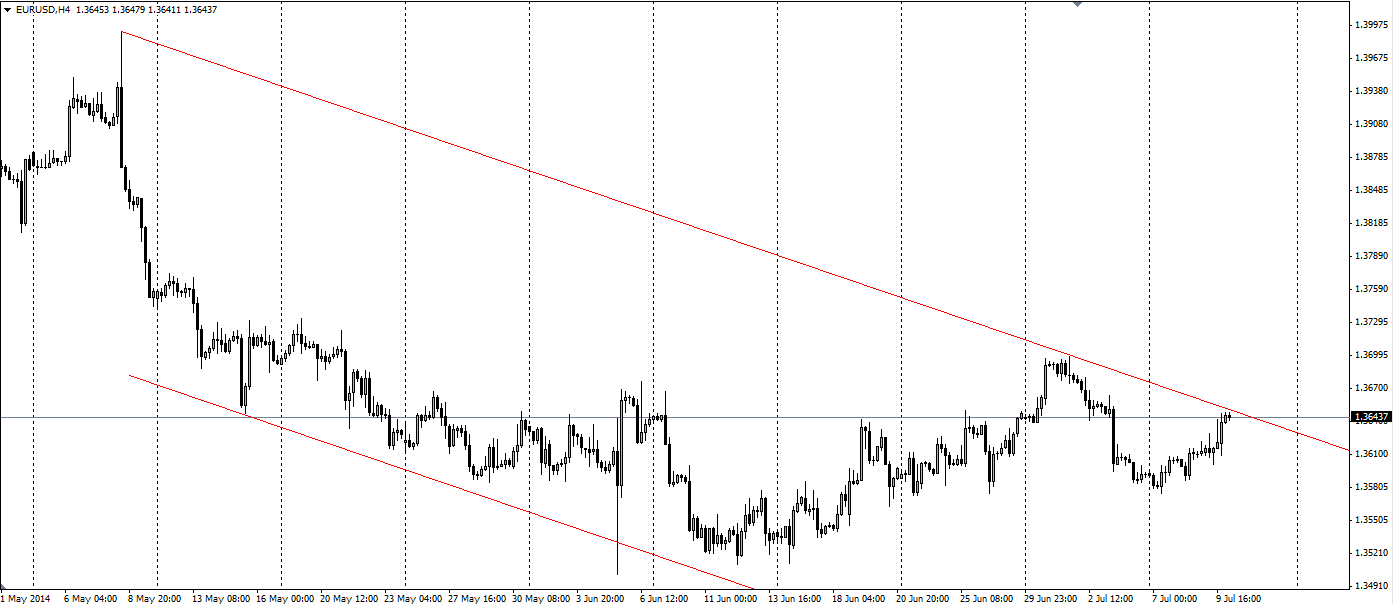

The EUR/USD pair is following a bearish channel that should provide traders with the set up they need to go short. The lack of news this week will ensure the pair trades off technicals and a bounce off the trend line is looking likely.

Ever since early May when European Central Bank (ECB) President Mario Draghi said they would “be comfortable acting in June” to stimulate the European Economy, the Euro has been on a bearish slide. Since then the ECB has enacted a raft of measures aimed at staving off inflation and boosting growth in a region that has a crippling unemployment rate at 11.6%.

One of the measures enacted was -0.1% interest rate on overnight deposits and 0.1% rate on loans. The result of this has been a flight of capital from the Euro zone as investors search for return elsewhere, lowering demand for the Euro.

There is little news out for the rest of the week for the Euro. Final CPI figures are due for France and Germany, but these will merely confirm the preliminary results, so should not provide any surprises. Spain will report a Flash CPI, but this will not shock the market much as Spain constitutes a small part of the EU. French Industrial Production is really the only news item of note (due on Thursday at 06:45 GMT), and is expected to fall to 0.1% from 0.3% a month ago. The ECB monthly bulletin is also on Thursday (at 08:00 GMT) but no surprises are expected. US Unemployment claims could provide a little volatility for this pair, however, this is expected to be flat at 315k.

