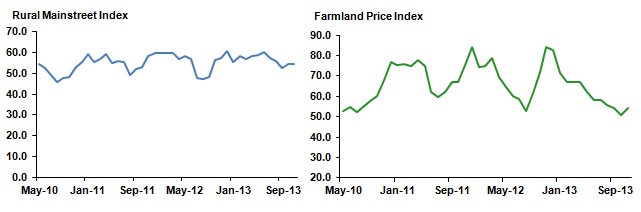

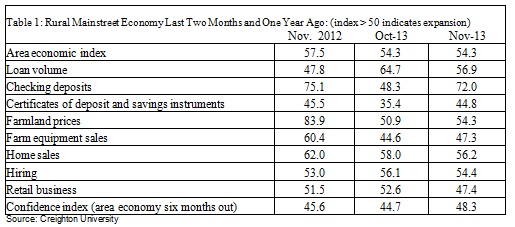

Farmland prices are still increasing despite a lack of Farm Bill negotiations and corn prices approaching sub $4. The farmland price index increased in this month's survey and has been above growth neutral for an astonishing 46 months, although bankers believe prices will decrease slightly as we enter 2014. The Rural Mainstreet Index (RMI) was unchanged in November and has been above growth neutral for 14 straight months.

The Rural Mainstreet Index (RMI), ranging between 0 and 100 with 50.0 representing growth neutral, was unchanged this month and remains above growth neutral at 54.3. Ernie Goss, economist at Creighton University, commented, “The overall index for the Rural Mainstreet Economy continues to point to positive, but slow economic growth in the months ahead.”

The farmland price index increased for only the second time in the last 12 months to 54.3 from 50.9 in October. Goss noted, “Despite the expansion in the index for the month, I expect farmland prices to grow at significantly slower rates for the first six months of 2014 than they did for the same period in 2013. In the November survey almost half, 49.1 percent, bankers indicated they expect farmland prices to decline by an average of 1 percent over the next 12 months."

Bankers were asked this month if they agreed with the Environmental Protection Agency's recommendation of lowering the 2014 mandated ethanol blend. Of bankers surveyed, only 13.6% agreed with the Environmental Protection Agency.

For the fifth month in a row, farm equipment sales were below growth neutral at 47.3. “According to bankers in our survey, farmers continue to reduce their purchases of big ticket items such as farm equipment,” said Goss.

The loan-volume index decreased to 56.9, from October's 64.7. The checking-deposit index increased considerably, to 72.0, from 48.3 last month.

This survey represents an early snapshot of the economy of rural, agriculturally and energy-dependent portions of the nation. The RMI is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Despite Headwinds, Farmland Prices On The Rise

Published 11/25/2013, 11:37 PM

Updated 07/09/2023, 06:31 AM

Despite Headwinds, Farmland Prices On The Rise

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.