The US dollar is looking a little bit more stronger against the ranging markets of the yen, which have been ranging over the last few months. The USD/JPY has historically ranged when lacking trends in the markets, and likes to go through periods of consolidation. So what’s different this time around?

Consolidation/ranging may actually be coming to an end, albeit slowly. It’s important to understand why, though, in the current market climate.

A stronger yen is unlikely to help the Japanese economy in the long run, that is very much certain. The whole point of Abenomics was driven by the fact that Japan needed to create inflation and they found the prospect started with the exchange rate mechanism, which they pummeled lower in an attempt to drive the export markets.

What we have seen, though, as of today, is that there is certainly some more weakness in the export markets, as the account balance came back at an abysmal 116.4 billion yen, compared to the forecast 347.7 yen. This shows that currently, Abenomics is having some struggles and export markets may need further help in order to pick up and go the extra distance in helping the Japanese economy.

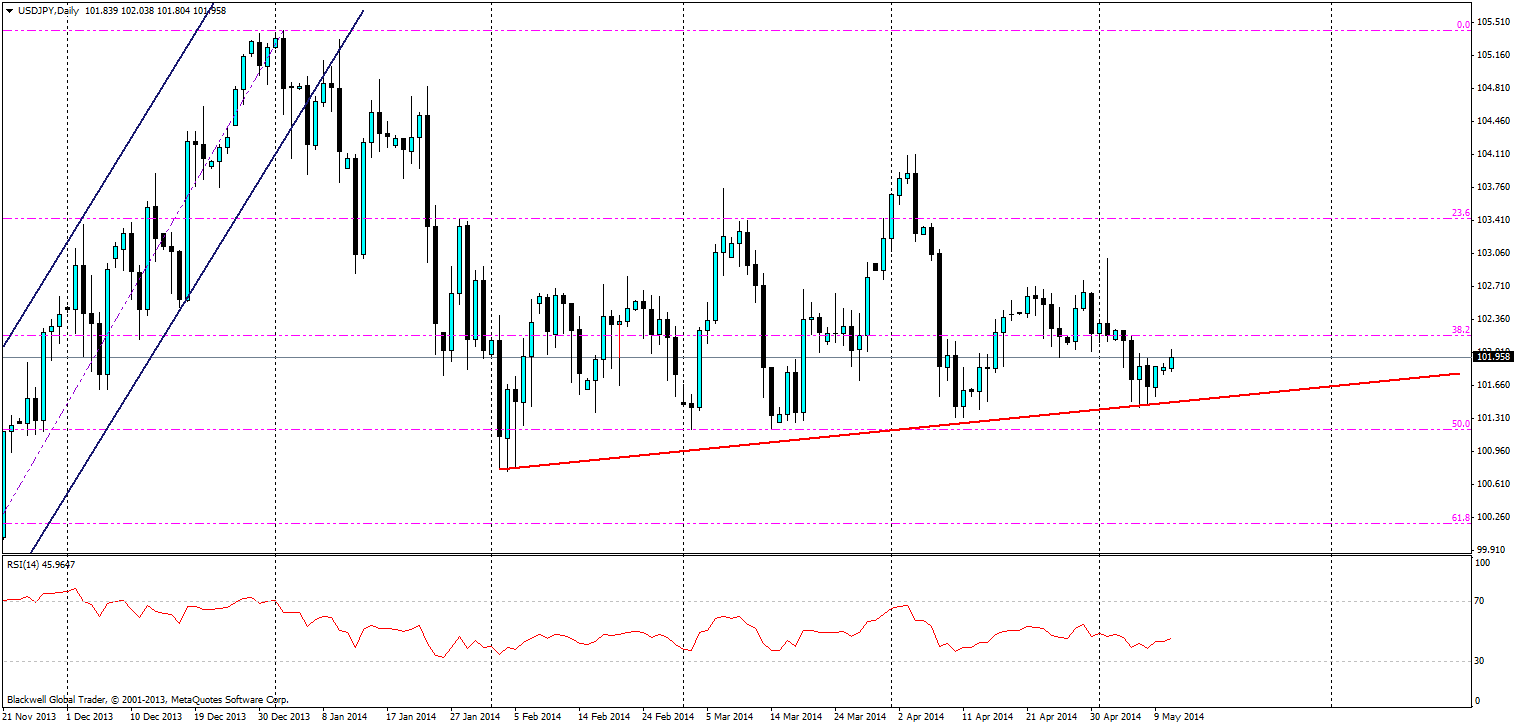

What is key to note though, is that the weakness in the yen is starting to increase again. A slight bullish uptrend is starting to form, as we have seen with each wave on the daily chart - higher lows which enables the formation of a bullish trend line, albeit small at this stage. If anything, I would certainly argue that we are in an ‘accumulation phase’ as people get ready for further action from the Bank of Japan.