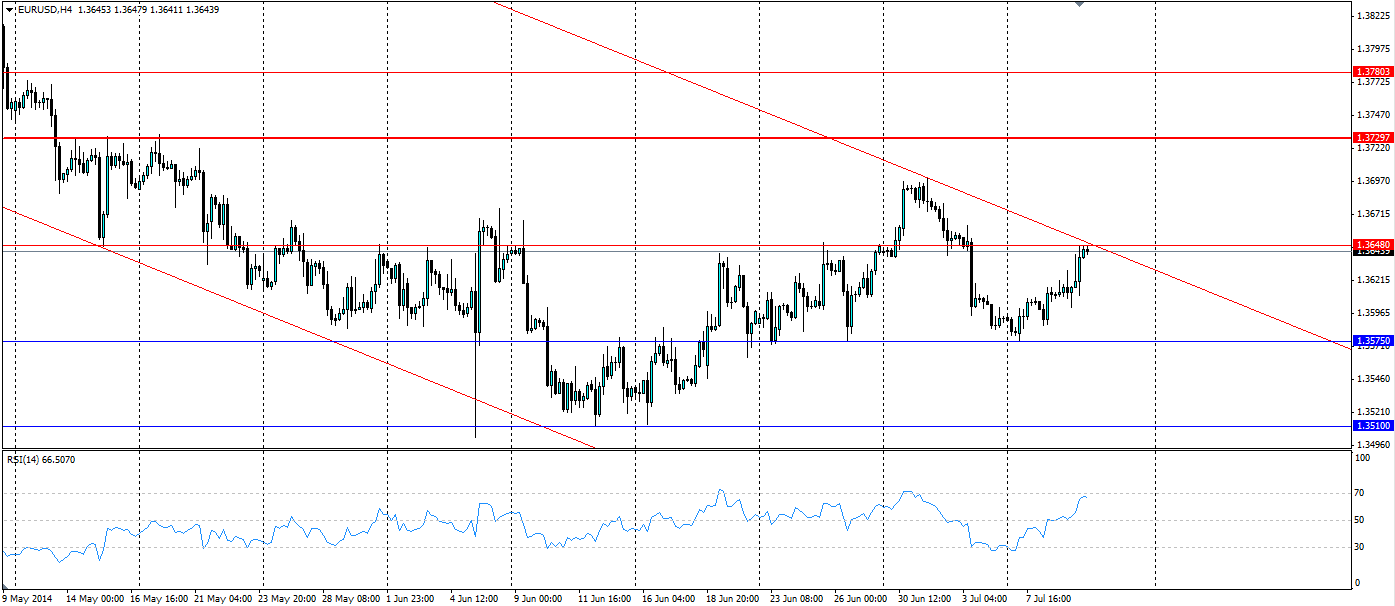

So technicals should be the driving factors for the EUR/USD pair. The price has recently confirmed the bearish channel when it bounced off the resistance at 1.3698 and headed lower. It is on the verge of testing the trend again and should bounce lower like last time. The RSI was showing just a shade under overbought conditions at 67.63 and is now heading down as momentum wanes.

The Resistance at 1.3648 looks to be holding firm at the moment, and combined with the dynamic resistance of the trend line, we can expect the price to reject off and head lower. The first target will be the support at 1.3575, which has been tested several times recently and may lead to a mini downward sloping triangle forming. 1.3510 is the next level of support with the bottom of the channel acting as dynamic support if these levels fail. The risk/reward ratio for a short position on this set should be relatively favourable as a stop loss can be set quite tightly to the resistance line, and just outside the trend line.

A bearish channel has formed on the EUR/USD H4 chart and the price looks set to bounce lower off it. The lack of market moving news this week will mean technicals play an important role.