EURUSD Movement

For the 24 hours to 23:00 GMT, the EUR rose 1.37% against the USD and closed at 1.0923, on the back of mixed economic data across the Euro-zone.

In economic news, Germany’s seasonally adjusted factory orders rose more than expected by 1.5% on a monthly basis in November, compared to market expectations of a rise of 0.1% and after recording a gain of 1.7% in the preceding month. Additionally, Germany’s Markit construction PMI expanded at the fastest pace in forty-five months to a level of 55.5 in December as compared to previous month’s reading of 52.5. Meanwhile, German retail sales rebounded less than forecasted by 0.2% MoM in November, after it slipped 0.1% in the preceding Month, while markets expected it to increase 0.5%.

Moreover, unemployment rate across Eurozone fell for a third straight month to 10.5% in November from prior month’s level of 10.6%, registering its lowest in four years. Market expected it to advance to 10.7%. Also, Eurozone’s consumer confidence remained steady at -5.7 in December, at par with market expectations. On the other hand, Eurozone’s retail sales unexpectedly declined by 0.3% MoM in December, following previous month’s drop of 0.2% whereas market expected it to rise by 0.2%.

In the US, initial jobless claims dropped to a level of 277.0K for the week ended 02 January from a more than five month high of 287.0K in the previous week, suggesting that the labour market continues to add jobs. Market anticipated it to drop to a level of 275.0K.

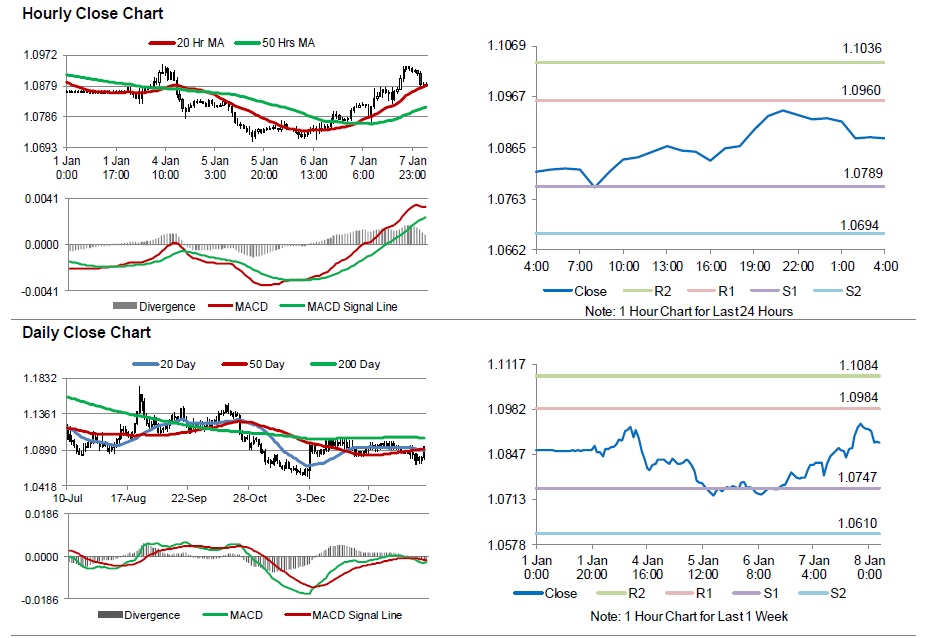

In the Asian session, at GMT0400, the pair is trading at 1.0883, with the EUR trading 0.36% lower from yesterday’s close.

The pair is expected to find support at 1.0789, and a fall through could take it to the next support level of 1.0694. The pair is expected to find its first resistance at 1.0960, and a rise through could take it to the next resistance level of 1.1036.

Going ahead, investors will look forward to Germany’s current account and trade balance data, both for November, set for release in a few hours. Additionally, US non-farm payrolls and unemployment rate data scheduled later today would grab lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.