- Dollar takes a breather, but Fed bets remain unchanged

- Euro suffers as ECB points to June rate cut

- Yen intervention warnings intensify

- S&P 500 and Nasdaq rebound, gold hits fresh record high

Fed officials say rate cut not imminent

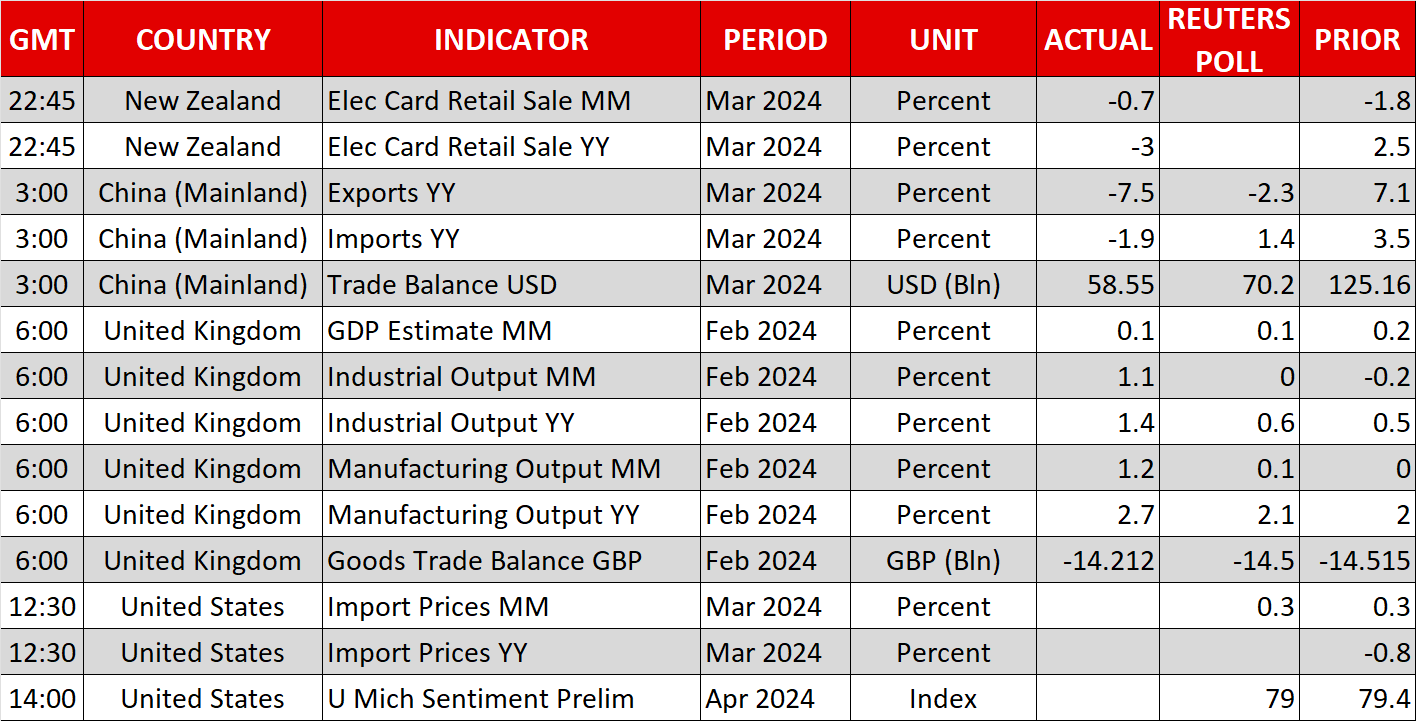

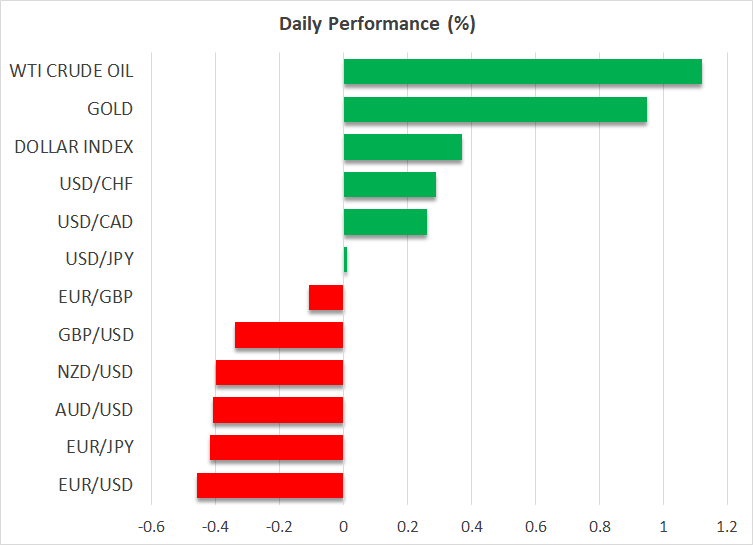

The US dollar pulled back against most of its major peers yesterday, taking a breather following Wednesday’s CPI-related rally, perhaps as the softer-than-expected PPI numbers allowed traders to lock in some profits.

Having said that though, the market’s perception about how the Fed needs to move forward has not changed, with Fed funds futures still pointing to 43bps worth of rate reductions by the end of the year.

This was probably due to remarks by a couple of Fed policymakers, who signaled no urgency to ease monetary policy anytime soon. Both New York Fed President Williams and Richmond Fed President Barkin noted that their confidence towards achieving their target has not increased and that there is no need to move to an easier monetary policy yet.

Their comments were echoed by Boston Fed President Susan Collins, who added that a strong labor market is also reducing the urgency to ease. Indeed, jobless claims for last week corroborated her view by sliding more than anticipated.

Euro extends fall as ECB moves closer to a cut

The euro was among the currencies that failed to benefit from the dollar’s pullback and responsible for this was the ECB. The European Central Bank kept interest rates unchanged as expected yesterday but sent clearer signals that it may start lowering them soon.

In the statement accompanying the decision, officials noted that if their confidence that inflation is converging to their target increases, then it may be appropriate to reduce the current level of policy restriction, while at the press conference, President Lagarde said that the decline in inflation is comforting them and that a few members felt sufficiently confident to cut rates.

