- ECB left policy unchanged, but our economists still look for a summer response

- Positive sentiment remains intact – US stocks closed with large gains

- EUR/USD is back above 1.2550 – Brent oil is back above USD100/bbl

- Australian macro continues to surprise positively

- Focus remains on monetary policy as the BoE meets and Fed‟s Bernanke speaks

The ECB did not deliver the rate cut that our economists had expected and generally sounded less dovish than expected – leaving staff projections for 2012 growth unchanged. This helped lift yields, also in the short end of the curve.

Sentiment started to improve, however, as ECB president Draghi stated that the decision to leave rates unchanged was not unanimous, but that some members were calling for a rate cut. We still see a high probability that majority will shift towards further easing and believe it is too early to rule out a July rate cut – even as there was no "language signalling" of a pre-commitment. Sentiment was further supported by international media reporting that the EU is working on ways to allow the European Stability Mechanism (ESM) to lend directly to banks, while the banks' home state would retain liability for the aid.

US stock markets closed with large gains – the S&P500 index up 2.3% – and the Dow Jones is now back in positive territory for the year. It thus appears that investors are positioning for a market positive response by Fed's Bernanke today as he testifies before Congress (i.e. expectations have risen for a promise of further stimuli). US Treasurys sold off yesterday, but have regained some of the losses overnight. Meanwhile, Spanish government bond spreads tightened further ahead of today's auctions. After all the headlines yesterday, one could say: so much for Spain being shot out of the market.

EUR/USD rebounded alongside risk assets and is now back trading above 1.2550. From a technical perspective, this means that the strong downtrend has been broken and it is worth keeping in mind that non-commercial investors according to the IMM data were near record short going into the week.

One currency that has clearly broken out of its recent downtrend is AUD, which gained further overnight on yet another positive data surprise. Employment rose by 39,000 in May and markets clearly need to discount less risk of a severe slowdown in Australia. Economic surprises in Australia have previously led economic surprises in the global economy. For AUD, our take is that AUD/USD could easily see further upside, as noncommercial investors had turned as short AUD by last week as in October 2008.

Global Daily

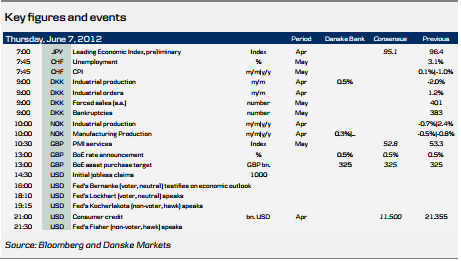

Focus today: The key event will be a testimony by Fed chairman Ben Bernanke before the Joint Economic Committee of the US Congress. Bernanke will talk on the economic outlook and his signals on further stimulus and – if any – what kind of stimulus will be studied closely. We believe the Fed now has the ammunition for further policy stimulus already at the 20 June meeting but it is likely to be a close call. Thus, Bernanke's speech will give important clues on this. Bernanke normally puts a lot of weight on labour market developments and whether the pace of growth is strong enough for the unemployment rate to decline at a decent pace. Growth has been below 2% in the last four out of five quarters including in Q1 when it was 1.9%. With the past three labour market reports disappointing, we believe Bernanke will be in the camp for more stimulus – and that he will be able to persuade the rest of FOMC which is currently dominated by doves.

Apart from Bernanke's speech, US initial jobless claims, UK service PMI and a BoE monetary policy meeting are scheduled for today. We expect the BoE to keep the base rate unchanged at 0.5% and the asset purchase target at GBP 325bn. However, we believe the MPC is considering all kinds of options to stimulate the economy which fell into technical recession last quarter. With only a few forecasters expecting a move, the market reaction is set to be limited.

Fixed income markets: The ECB meeting was a slight disappointment, but not far from most watchers‟ expectations. Still, market sentiment improved during the press conference. This is not the market reaction we would expect given what Mr Draghi communicated. However, as he spoke, international media reported that the EU is working on ways to allow the European Stability Mechanism (ESM) to lend directly to banks, while the banks' home state would retain liability for the aid. Bear in mind that such a move would involve ESM treaty changes, which take time (remember that the ESM is not even fully ratified yet). While the risk sentiment might have a bit further to go on this story, we advise a cautious stance. In our view, the real game changer will rather be when the major central banks start easing monetary policies. Today we will look for Spanish auctions in the 2y, 5y and 10y segments. Further, we will keep a close eye on Bernanke's testimony before US lawmakers on the economic outlook, although we doubt we will hear more or less about QE3 than we have to date.

