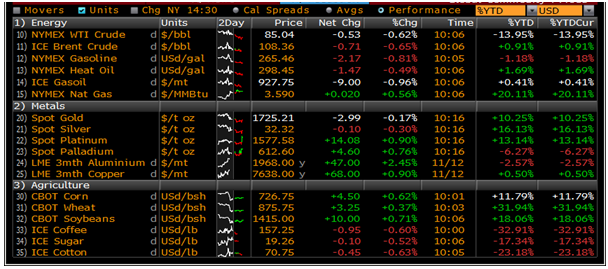

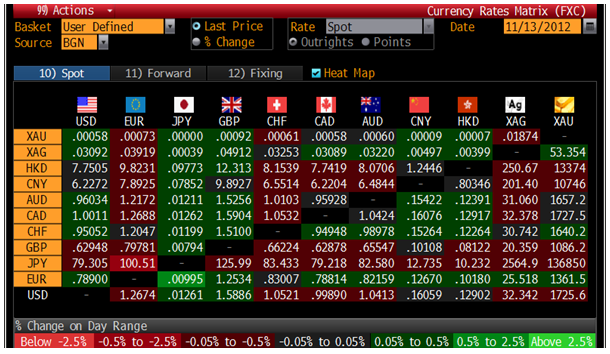

Today’s AM fix was USD 1,724.75, EUR 1,360.86, and GBP 1,085.23 per ounce.

Yesterday’s AM fix was USD 1,735.75, EUR 1,365.44, and GBP 1,091.39 per ounce.

Gold fell $3.10 or 0.18% in New York yesterday and closed at $1,727.90. Silver slipped to a low of $32.186 and finished with a loss of 0.49%.

Gold edged down on Tuesday on low volumes when the euro dropped to a 2-month low against the US dollar despite confusion about a deeper bailout package for Greece has driven many investors to wait on the sidelines.

Eurozone finance ministers suggested that Athens should be given until 2022 to lower its debt to GDP ratio to 120% but IMF chief Christine Lagarde insisted the current target of 2020 should remain.

Gold’s rally in 3Q saw it hit just short of $1,800, down from the all time nominal record of $1,920 in 2011 when investors turned to the yellow metal as an inflation hedge and safe haven during the height of the European debt crisis.

Barrick Gold’s (the largest mining producer) CEO, Jamie Sokalsky, said prices may rise to $2,000 in 2013 as costs and barriers to production restrict supply, while demand from central banks and Chinese consumers keeps climbing.

New York’s SPDR Gold Trust, the largest ETF, dropped 0.07% on Friday from Thursday, while those of the largest silver-backed ETF, New York’s iShares Silver Trust rose 0.45% percent over the same period.

The Telegraph has an interesting article on silver which suggests that it might rise by over five times in the next few years.

Emma Wall interviews fund manager Ian Williams who says that "silver is about to enter a sustained bull market that will take the price from the current level of $32 an ounce to $165 an ounce and we expect this price to be hit at the end of October 2015."

"This forecast is based entirely using technical & cyclical analysis and is in keeping with the mathematical form displayed so far in the bull run that has taken silver from $8/oz in 2008 to its current price of $32 an ounce – having hit $50 an ounce in 2011."

Mr. Williams noted that the silver price was more volatile than gold, but that he predicts silver to continue to dramatically outperform gold.

The Charteris manager said that macro fundamentals were supportive for the silver price, such as the re-election of President Obama, who supports Ben Bernanke's policy of quantitative easing.

"Strong demand for precious metals will remain as long as we have QE, which do well with each round of money printing. QE is bound to lead to inflation at some point and at that time, real assets will do best," he said.

"Investing in a fund that holds a range of precious metals gives you positive diversification and less reliance on just gold."

We have long been more bullish on silver than on gold and have said since 2003 that silver will likely reach its inflation adjusted high of $150/oz in the coming years. Indeed, we believe that the end of the precious metal bull markets may see the gold silver ratio return to its geological long term average of 15:1.

Therefore were gold to trade at over its inflation adjusted high of $2,500/oz (as we believe likely) then silver would be priced at $166.66/oz or $2,500/oz divided by 15.

