Many years ago, if you asked someone what drove stock prices, they would give you a simple, honest answer: earnings. If a company had strong earnings, and those earnings were projected to grow, then the stock price was strong. If not, then not.

Take a time machine back to that same person and tell them about the new world in which what drives stock prices is the USD/JPY. Yep, the ratio of the US dollar to the Japanese Yen is what everyone follows, pip by pip (tonight being yet another example, as everyone is tied up in knots as to what that chortling buffoon Kurado is going to announce). What the USD/JPY has to do with honest-to-God equity value is beyond me.

In spite of this, earnings still matter, and as we head into another earnings season, the bulls better pray to whatever pagan gods they worship that company after company magically defy the downturn that the economy is quite obviously entering. It isn’t off to a good start this evening, however, as the charts below show.

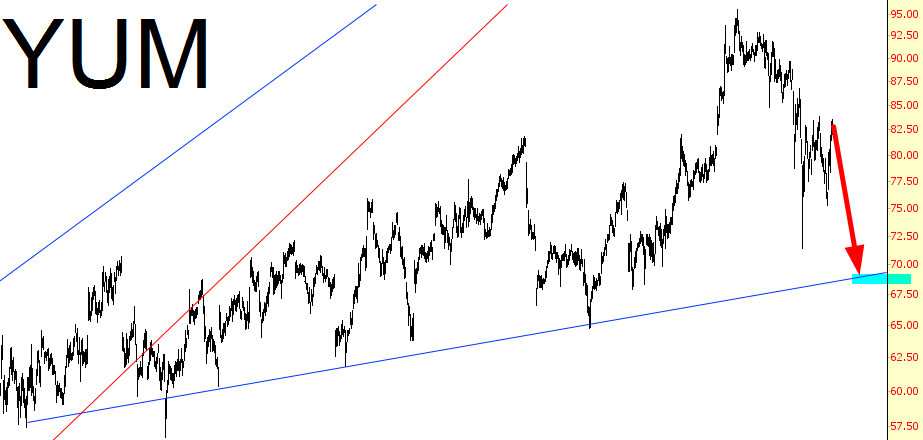

First off, there is Yum! Brands Inc (NYSE:YUM), which is the organization that owns the fine dining establishments Kentucky Fried Chicken, Taco Bell, and Pizza Hut. I guess even the morbidly obese typical American gastropod has had his fill over low-quality, over-salted, over-greased crap that these dreadful little venues crank out, as the stock has lost nearly one-fifth of its market cap after hours (after having already dropped substantially in recent months):

Software make Adobe Systems Incorporated (NASDAQ:ADBE) is having a relatively gentle time of it, as its percentage loss is (as of this writing, at least) still confined to the single digits. All the same, it’s pretty ugly out there.

These are just two companies out of the thousands that will be reporting in the weeks ahead. Let’s hope this is representative of plenty of bad news to come.