GROWTHACES.COM Forex Trading Strategies:

Taken Positions:

EUR/USD trading strategy: short at 1.1590, target 1.1375, stop-loss 1.1665

USD/CAD trading strategy: long at 1.1880, target 1.2200, stop-loss 1.1920

NZD/USD trading strategy: long at 0.7690, target 0.8000, stop-loss 0.7730

EUR/GBP trading strategy: short at 0.7640, target 0.7520, stop-loss 0.7700

Pending Orders:

AUD/NZD trading strategy: sell at 1.0680, if filled target 1.0350, stop-loss 1.0760

We encourage you to visit our website and subscribe to our newsletter to receive daily forex analysis and trading positions summary.

EUR/USD: No Need To Rush To Raise Fed Rates

(stay short ahead of the ECB’s QE announcement)

- ECB Governing Council member Ewald Nowotny said that that the central bank had limited options to counter long-term stagnation in the euro zone. He added the euro zone may see negative inflation early this year, but he did not expect deflation over the course of all of 2015.

- Euro zone current account surplus amounted in November to EUR 18.1 bn (seasonally adjusted) vs. median forecast of EUR 21.3 mn and EUR 19.5 mn in October.

- U.S. consumer prices fell 0.4% mom, the largest drop since December 2008 and increased 0.8% yoy, above the median forecast of 0.7% yoy. Core CPI, which strips out food and energy, was unchanged in December and rose 1.6% yoy (vs. forecast of 1.7% yoy). Gasoline prices tumbled 9.4%, the biggest drop since December 2008, after declining 6.6% in November.

- U.S. Industrial production fell 0.1% mom in December, a bit weaker than the consensus for no change. That follows a 1.3% surge in November. Manufacturing output was up 0.3% mom (expected 0.2% mom), with the prior month's revised up to 1.3% mom from 1.1% mom. Mining output was also up a surprisingly substantial 2.2% mom, but both factors were countered by a 7.3% plunge in utility output due to relatively mild weather. Overall capacity utilization slipped to 79.7% from 80.0%.

- The University of Michigan's preliminary reading on the overall index on consumer sentiment for this month came in at 98.2, the highest since January 2004 and above the median forecast of 94.1. The final December reading was 93.6. The survey's gauge of consumer expectations rose to 91.6 from 86.4, beating the 87.0 forecast. The survey's barometer of current economic conditions rose to 108.3 from 104.8 and above the 105.4 forecast.

- Federal Reserve Bank President John Williams (voting) said: “There is no need to rush to raise rates. (…) If the forecast evolves the way I expect, six months from now or whatever - middle of this year - I think we’ll have a better position to understand either well we need to wait longer, or maybe it's we could act now.”

- St. Louis Fed President James Bullard is the opinion that inflation is not low enough to justify keeping borrowing costs at zero. Bullard, who is not a voter on the Fed's policy-setting committee this year, has long advocated for the central bank to raise interest rates sooner than the Fed was willing to move.

- On the other hand, Minneapolis Fed President Narayana Kocherlakota, who does not vote on Fed policy this year, said the Federal Reserve should take seriously signs that the U.S. economy could undershoot the Fed's 2% inflation target for years. Kocherlakota is among the Fed’s biggest opponents of tighter policy in the face of prolonged low inflation.

- We expect the EUR to remain weak ahead of the ECB’s QE announcement on Thursday. Given strong expectations for the decision on quantitative easing, a reaction to the decision depends on the scale of the ECB’s programme. In our opinion profit taking on recent EUR-selling positions is the most possible scenario. In the medium-term we expect a recovery of the EUR/USD due to expected delay of Fed’s hikes.

- The EUR/USD fell on Friday to 1.1460 but recovered soon and is continuing its corrective move today in the European session. It looks like profits booking in anticipation for stronger recovery after the ECB’s decision on Thursday which reassures us that such a scenario is very likely. We stay short ahead of the ECB’s decision, but the medium-term outlook for the EUR/USD is bullish.

- We have holiday in the United States today. The market activity in the U.S. session will be lower than usually.

Significant technical analysis' levels:

Resistance: 1.1647 (hourly high Jan 16), 1.1754 (10-dma), 1.1792 (high Jan 15)

Support: 1.1460 (low Jan 16, 2015), 1.1445 (low Nov 11, 2003), 1.1376 (low Nov 7, 2003)

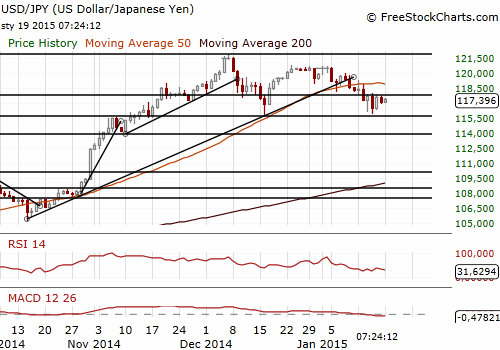

USD/JPY: BOJ Is Likely To Cut Inflation Forecasts

(stay sideways)

- Kozo Yamamoto, a leading expert on fiscal and monetary policy in Shinzo Abe's ruling Liberal Democratic Party, is the opinion that the Bank of Japan does not need to ease monetary policy further this year unless the economy is hit by a severe external shock. He said, however, that slumping oil prices and the hit on consumption from a sales tax hike mean the central bank is unlikely to meet its pledge of achieving its 2% inflation target during the fiscal year beginning in April.

- Consumer confidence index, which includes views on incomes and jobs, was at 38.8 in December, up from 37.7 in November. The Cabinet Office raised its view on the consumer confidence index, saying that there are signs that its declining trend may be coming to an end.

- In our opinion the outlook is unclear, so we stay sideways on the USD/JPY. The JPY traders will be focused also on BOJ meeting (on Wednesday). The central bank is expected to discuss a cut in the forecast for the rise in the core CPI to the lower half of the 1 percent range from the present outlook outlined on October 31. This would be supportive for the JPY bears. On the other hand, recent increased volatility on financial markets may strengthen demand for safe-haven assets.

Significant technical analysis' levels:

Resistance: 117.77 (high Jan 16), 117.95 (high Jan 14), 118.00 (psychological level)

Support: 115.85 (low Jan 14), 115.56 (low Nov 16, 2014), 115.49 (38.2% of 105.19-121.86)