while Spain’s services PMI advanced for the same month.

In the US, the new orders for factory goods jumped in July, pointing further signs of strength in the manufacturing sector. The factory orders rose 10.5% in July, marking its biggest one-month increase since 1992, following a 1.5% increase in the previous month. Additionally, the number of mortgage applications recorded a rise of 0.2% on a weekly basis, in the week ended 29 August 2014, compared to a rise of 2.8% in the preceding week. Meanwhile, the seasonally adjusted Redbook index registered a rise of 0.7% on a monthly basis, in the week ended 29 August 2014. It had climbed 0.5% in the prior week. On the other hand, the New York City ISM current business condition index eased to 57.1 August, from previous month’s reading of 68.1.

Separately, the Fed, in its Beige Book survey, indicated that the US economy continued to expand at a “moderate to modest” pace over the summer, as all twelve Federal Reserve regions continued to expand. It further highlighted improvement in labour market, consumer spending and tourism in most of the Fed’s twelve districts but mentioned that manufacturing activity remained mixed.

In the Asian session, at GMT0300, the pair is trading at 1.3147, with the EUR trading tad lower from yesterday’s close.

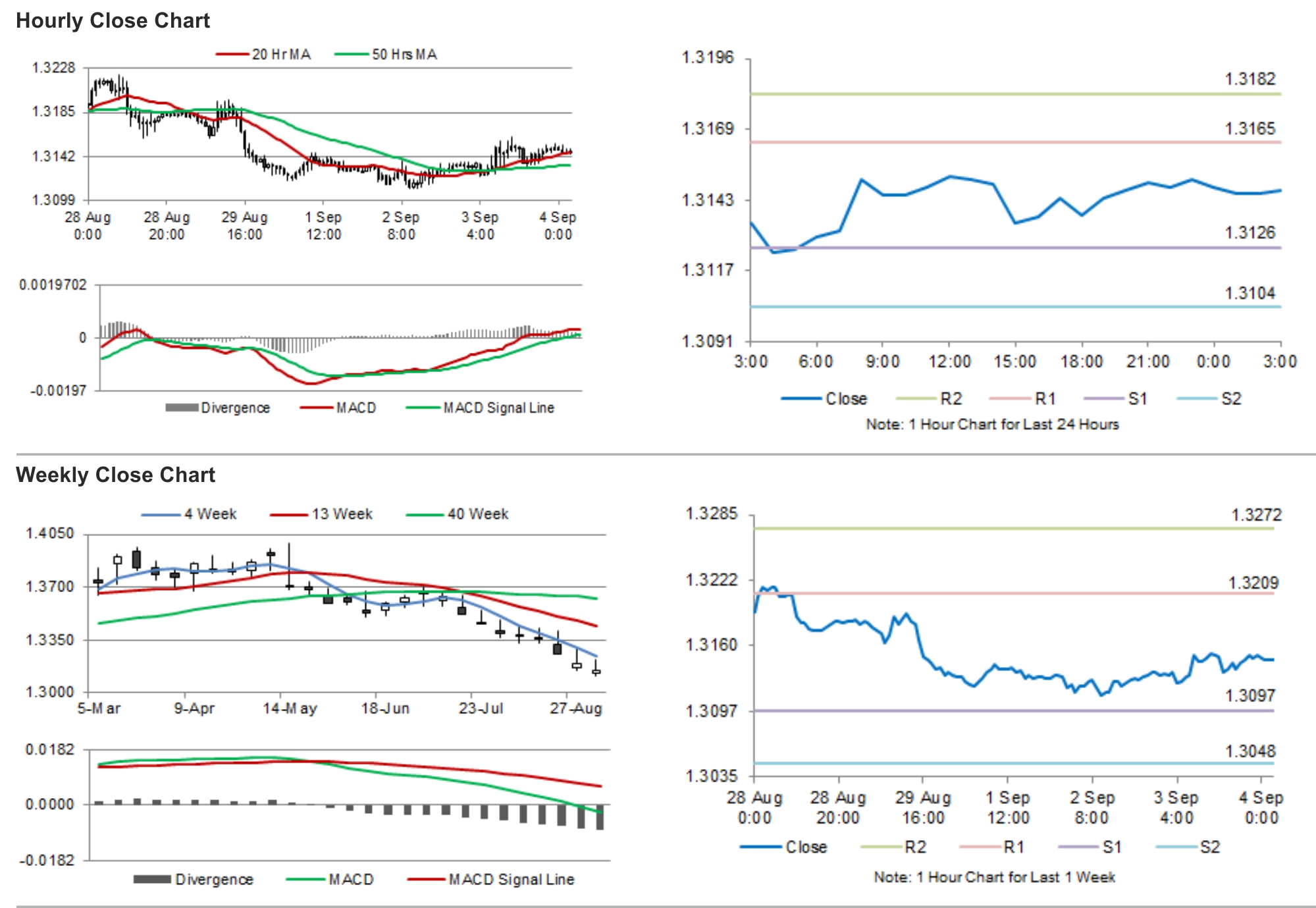

The pair is expected to find support at 1.3126, and a fall through could take it to the next support level of 1.3104. The pair is expected to find its first resistance at 1.3165, and a rise through could take it to the next resistance level of 1.3182.

Trading trends in the Euro today would be determined by the much crucial interest rate decision by the ECB, scheduled later today. Meanwhile, investors would also keep a close eye on German factory orders, French unemployment rate and initial jobless claims data from the US, set for release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.