I say further action from the Bank of Japan, as it seems with a sales tax and weaker exports, the Bank of Japan will have to act to further stimulate the markets.

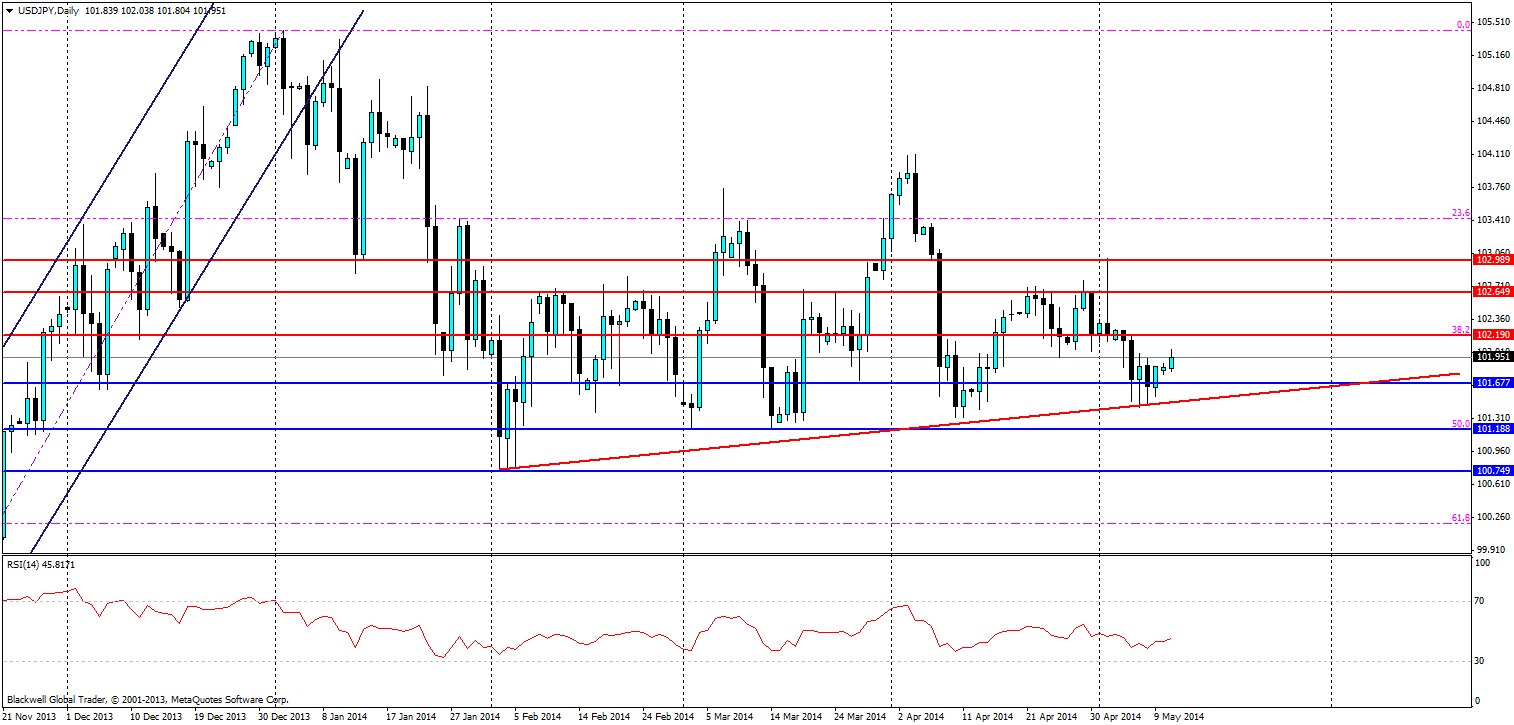

Resistance levels can be found at 102.190 (38.2 fib), 102.649 and 102.989. Heavy resistance, though, is likely to be found at 102.190, as Fibonacci levels have been very strong for the USD/JPY traders as of late, and especially in consolidation phases.

Support levels can also be found at 101.677, 101.188 and 100.749. However, I would expect the current trend line in play to act as heavy support if the pair drops through the 101.677, and any stop losses I would like to place just below the current line.

Whatever your play when it comes to the USD/JPY, it’s certainly clear that there are opportunities for trading it and this uptrend is a key point to take note of. With the BoJ coming under more and more pressure, the time to act is sooner rather than later, and I expect by year's end, we will certainly be looking at a USD/JPY around the 110 range, rather than the current very low rate of 102.