We have also long suggested that owning both gold and silver was sensible from a diversification point of view. Gold is more of a safe haven asset and currency in general and is more of a hedge against macroeconomic and monetary risk.

Silver is similar, while more volatile, but continues to have the potential for far higher returns.

NEWSWIRE

(Bloomberg) -- Gold to Climb to $1,849, LBMA Survey Shows, as Outlook Cut

Gold will probably gain 7 percent to $1,849 by September, according to the average response in a survey of attendees at the London Bullion Market Association’s annual conference, who cut predictions during the two-day event.

Attendees said in a separate survey yesterday that the metal may trade at $1,914 an ounce by the LBMA’s next annual gathering in 10 months, according to Tom Kendall, head of precious-metals research at Credit Suisse Group AG, who presented the findings in Hong Kong today. Rallies were also forecast for silver and platinum, the results showed.

While gold is poised for a 12th year of gains as central banks including the U.S. Federal Reserve ramp up stimulus, it’s 10 percent below the all-time high reached last year. Gold may surpass $1,800 this year depending on further actions from the Fed, according to Kendall, the most accurate precious-metals forecaster in the past eight quarters tracked by Bloomberg. Goldman Sachs Group Inc. expects gold futures to gain to $1,940 an ounce in 12 months, according to a report dated November 9.

“The price can trend a little bit higher,” Kendall said in an interview on November 11. “It’s going to be a market that needs fresh stimulus or a new geopolitical headline to get investors really excited about gold again.”

Gold for immediate delivery declined as much as 0.4 percent to $1,721.55 an ounce and traded at $1,724.95 at 5:33 p.m. in Hong Kong. Spot gold reached an all-time high of $1,921.15 on Sept. 6, 2011.

Montreal Call

At the LBMA’s last annual gathering, held in Montreal in September 2011, the average response in the final survey was for a rally to $2,019 by the time of the Hong Kong meeting. After the results was released on Sept. 20 that year, the highest that gold reached was $1,816.70, touched the following day.

Silver will probably climb to $38.40 an ounce by September, according to the survey today, from $32.27 now. Platinum may advance 14 percent to $1,794.90 an ounce, while palladium may gain 18 percent to $724.70 an ounce, the results showed.

The Fed said on October 24 it will maintain $40 billion in monthly purchases of mortgage debt and probably hold interest rates near zero until 2015 to spur growth and reduce joblessness. The Bank of Japan expanded an asset-purchase program on October 30 for the second time in two months and the European Central Bank has said that it is ready to buy bonds of indebted nations.

“Next year it’s reasonable to be talking about a gold price of between $1,800 and $2,000,” said Kendall. For the metal to reach the “top end of that range, it will require investors to become more engaged in the gold market again, particularly on the institutional side.”

Holdings in gold-backed exchange-traded products were unchanged at 2,594.6 metric tons yesterday after reaching a record 2,596.1 tons on November 8, data compiled by Bloomberg show. They have risen 10 percent this year.

The LBMA is a London-based group that represents the wholesale market for gold and silver.

(Bloomberg) -- Gold Mining Breakeven Costs Are Increasing, Barrick CEO Says

The breakeven cost for mining gold is going up on so-called resource nationalization, a shortage of skilled labor, infrastructure access to remote mines and rising capital expenditures, Jamie Sokalsky, CEO of Barrick, said at a conference in Hong Kong today.

(Bloomberg) -- Gold Bull Market Shows No Signs of Reversing, Barrick CEO Says

The gold bull market shows no signs of reversing, Jamie Sokalsky, ceo of Barrick Gold Corp., said at a conference in Hong Kong today.

Mine supply hasn’t kept up with demand as production is declining in mature areas and costs are increasing, he said.

(Bloomberg) -- Russia’s Palladium Sales Seen Dropping to 250,000 Ounces in 2012

Sales from palladium stockpiles in the country may be lower or zero next year, Mark Danks, marketing manager at Johnson Matthey, says in Moscow. *NOTE: Russia’s palladium sales from stockpiles were 770,000 oz in 2011.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Diversify With Silver As Set To 'Increase 400% In 3 Years'

Published 11/13/2012, 08:31 AM

Updated 07/09/2023, 06:31 AM

Diversify With Silver As Set To 'Increase 400% In 3 Years'

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.