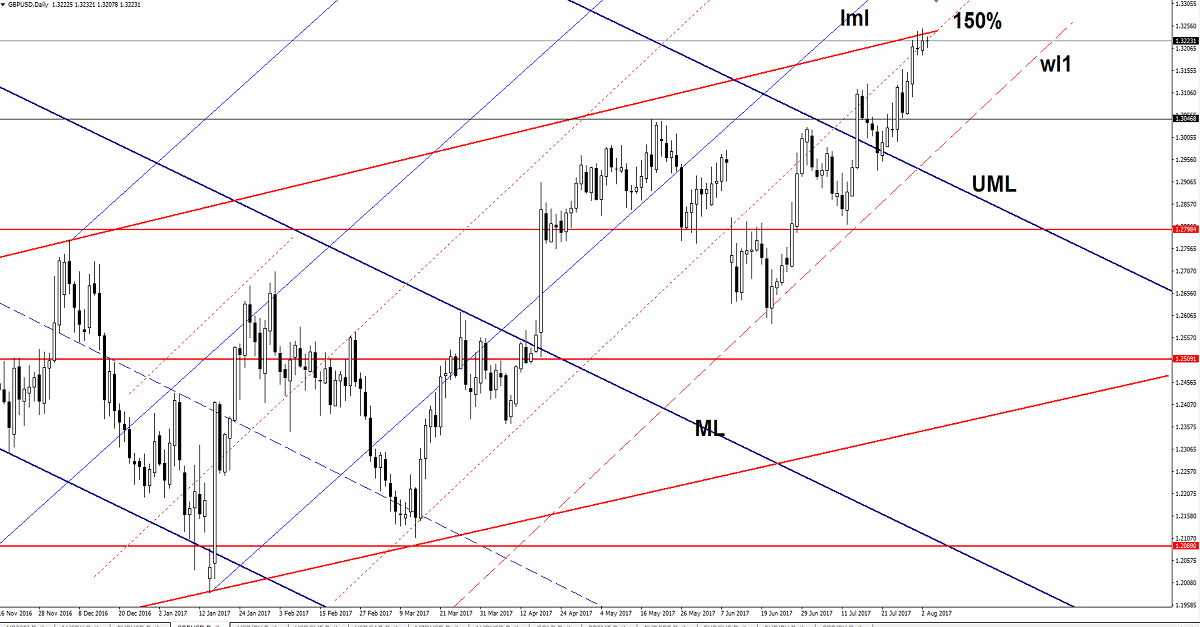

GBP/USD price changed little in the morning ahead of the BOE, but most likely we’ll have some volatility later, after the UK and US data will be released. GBP/USD stays higher and continues to pressure an important dynamic resistance, we’ll see if we’ll have a break or a bounce.

Is trading around the 1.3225 level, you should be careful because the fundamental factors will take the lead in the upcoming hours. Technically, the rate has found strong resistance again and could slip lower, but remains to see what impact will have the economic figures.

The Bank of England will release the Official Bank Rate later, which is expected to remain unchanged at 0.25%, while the Asset Purchase Facility should stay steady at 435B as the MPC members are expected to vote unanimously for this decision.

BOE Gov Carney’s speech could bring life on the GBP/USD, the cable could drop on a dovish speech, but is premature to say what will really happen.

GBP/USD has found temporary resistance at the upside line of the ascending channel (up sloping red line) and now looks undecided. Don’t worry because the economic data will bring us a clear direction. Looks like that the rate has developed a minor Rising Wedge pattern, but this is far from being confirmed, so the perspective remains bullish despite a minor drop.

A rejection from the up sloping red line will send the rate towards the warning line (wl1), where is expected to find support again. However a breakout above the red line will confirm a further upside movement, the next upside target will be at the lower median line (lml).

