After a quiet week during the Christmas holiday, the euro burst out of the starting gates on Friday. EUR/USD has gained over one cent on the day, as the pair trades around the 1.38 line in the European session. On Thursday, US Unemployment Claims bounced back and dropped to three-week lows. There are only two releases on Friday, both out of the US. There are no Eurozone events on Friday.

There was more good news out of the US this week, as Unemployment Claims recovered following two disappointing releases. The key employment indicator fell to 338 thousand last week, compared to 379 thousand in the previous release. The estimate stood at 346 thousand. With the Federal Reserve poised to begin its long-awaited QE taper next month, employment releases have taken on added significance. If the US labor market continues to improve, the Fed could decide on another taper early in 2014, which would give a boost to the US dollar against its major rivals.

There was some early holiday cheer from US releases on Tuesday, as manufacturing and housing numbers pointed upwards. Core Durable Goods Orders posted a strong gain of 1.2%, its best showing since April. The key manufacturing indicator had posted four consecutive declines, so the sharp gain was welcome news. Durable Goods Orders bounced back from a sharp decline in October with a gain of 3.5%, well above the estimate of 1.7%. New Homes Sales also impressed with a five-month high, climbing to 464 thousand. The estimate stood at 449 thousand.

In the Eurozone, French numbers have not looked very good of late, so Tuesday’s Consumer Spending data was a pleasant surprise. The indicator posted a gain of 1.4%, its strongest gain since September 2010. Four of the five past releases have been declines, and the November estimate stood at 0.3%. The solid reading comes after a string of poor releases from the Eurozone’s second largest economy. French Services and Manufacturing PMIs for November pointed to contraction, while Industrial Production continues to struggle, having posted just one gain since May. EUR/USD" title="EUR/USD" height="300" width="400">

EUR/USD" title="EUR/USD" height="300" width="400">

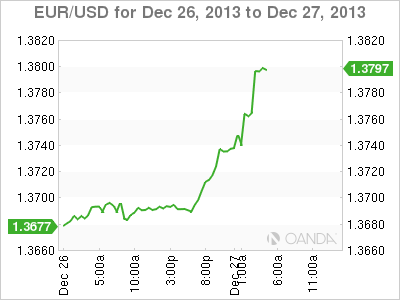

- EUR/USD December 26 at 9:40 GMT

- EUR/USD 1.3894 H: 1.3802 L: 1.3693

- EUR/USD has posted sharp gains in Friday trading. The pair pushed across the 1.37 line early in the Asian session and continues to climb in the European session, with the pair touching a high of 1.3806 earlier.

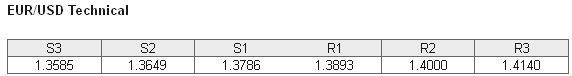

- On the downside, 1.3786 has reverted to a support role following strong gains by the Euro on Friday. This is a weak line which could see more activity if the euro retracts. This is followed by a support level at 1.3649.

- 1.3893 is providing resistance. This is followed by the key round number of 1.4000, which has remained intact since October 2011.

- Current range: 1.3786 to 1.3893

Further levels in both directions:

- Below: 1.3786, 1.3649, 1.3585, 1.3500 and 1.3410

- Above: 1.3893, 1.4000, 1.4140 and 1.4268

OANDA's Open Positions Ratio

EUR/USD ratio is pointing to gains in short positions in Friday trading. With the euro posting sharp gains, the ratio movement is largely due to many long positions being covered, resulting in a higher percentage of open short positions. The ratio is still made up largely of short positions, indicative of a trader bias towards the dollar reversing directions and moving to higher ground.

The euro has posted sharp gains on Friday, as low liquidity has resulted in sharp movement from the pair in the European session. This trend could continue during the day, so we could see further volatility in the North American session.

EUR/USD Fundamentals

- 15:30 US Natural Gas Storage. Exp. -177B.

- 16:00 US Crude Oil Inventories. Exp. 0.5%.