FX markets: Despite no further stimuli from the ECB, markets have continued to rally, as the lack of negative surprises and the increased hopes of EU aid to European banks have left the "excessive" bearish market positioning vulnerable. As discussed on the front page, excessive positioning is exactly what has allowed for the strong rebound in AUD. As long as the Fed's Bernanke does not disappoint markets too much today, we could see further short covering this week in not least the high-beta currencies, but perhaps even the euro. The downtrend in EUR/USD has been broken for now, but while investors are likely to remain very short EUR, this is not the first positive beta currency that we would pick up. Consider instead the commodity currencies such as AUD, NZD and CAD, while keeping stops tight as growth visibility remains low and European debt risks high.

Scandi Daily

Denmark: Industrial production, which disappointed in March and fell to its lowest level in a year, is expected to have corrected somewhat in April with growth of 0.5% m/m. However, the weaker outlook for exports (due to the escalating crisis in the euro area)should limit the growth opportunities for export-dependent industries.

Norway: Industrial production has been weaker than indicated by the PMI so far this year but the quarterly GDP figures suggested somewhat stronger growth in industry. Therefore, we do not expect to see any major slowdown in April and predict growth of 0.3% m/m in today's number.

view | Jun 03, 2012 07:17AM GMT | Add a Comment

Danske Markets

- Articles (1020)

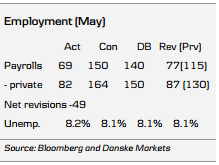

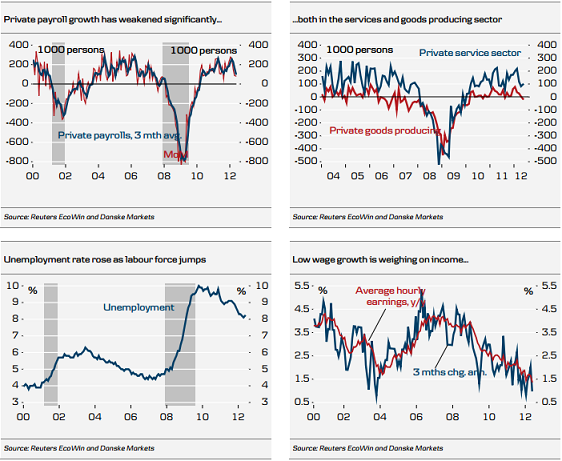

- The May employment report was overall disappointing with weakness in job growth across a broad range of sectors. While some of the current weakness can be explained by a payback from the warm winter months, the underlying state of the labour market seems to be weakening as well.

- The implications of today’s report are twofold. First, it is clear that private consumption growth cannot keep up momentum if the labour market does not recover.

- Second, we expect the Fed to err on the side of caution and implement QE3 at the 20 June FOMC meeting to facilitate stronger growth. We expect Ben Bernanke to indicate this at his testimony before Congress on Thursday 7 June.

May Employment

Details

Over the past three months, job growth has slowed from an average of 252,000 per month in December to February to 96,000 from February to May. Some of the slowdown can be explained by warm winter weather as the unusually warm weather has likely pushed forward some of the seasonal boost to hiring, which usually occurs in the spring months. This is now showing up as weakness in the weather-dependent sectors such as construction and leisure and hospitality. However, this is unlikely to explain all of the loss in job growth.

Turning to the details, weakness in the establishment survey was evident also outside of the most weather-dependent sectors. Private payrolls rose a modest 82,000, the government shed 13,000 and net revisions to April and March amounted to -49,000. Construction employment was a big negative shedding 28,000 persons, which points to some payback from warm winter months. The same goes for leisure and hospitality, which shed 9,000 persons after adding on average 37,000 per month in the three months

from December to February. Weakness was also seen in other places though, with manufacturing adding only 12,000, retail trade 2,000 and temporary help services grew a modest 9,000. The best performing sector was transportation adding 54,000 jobs and education and health with 46,000.

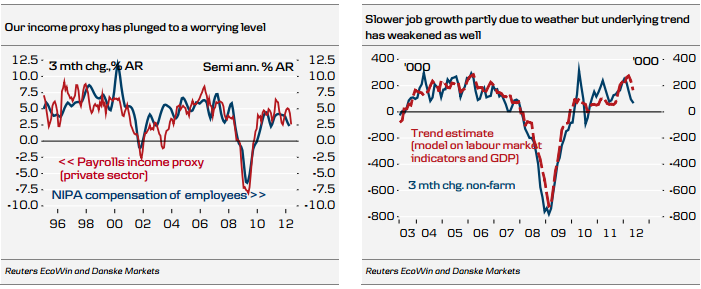

The average private workweek held steady at 33.7 but aggregate hours dropped 0.2%. With hourly earnings rising only 0.1%, our proxy for nominal income growth plunged to 2.7% annualised, which is clearly not enough to hold up private consumption growth at the current levels.

One positive was that the household survey showed an increase of 422,000 in employment but with 642,000 joining the labour force, unemployment rose one notch.