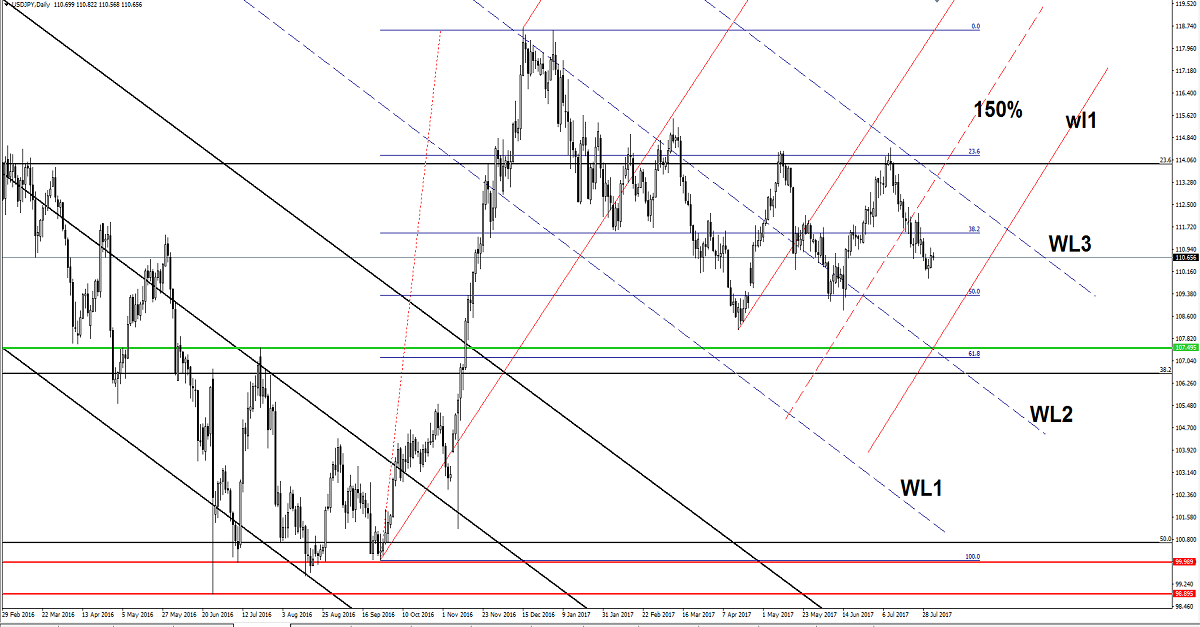

USD/JPY Undecided

USD/JPY needs a spark to be able to start a significant move. Continues to move in range on the short term, is located above the 110.50 level and is fighting hard to increase. We don’t have a clear direction because the Nikkei is narrowing near 20058 major horizontal resistance.

We don’t have any trading opportunity at this moment, but we may have one if will come down to retest the 50% retracement level and the warning line (wl1).

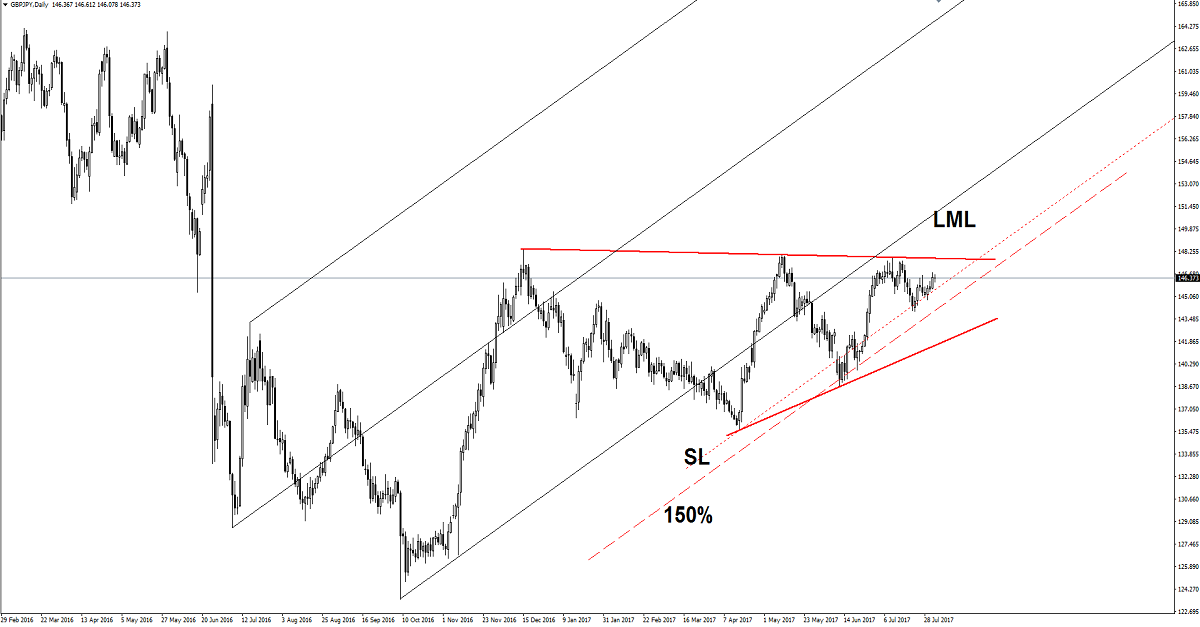

GBP/JPY Can Bears Step In?

GBP/JPY moves in range on the daily chart, we’ll have a clear direction after a valid breakout from the chart pattern. Could start a broader drop if will fail to breakout above the down sloping red line. A valid breakdown below the 150% Fibonacci line (ascending dotted line) will confirm a sharp drop, while a valid breakout above the red line will signal an increase at least towards the lower median line (LML).

Risk Disclaimer: Trading in general is very risky and is not suited for everyone. There is always a chance of losing some or all of your initial investment/deposit, so do not invest money you can afford to lose. You are strongly advised to carry out your independent research before making any trading decisions. All the analysis, market reports posted on this site are only educational and do not constitute an investment advice or recommendation to open or close positions on international financial markets. The author is not responsible for any loss of profit or damage which may arise from transactions made based on any information on this web site.