The euro’s troubles continue, as the currency tries to find its footing against the surging US dollar. On Tuesday, EUR/USD took a tumble and fell into 1.27 territory, following comments by a senior ECB policymaker that the ECB planned to maintain low interest rates. EUR/USD has recovered partially and is back above the 1.28 level in Wednesday’s European session. Looking at Wednesday’s releases, French Industrial Production dropped 0.4%, and the Italian Industrial Production posted a weak gain of 0.1%. In the US, there are three key releases today. The US holds a 10-year bond auction, and the Federal Reserve will publish the minutes of the most recent FOMC policy meeting, which could shake up the markets. As well, Federal Reserve head Bernard Bernanke will speak at a conference in Cambridge Mass.

The euro posted sharp losses on Tuesday, dropping to a low of 1.2756, its lowest level since early April. The euro fell after remarks by ECB executive board member Jorg Asmussen, who said that the ECB could maintain its present interest rates for more than 12 months. The ECB rate is currently at a record low of 0.50%. Asmussen’s comments reiterated remarks by Mario Draghi that interest rates would remain at low levels for an “extended period”. In other words, we’re unlikely to see any hikes in rates as long the Eurozone continues to experience weak growth. The dollar got some further help on Tuesday from a solid US employment release. The JOLTS Job Openings came in at 3.73 million, slightly above the estimate of 3.81 million.

With the US posting strong employment numbers and the recovery looking stronger, there is increased speculation that the Federal Reserve will taper QE later this year. Federal Reserve chair Bernard Bernanke has stated that the Fed would act by the end of the year if the economy continues to improve, resulting in a massive sell-off of US bonds, which raised yields and bolstered the US dollar. The markets are eagerly waiting for he release of the FOMC’s last recent policy meeting, which will be released on Wednesday. Traders should be prepared for some volatility from EUR/USD after this major release. Bernanke will be addressing an economic conference later on Wednesday, and analysts will be monitoring the speech for any clues as to the Fed’s future monetary policy.

In the Eurozone, the political crisis which gripped Portugal last week is over, at least according to Prime Minister Pedro Passos Coelho. The country has been struggling with austerity measures as part of its bailout program, and the government looked like it might fall after the finance and foreign ministers tendered their resignations. Coelho said a deal had been reached with a junior coalition party, which would ensure that the government remains in power. There was concern in the Eurozone that the crisis could derail the 78 billion bailout agreement which Portugal received. The deal which would keep the government afloat is subject to the approval of Portugal’s president, Anibal Cavaco Silva. He continues to meet with the country’s political parties, and a decision is expected shortly.

Meanwhile, Spain has its own political crisis brewing. The ruling party in Spain appears to have been involved in a corruption scandal, and Prime Minister Mariano Rajoy has been accused of being involvement. There is a report in the Spanish media that Rajoy received illegal payments while serving as a minister in the Aznar government back in the late ’90s. The scandal threatens to topple the government and bring more instability to Spain, which has severe economic problems as it is. Another political crisis in the Eurozone is certainly not good news for the struggling euro.

Eurozone financial ministers met on Monday, and decided to release more bailout aid to Greece, but with a catch, as only part of the scheduled tranche of 8.1 billion euros will be transferred to Athens. Under the new arrangement, Greece will receive 3 billion euros in July and additional funds in August and October. The Eurogroup decision to give Greece only a portion of the funds currently reflects growing unease with the lack of progress by Athens in implementing the bailout conditions, including improved tax collection and cuts to the bloated public service. Greece has been put on notice that it will have to show more progress in economic restructuring before the troika releases more bailout funds. EUR/USD" width="400" height="300">

EUR/USD" width="400" height="300">

EUR/USD July 10 at 10:10 GMT

EUR/USD 1.2815 H: 1.2835 L: 1.2766

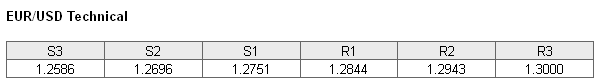

EUR/USD took a hit on Tuesday, dropping below the 1.28 level. The pair has moved back above 1.28 on Wednesday. EUR/USD is receiving support at 1.2751. This line could face pressure if the euro retracts. This is followed by a stronger support at 1.2696. This line has held firm since November 2012 . On the upside, the pair is facing resistance at 1.2844. This line has strengthened as the pair trades at lower levels. The next resistance line is at 1.2943.

- Current range: 1.2751 to 1.2844

- Below: 1.2751, 1.2696, 1.2586 and 1.2495

- Above: 1.2844, 1.2943, 1.3000, 1.3050, 1.3100 and 1.3162

The EUR/USD ratio has shifted directions from what we saw on Tuesday, and is pointing to movement towards long positions in Wednesday trading. This is consistent with what we are seeing from the pair in the European session , as the euro has edged higher and crossed above the 1.28 line. The ratio continues to have a majority made up of long positions, indicating trader bias towards the euro continuing to push higher.

The euro was sharply lower on Tuesday, and is struggling to remain in 1.28 territory on Wednesday. With the release of the minutes of the Federal Reserve’s most recent policy meeting later in the day, we could see some volatility from EUR/USD after this release.

EUR/USD Fundamentals

- 6:00 German Final CPI. Estimate 0.1%. Actual 0.1%.

- 6:45 French Industrial Production. Estimate -0.5%. Actual -0.4%.

- 8:00 Italian Industrial Production. Estimate 0.1%. Actual 0.4%.

- 14:00 US Wholesale Inventories. Estimate 0.3%

- 14:30 US Crude Inventories. Estimate -2.9M.

- 17:00 US 10-year Bond Auction.

- 18:00 FOMC Meeting Minutes.

- 20:10 US Federal Reserve Chairman Bernard Bernanke Speaks.