Assessment and outlook

With at least some of the current weakness related to weather distortions, we expect job growth to rebound in coming months. That said, economic data has been mixed lately, with the most recent prints on initial jobless claims, consumer confidence and pending home sales signalling a slowdown in growth.

We expect the Fed to react to the weakness in the labour market and believe the chance of another round of quantitative easing at the 20 June meeting has risen to 80% following today’s employment report. Private Payroll

Private Payroll Income Proxy

Income Proxy

Disclosure

This research report has been prepared by Danske Research, a division of Danske Bank A/S ("Danske Bank").

Analyst certification

Each research analyst responsible for the content of this research report certifies that the views expressed in the research report accurately reflect the research an alyst’s personal view about the financial instruments and issuers covered by the research report. Each responsible research analyst further certifies that no part of the compensation of the research analyst was, is or will be, directly or indirectly, related to the specific recommendations expressed in the research report.

Regulation

Danske Bank is authorized and subject to regulation b y the Danish Financial Supervisory Authority and is subject to the rules and regulation of the relevant regulators in all other jurisdictions where it conducts business. Danske Bank is subject to limited regulation by the Financial Services Authority (UK). Details on the extent of the regulation by the Financial Services Authority are available from Danske Bank upon request.

The research reports of Danske Bank are prepared in accordance with the Danish Society of Financial Analysts’ rules of ethics and the recommendations of th e Danish Securities Dealers Association.

Conflicts of interest

Danske Bank has established procedures to prevent conflicts of interest and to ensure the provision of high quality research based on research objectivity and independence. These procedures are documented in the research policies of Danske Bank. E mployees within the Danske Bank Research Departments have been instructed that any request that might impair the objectivity and independence of research shall be referred to the Research Management and the Compliance Department. Danske Bank Research Departments are organised independently from and do not report to other business areas within Danske Bank.

Research analysts are remunerated in part based on the over -all profitability of Danske Bank, which includes investment banking revenues, but do not receive bonuses or other remuneration linked to specific corporate finance or debt capital transactions.

Financial models and/or methodology used in this research report

Calculations and presentations in this research report are based on standard econometric tools and methodology as well as publicly available statistics for each individual security, issuer and/or country. Documentation can be obtained from the authors upon request.

Risk warning

Major risks connected with recommendations or opinions in this research report, including as sensitivity analysis

of relevant assumptions, are stated throughout the text.

Expected updates

Danske Daily is updated on a daily basis.

First date of publication

Please see the front page of this research report for the first date of publication. Price-related data is calculated using the closing price from the day before publication.

General disclaimer

This research has been prepared by Danske Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a soli citation of an offer to purchase or sell any relevant financial instruments (i.e. financial instruments mentioned herein or other financial instruments of any issuer mentioned herein and/or options, warrants, rights or other interests with respect to any such financial instruments) ("Relevant Financial Instruments").

The research report has been prepared independently and solely on the basis of publicly available information which Danske Bank considers to be reliable. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness, and Danske Bank, its affiliates and subsidiaries accept no liability whatsoever for any direct or consequential loss, including without limitation any loss of profits, arising from reliance on this research report.

The opinions expressed herein are the opinions of the research analysts responsible for the research report and reflect their judgment as of the date hereof. These opinions are subject to change, and Danske Bank does not undertake to notify any recipient of this research report of any such change nor of any other changes related to the information provided in the research report.

This research report is not intended for retail customers in the United Kingdom or the United States.

This research report is protected by copyright and is intended solely for the designated addressee. It may not be reproduced or distributed, in whole or in part, by any recipient for any purpose without Danske Bank’s prior written consent.

Disclaimer related to distribution in the United States

This research report is distributed in the United States by Danske Markets Inc., a U.S. registered broker-dealer and subsidiary of Danske Bank, pursuant to SEC Rule 15a-6 and related interpretations issued by the U.S. Securities and Exchange Commission. The research report is intended for distribution in the United States solely to "U.S. institutional investors" as defined in SEC Rule 15a-6. Danske Markets Inc. accepts responsibility for this research report in connection with distribution in the United States solely to “U.S. institutional investors.”

Danske Bank is not subject to U.S. rules with regard to the preparation of research reports and the independence of research analysts. In addition, the research analysts of Danske Bank who have prepared this research report are not registered or qualified as research analysts with the NYSE or FINRA, but satisfy the applicable requirements of a non-U.S. jurisdiction.

Any U.S. investor recipient of this research report who wishes to purchase or sell any Relevant Financial Instrument may do so only by contacting Danske Markets Inc. directly and should be aware that investing in nonU.S. financial instruments may entail certain risks. Financial instruments of non-U.S. issuers may not be registered with the U.S. Securities and Exchange Commission and may not be subject to the reporting and auditing standards of the U.S. Securities and Exchange Commission.