News flow about how Trump's treatment is going has a significant impact on market trading. It seems that the health of the markets now depends directly on the state of the U.S. president. Reports that his health has improved over the weekend created positive momentum in opening markets in Asia. However, it has proven to be unsustainable.

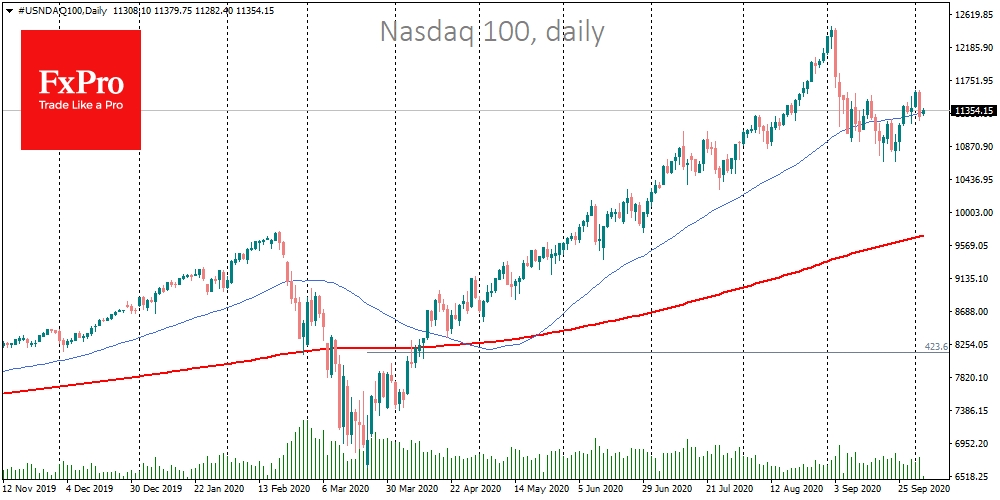

The S&P 500 and NASDAQ 100 on Friday fell below their 50-day average. The ability to close assuredly above these signal levels may indicate a break in the downtrend and a return to growth after September's correction.

Futures on indices faced an obstacle when trying to grow this morning. A clear technical signal will only be received if there is a sharp upward or downward movement from this line. Without this, the chances are high that the indices will continue to hover around this mark without a particular direction, and this is the most dangerous situation.

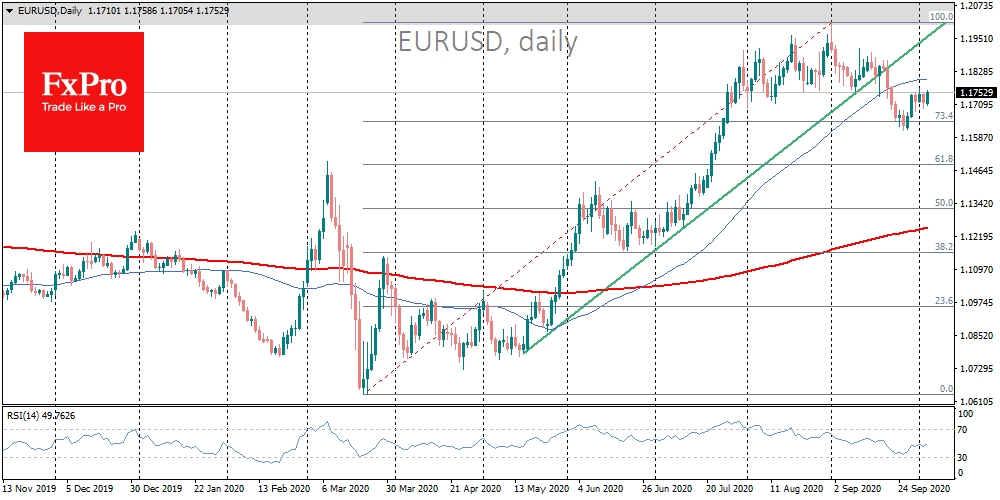

In foreign exchange markets, the dollar stagnated while waiting for additional signals. Trump's weakness in the election race is a positive factor for the U.S. currency as it increases the caution of stock markets and increases the traction in protective instruments.

Beyond politics, economic dynamics can have a significant impact on currency trading. The final September PMI estimates for the Eurozone were better than expected. This supported the growth of the euro as it helped to put aside fears of a second wave of disease affecting the economy.

The euro area's composite PMI remained in growth territory, rising to 50.4 against the first estimate of 50.1. The Index data has had a substantial impact on EUR//USD so far this year. During early trading in Europe, those indices were better than expected and helped to keep the pair above 1.1700.

Data for the USA will be published by the beginning of the New York session. If statistics are better than expected there too, this will be a plus for stock indices. However, in the case of EUR/USD, investor interest may sway in favour of America if there are more confident growth signs again.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Euro Increases On Upbeat PMIs, Stocks Are Trying To Form Growth

Published 10/05/2020, 08:22 AM

Updated 03/21/2024, 07:45 AM

Euro Increases On Upbeat PMIs, Stocks Are Trying To Form Growth

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.