EUR/USD is flirting with the 1.37 line on Friday, as the euro continues to lose ground. The euro remains under pressure as the markets are expecting a strong Non-Farm Payrolls release on Friday. The US Unemployment Rate will be released at the same time. In the Eurozone, the week ended on a positive note as German Factory Orders beat the estimate.

US employment numbers are in the spotlight on Friday, with Non-Farm Payrolls and the Unemployment Rate on the schedule. The markets are anticipating a strong reading from Non-Farm Payrolls, with the estimate standing at 199 thousand. Unemployment Claims disappointed on Thursday, as the key indicator jumped to 326 thousand last week, up from 311 thousand in the previous release. This missed the estimate of 319 thousand. Earlier in the week, ADP Nonfarm Payrolls jumped to 191 thousand, up from 139 thousand a month earlier. This practically matched the estimate of 192 thousand.

The Eurozone continues to struggle with weak inflation and a high euro, so there has been pressure on the ECB for some time now to take action. However, on Thursday the ECB opted to stand pat. The central bank kept interest rates at the ultra-low level of 0.25% and ECB chief Mario Draghi said that monetary easing remains a possibility. Draghi added that there was discussion among the policymakers about implementing QE. Will the markets give a thumbs-down to the lack of action by the ECB? If so, we could see the euro drop further.

The good news for the lackluster Eurozone is that German data continues to surpass expectations. Factory Orders dipped in March to 0.6%, but edged above the estimate of 0.5%. Retail Sales gained 1.3%, crushing the forecast of -0.5%. Unemployment Change continues to improve and Consumer Climate and Business Climate looked sharp, pointing to stronger confidence in the German economy, the largest in the Eurozone.

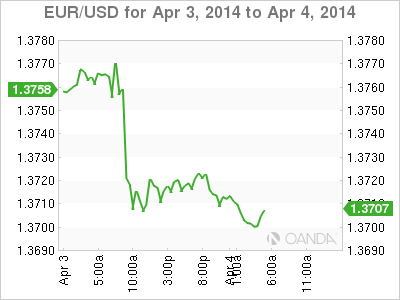

EUR/USD April 4 at 9:50 GMT

EUR/USD 1.3710 H: 1.3723 L: 1.3696

EUR/USD Technical

S3 S2 S1 R1 R2 R3 1.3410 1.3585 1.3649 1.3786 1.3893 1.4000

- EUR/USD has edged lower on Friday. The pair briefly dipped below the 1.37 level late in the Asian session.

- 1.3649 is providing support. 1.3585 is stronger.

- On the downside, 1.3786 has some breathing room with the euro trading at lower levels. The next line of resistance is 1.3893, which is protecting the 1.39 level.

- Current range: 1.3649 to 1.3786

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3410 and 1.3335

- Above: 1.3786, 1.3893, 1.4000, 1.4149 and 1.4307

OANDA's Open Positions Ratio

EUR/USD ratio has posted gains in long positions on Friday, continuing the direction seen a day earlier. This is not consistent with the pair's current movement, as the euro has edged lower. Short positions retain a strong majority, indicative of trader bias towards the dollar posting gains at the expense of the euro.

EUR/USD is under pressure, as the pair trades just above the 1.37 line. With the US releasing the all-important Non-Farm Payrolls, we could some strong movement during the North American session.

EUR/USD Fundamentals

- 6:00 German Factory Orders. Estimate 0.5%. Actual 0.6%.

- 8:10 Eurozone Retail PMI. Estimate 49.2 points.

- 12:30 US Non-Farm Employment Change. Estimate 199K.

- 12:30 US Unemployment Rate. Estimate 6.6%.

- 12:30 US Average Hourly Earnings. Estimate 0.2%.