Although she did not explicitly telegraph a June rate cut, a few hours after her speech, a report citing three sources close to the ECB discussion revealed that policymakers still expect to cut interest rates in June.

With the Fed now seen as more likely to begin cutting interest rates in September, this divergence in monetary policy expectations could continue weighing on euro/dollar, perhaps driving it below the 1.0665 zone that offered support in November.

Japan’s Suzuki drops fresh intervention warnings

The yen was also unable to recover ground, with dollar/yen hitting a fresh 34-year high even as Japanese Finance Minister Suzuki dropped fresh warnings about excessive yen moves. Although he repeated that they are not looking at levels themselves, he added that they are monitoring the moves with a high sense of urgency.

Having said that, he refrained from clarifying whether the latest move on the US CPI numbers is deemed excessive, allowing dollar/yen buyers to stay in the game.

Stocks rebound; gold keeps defying gravity

On Wall Street, the Dow Jones closed the session virtually unchanged, but both the S&P 500 and the Nasdaq finished in the green, with the latter gaining nearly 1.7%. This suggests that tech-related momentum remains elevated, with investors perhaps still trying to pencil in future growth opportunities relating to artificial intelligence (AI).

Although the CPI numbers triggered some liquidation due to reduced rate-cut expectations, the fact that yesterday’s PPI data did not corroborate the picture painted by the CPI figures may have encouraged fresh buying.

Gold traders also added to their long positions, with the precious metal hitting a fresh record high today. Gold’s quick recovery confirms that its main driver nowadays is not speculation about the Fed’s future course of action, but rather, elevated Chinese demand and geopolitical uncertainty.