Well, it turns out that third-quarter earnings were pretty good for E. I. Du Pont de Nemours and Company (DD). The company surprised with solid volume growth and its cash balance soared.

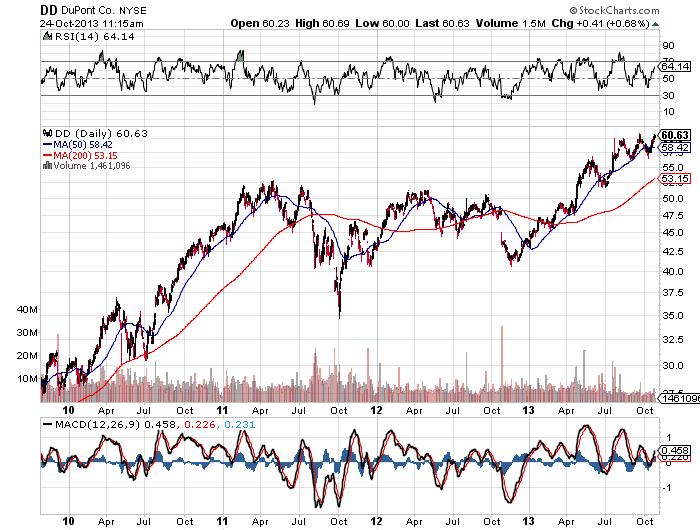

DuPont recently broke out of a two-year-long stock market consolidation. Still yielding around three percent, this position is not expensively priced, and its latest numbers were very good, considering the size and maturity of this business.

The company’s third-quarter consolidated sales grew five percent to $7.7 billion. The strongest division was, once again, in agriculture, with a 15% gain in sales to $1.6 billion on stronger volumes and higher pricing in Latin America.

Every single operating division posted improved operating earnings comparatively, except for the company’s performance chemicals business. Sales in Europe, the Middle East, and Africa (EMEA) grew a surprising 10% during the quarter, while sales in North America and the Asia Pacific grew three percent; Latin American sales grew four percent.

Of note was the company’s strong improvement in shareholders’ equity, and as is typical with so many large corporations, DuPont’s cash and cash equivalents balance soared to $7.0 billion, from $4.3 billion at the end of 2012.

The company’s third-quarter dividend was $0.45 a share, compared to $0.43 in the same quarter last year. Another dividend increase is likely within the next two quarters; the company can certainly afford it.

As I stated before, the most important division for DuPont is its agriculture business. Third-quarter expenditures on research and development were $540 million, compared to $521 million in the same quarter last year. Virtually all of the increased spending was dedicated to the company’s agriculture business.

Wall Street wants DuPont to spin off its agriculture division into a whole new company. This certainly would make for a very attractive asset, but it’s the one bright spot in DuPont’s mature roster of businesses. It’s hard to imagine the company would sell its best asset.

On the stock market, DuPont has seemingly broken out of its major consolidation, and while growth expectations are still very modest for this conglomerate, the prospect of increasing quarterly dividends is improving. The company’s stock chart is featured below:

More and more of DuPont’s business is being considered non-domestic. According to the company, the percentage of total consolidated sales in developing markets increased to 40% from 38% in the comparable quarter. For DuPont, developing markets include China, India, Latin America, Eastern and Central Europe, the Middle East, Africa, and Southeast Asia. While many of these regions are the source of decent growth for DuPont, local prices and currency translation is a hurdle.

All in all, it was a very solid quarter for DuPont. Just like so many other large companies have been reporting, DuPont’s operating earnings beat consensus but revenues came in slightly short.

Street estimates for DuPont for this year and next have been going up across the board. Company management cited that its agriculture segment is experiencing a strong start to the fourth quarter. Management was deliberately conservative with its year-end forecast and this is typical of companies wanting to beat consensus. DuPont is a solid dividend payer and may be an attractive investment opportunity on dips for income-seeking investors.

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and analysis. The opinions in this e-newsletter are just that, opinions of the authors. Information contained herein, while believed to be correct, is not guaranteed as accurate. Warning: Investing often involves high risks and you can lose a lot of money. Please do not invest with money you cannot afford to lose.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

DuPont: Booming Agriculture Business, Solid Dividend Payer

Published 10/25/2013, 06:17 PM

Updated 07/09/2023, 06:31 AM

DuPont: Booming Agriculture Business, Solid Dividend Payer

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.