The official US National Debt is about $18,000,000,000,000, or 57 times the current market price of the US Gold SUPPOSEDLY stored at Fort Knox, the NY Fed, and elsewhere. With so much paper in the system it is easy to see why the Fed publicly denigrates gold.

In the single year from Sept. 30, 2013 to Sept. 30, 2014, the US official national debt increased by over three times the value of all the gold that the US supposedly owns. The total debt and the increase in that debt is clearly “a problem.”

What about a comparison relevant to you and me?

The per capital national debt for all US citizens is approximately 2,600 hours of work based on the annual average wage. But since only about 100,000,000 Americans are working, that increases the work time to pay off the national debt to about four years.

Repeat: Every employee in the US would have to work about 4 years at the average hourly wage to pay the national debt. It gets worse. The unfunded liabilities of the US government are about 10 times larger (depending on who is counting) and that means every worker would have to labor for 40 years to pay the debt and unfunded liabilities.

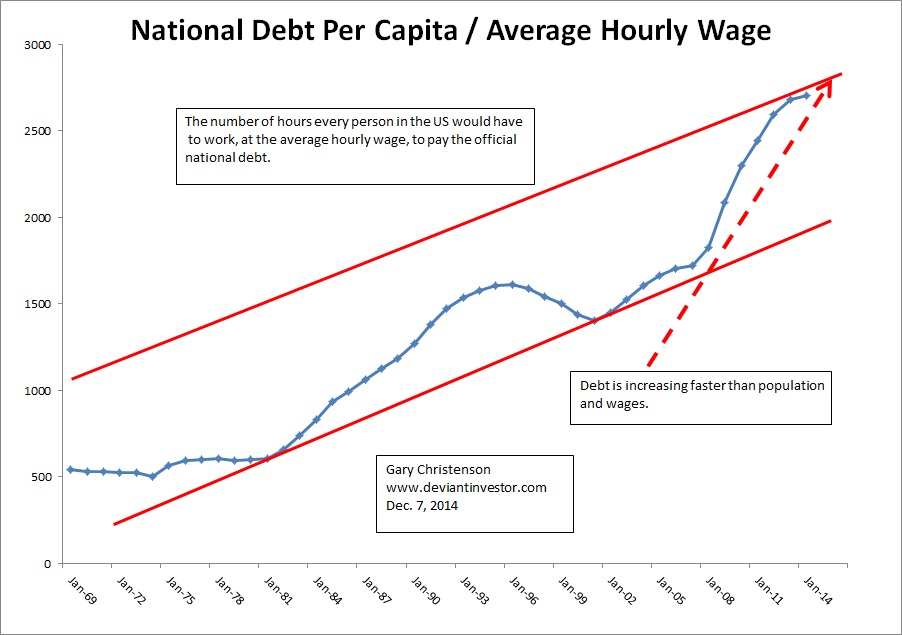

The above graph of official US national debt divided by population and divided by the average hourly wage shows:

The national debt has been increasing faster than both population growth and hourly wages.

The graph shows the number of hours of work, at the average wage, to pay off the national debt. It has accelerated higher since 9-11.

The 45 year trend is clearly up and accelerating.

Observations:

The phrase about the inevitability of “death and taxes” should be updated to “debt, death and taxes,” and it will soon become “debt, default, and taxes.” Call it DDT, which is the name for a poison.

National debt has increased exponentially since 1913 at 9.0% per year, since 1971 at 9.2% per year, and since October 1, 2008 at 10.1% per year.

Debt is increasing much more rapidly than wages.

“The Powers That Be” want exponentially increasing debt, otherwise world economies would be run differently.

Clearly the debt will NEVER be paid in 2014 dollars.

The only solution is default, either now or later, either by refusing to pay the debt and/or by inflating the dollar so its value decreases to nearly nothing, and hence the debt is rolled-over and paid with “Zimbabwe” dollars.

Politicians no longer speak about “growing our way out.” They know that growth of that magnitude can not happen.

“The Powers That Be” want to retain power and wealth as long as possible, so they will do whatever they can to keep the debt and currency bubbles inflated.

Potential policy changes to lengthen the time BEFORE inevitable default:

- Higher taxes

- Additional less visible taxes

- Accelerating devaluation of the dollar and more consumer price inflation

- Asset confiscations

- Nationalization of pension funds

- Required investment in T-Bonds

The End Game:

The US Dollar will eventually purchase much less than it currently does. The devaluation process that has reduced its purchasing power since 1913, every year on average, will continue.

The local currency devaluation process is clearly evident in Japan and will become increasingly evident in Europe and the US.

All unbacked currencies will be devalued and some will collapse before others.

Expect more discussion about gold-backed rubles, Yuan, SDR (IMF Special Drawing Rights) and others. Expect central banker resistance.

Prices for gold, Silver, land, diamonds, art and other real assets will increase substantially in dollar terms as the currency and bond bubbles eventually implode.

Social unrest! The people will be angered by currency collapses and the apparent theft of their savings and pensions. What happens when EBT cards purchase half of what they did in the previous year? The Powers That Be will respond to the social unrest.

Avoid the “poison” of DDT – Debt, Default, and Taxes.

What have you personally done to prepare for further currency devaluation? Have you considered insuring your purchasing power and net worth with physical (not paper) gold and silver? When priced in US dollars both gold and silver are currently selling at bargain levels.