Upward momentum stalled on Wall Street yesterday, with only the Nasdaq 100 index extending gains, as earnings reports failed to continue the strong trend. Holidays in Australia and New Zealand may impact liquidity during the Asian session.

US30USD Daily Chart

Source: OANDA fxTrade

- The US30 index touched the highest level since Oct. 5 yesterday before giving back gains to close lower on the day. Boeing (NYSE:BA) and Tesla (NASDAQ:TSLA) were drags on sentiment

- Rising 55-day moving average support is at 25,919 today

- U.S. durable goods orders are expected to rise 0.8% m/m in March, a sharp rebound from February’s 1.6% decline, as the volatility in this data series continues.

DE30EUR Daily Chart

Source: OANDA fxTrade

- The Germany30 index climbed to a near seven-month high yesterday, despite further disappointments from the IFO surveys, as it took its cue from Wall Street

- The index touched the highest since Oct. 1 yesterday. The 78.6% Fibonacci retracement of the May-December drop is at 12,581

- Germany’s IFO surveys for April were all below forecast with the current assessment slipping to 103.3 from 103.8, the business climate index to 99.2 from 99.6 and the expectations index to 95.2 from 95.6.

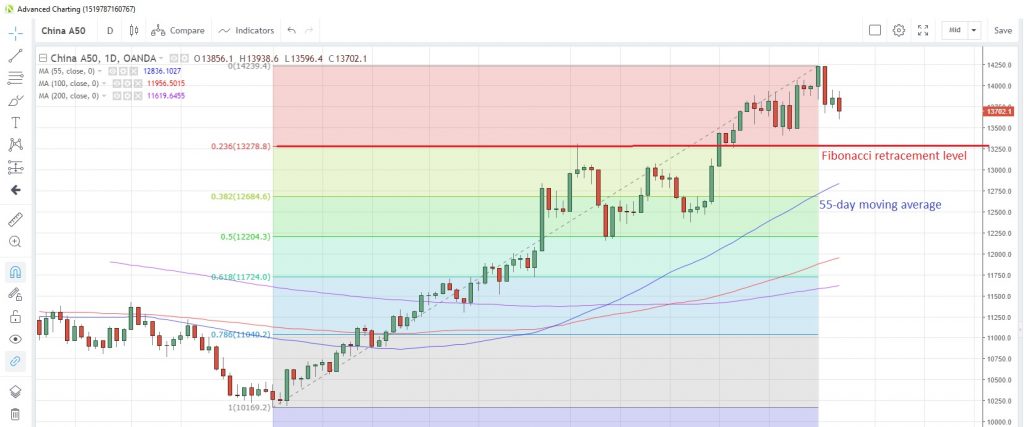

CN50USD Daily Chart

Source: OANDA fxTrade

- The China50 index slid to an eight-day low yesterday despite local reports of “substantial” progress in the trade talks with the U.S.

- Prices are heading toward Fibonacci support at 13,278, which is the 23.6% retracement of the rally to April 19. The 55-day moving average is at 12,836 and the index has traded above this average since Jan. 22

- China’s Premier Li acknowledged that the domestic economy is facing downward pressure. The government is to keep economic activity within a reasonable range by deepening reforms and cutting taxes.