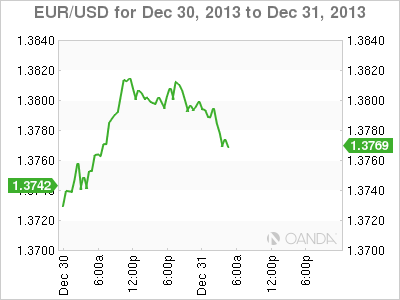

The EUR/USD has reversed directions on Tuesday and lost most of the gains made on the previous day. The pair is trading in the low-1.37 range in the European session. In economic news, US Pending Housing Sales posted a slight gain of 0.2%, well short of the estimate. Tuesday has just three releases, highlighted by US CB Consumer Confidence. The markets are expecting a sharp rise in the November reading. German markets are closed for a holiday, and there are no Eurozone releases on the schedule. With light trading due to the holiday season, traders should be prepared for more volatility than usual.

A quiet holiday week hasn't stopped the euro from continuing to post gains against the US dollar. Low liquidity over a holiday period can lead to strong currency movements, and we got a taste of that on Friday. The euro shot up about 200 points as it hit a high of 1.3896. However, it then retracted and closed in the mid-1.37 range. As well, the recent Fed taper decision has fuelled a "risk on" atmosphere which has led to increased selling of the safe-haven US dollar and boosted the euro. With thin trade likely this week as well due to the holidays, we could see further volatility from EUR/USD.

The first US release of the week did not impress, as US Pending Home Sales gained just 0.2% in November. This was well short of the forecast of 1.1%. However, the modest gain did break a string of five straight declines, so perhaps the key indicator has turned the corner on its recent downward spiral. Last week’s housing data looked much stronger, as New Home Sales beat the forecast.

Late last week, Unemployment Claims bounced back nicely following two disappointing releases. The key employment indicator fell to 338 thousand, compared to 379 thousand in the previous release. The estimate stood at 346 thousand. With the Federal Reserve poised to begin its long-awaited QE taper next month, employment releases have taken on added significance. If the US labor market continues to improve, the Fed could decide on another taper early in 2014, which would give a boost to the US dollar against its major rivals.

There was some holiday cheer from US releases last week, as manufacturing and housing numbers pointed upwards. Core Durable Goods Orders posted a strong gain of 1.2%, its best showing since April. The key manufacturing indicator had posted four consecutive declines, so the sharp gain was welcome news. Durable Goods Orders bounced back from a sharp decline in October with a gain of 3.5%, well above the estimate of 1.7%. New Homes Sales also impressed with a five-month high, climbing to 464 thousand. The estimate stood at 449 thousand.

With all the bad news about Eurozone bailouts for struggling members, there was a happier episode as Ireland recently exited the bailout program it had received from the EU and the IMF. Ireland had been party to the bailout for three years, and will now be able to borrow money on the international markets. Key sectors such as tourism and agriculture are improving, and unemployment is down to about 12.5%. However, economic growth is expected to be limited, as the country was forced to undergo drastic budget cuts and tax increases as part of the bailout. Finance Minister Michael Noonan has said the exit from the bailout is a step in the right direction, but admits that the road to recovery will be a long one. EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="400" height="300">

EUR/USD Daily Chart" title="EUR/USD Daily Chart" width="400" height="300">

EUR/USD December 31 at 10:10 GMT

EUR/USD 1.3775 H: 1.3813 L: 1.3760 EUR/USD Technical Chart" title="EUR/USD Technical Chart" width="400" height="300">

EUR/USD Technical Chart" title="EUR/USD Technical Chart" width="400" height="300">

- EUR/USD has posted modest losses in Tuesday trading. The pair dropped below the 1.38 line in the Asian session.

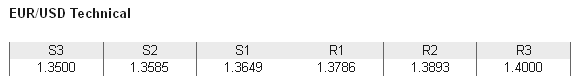

- On the downside, 1.3649 continues to provide support. This line has some breathing room as EUR/USD close to the 1.38 level. This is followed by a support line at 1.3585.

- On the upside, 1.3786 is under strong pressure. This line has had a busy week so far and could see more activity during the day. This is followed by resistance at 1.3893.

- Current range: 1.3649 to 1.3786

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3500 and 1.3410

- Above: 1.3786, 1.3893, 1.4000, 1.4140 and 1.4268

OANDA's Open Positions Ratio

EUR/USD ratio has reversed directions in Tuesday trading and is pointing to gains in short positions. This is consistent with what we are seeing from the pair, as the euro has also changed directions and has lost ground. The ratio is still made up largely of short positions, indicative of a trader bias towards the dollar continuing to move to higher ground.

The dollar has posted some gains on Tuesday, but the euro continues to trade at high levels. We could see some further movement during the North American session, as the US releases key consumer confidence data later on.

EUR/USD Fundamentals

- 14:00 US S&P/CS Composite-20 HPI. Estimate. 13.4%.

- 14:45 US Chicago PMI. Estimate. 61.3 points.

- 15:00 US CB Consumer Confidence. Estimate. 76.5 points.