GROWTHACES.COM Forex Trading Strategies

Taken Positions

USD/JPY: long at 120.05, target 121.65, stop-loss 119.45, risk factor **

USD/CHF: long at 0.9775, target 0.9885, stop-loss 0.9725, risk factor **

CHF/JPY: short at 123.20, target 120.50, stop-loss 124.40, risk factor ***

Pending Orders

EUR/USD: sell at 1.0620, if filled – target 1.0460, stop-loss 1.0705, risk factor **

GBP/USD: sell at 1.4730, if filled - target 1.4500, stop-loss 1.4845, risk factor *

EUR/JPY: sell at 127.20, if filled - target 125.00, stop-loss 128.10, risk factor ***

EUR/CAD: sell at 1.3370, if filled – target 1.3200, stop-loss 1.3460, risk factor **

GBP/JPY: sell at 176.40, if filled – target 173.70, stop-loss 177.75, risk factor ***

AUD/NZD: buy at 1.0135, if filled – target 1.0290, stop-loss 1.0090, risk factor **

EUR/USD: Markets Begin Taper Talk Ahead Of ECB Meeting

(sell at 1.0620)

- European Commission Vice President Valdis Dombrovskis said Greece was not moving fast enough to draw up and implement structural reforms and there was limited time to prevent it running out of cash. A meeting of deputy finance ministers, called the Euro Working Group, on Thursday gave Athens a deadline of six working days to present a revised economic reform plan, before euro zone finance ministers meet on April 24 to decide whether to unlock emergency funding to keep Greece afloat. Dombrovskis noted that April 24 was not a formal deadline to reach a deal with Greece, but the country's financial difficulties were pressing. He said: “If the Greek government does not like some of the programme measures it is possible to replace them with other measures with equal fiscal value.”

- The ECB meeting is scheduled for Wednesday. We should expect little news from ECB President Draghi’s press conference. He may reveal whether the ECB's Governing Council extended the limit on emergency liquidity that can be drawn by Greek banks.

- The weaker EUR is already pushing up import prices of core consumer goods, so the risk of an outright deflation in the Eurozone is very small now. On QE launch day, the ECB lifted its growth forecast to 1.5% for 2015, from a previous 1% and said inflation would rise from zero this year to 1.8% in 2018. Since then, the Eurozone data has generally beaten forecasts. Business activity this month was its highest since May 2011, and inflation is expected to nudge back into positive territory after months of declines. QE has helped drive down bond yields, even though many had already been at record lows before its launch. This has raised concerns that money-printing could lead to a bubble in the market.

- Eurozone industrial production jumped 1.1% mom and 1.6% yoy in February, much more than expected rise of 0.4% mom. The monthly gain was across the board in the production of energy, capital goods, durable and non-durable consumer goods.

- Some investors are already asking when and how the ECB might start scaling down its stimulus. ECB’s Governing Council member Yves Mersch said last week the bank would be free to adjust its quantitative easing if it advanced faster than expected towards its goal of lifting inflation. Such a rhetoric is rather unlikely already at April ECB meeting. However, in our opinion this issue may be raised in the coming months and the ECB could consider tapering before September 2016.

- U.S. retail sales data will be released today and our forecast (1.6% mom) is clearly above consensus estimates (1.0% mom).

- Sentiment towards the EUR/USD remains bearish. The nearest target of the EUR/USD is the 12-year low from March 16 at 1.0457. We are looking to use upticks as an opportunity to get short for a return to 1.0457. We have lowered our sell order to 1.0620.

Significant technical analysis' levels:

Resistance: 1.0620 (high Apr 13), 1.0685 (high Apr 10), 1.0788 (high Apr 9)

Support: 1.0521 (low Apr 13), 1.0457 (low Mar 16), 1.0335 (low Jan 2, 2003)

GBP/USD Falls After UK Inflation Data

(sell at 1.4730)

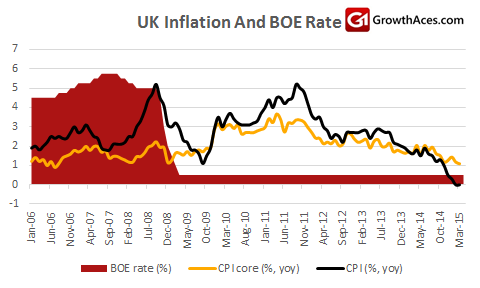

- British CPI inflation amounted to 0.2% mom and 0.0% yoy in March. The reading was in line with expectations. The sharp fall in inflation has been driven by the slump in oil prices which took place last year, as well as falls in food prices.

- Core inflation, which strips out increases in energy, food, alcohol and tobacco, fell to its lowest level in nearly nine years at 1.0% yoy in March compared with 1.2% yoy in February. Clothing prices fell between February and March for the first time on record, possibly reflecting changes to seasonal discounting patterns. Factory gate prices sank by 1.7% yoy, as expected.

- The Office for National Statistics said house prices inflation across Britain slowed to 7.2% yoy in February from 8.4% yoy in January.

- We do not expect any response from the Bank of England to inflation data. BoE Governor Mark Carney said last month that cutting rates purely in response to falling oil prices would be "extremely foolish". In our opinion the central bank will raise rates in the first quarter of 2016.

- Investors are now waiting for jobs report to be released on Friday.

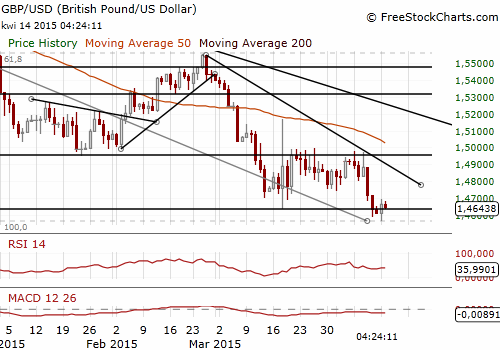

- The GBP/USD hit a new 5-year low at 1.4567 yesterday. The GBP/USD rebounded as poll showed support for Britain's Conservative Party, led by Prime Minister David Cameron, has increased by three percentage points to 39% ahead of Britain’s May 7 election. The recovery was short-lived. The cable fell again to a day’s low of 1.4605 after inflation came in at zero for the second month running today.

- The GBP/USD is likely to fall further towards 1.4228, the 2010 low, in coming weeks. The technical situation supports the bearish market structure – the tankan and kijun lines are negatively aligned. Our strategy is to use upticks to get short.

Significant technical analysis' levels:

Resistance: 1.4700 (psychological level), 1.4724 (high Apr 10), 1.4740 (low Apr 1)

Support: 1.4567 (low Apr 13), 1.4505 (low Jun 11, 2010), 1.4500 (psychological level)

Source: Growth Aces Forex Trading Strategies